Last week, we wrote about the big-picture technicals in Gold and Silver, employing quarterly and monthly charts.

Gold is overbought, but history suggests it can become even more overbought. Meanwhile, Silver made its highest monthly and weekly close in 11 years.

Both metals have room to move before stiff resistance sets in.

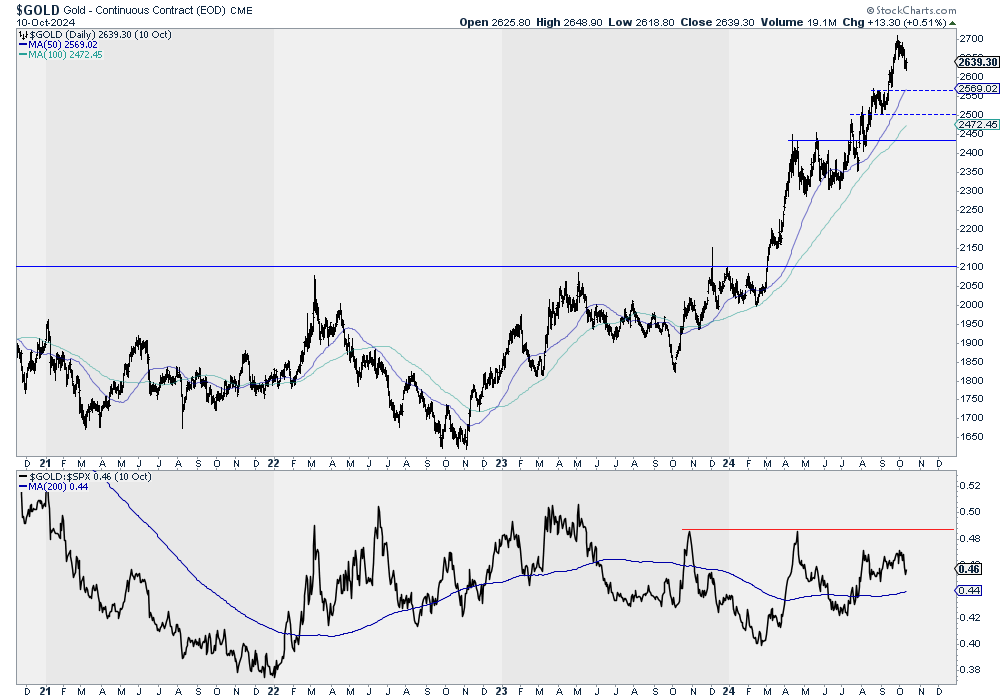

Gold is in all-time high territory, so its resistance is harder to peg.

With its breakout from the 13-year cup and handle pattern in March 2024, Gold has a clear path to the measured upside target of $3000/oz.

Although Gold appears to be quite overbought, it has gained only 9% in the last two months. Before that, in early August 2024, it traded at the same level as nearly four months earlier in April 2024.

The more pressing issue is the negative divergence in the Gold to S&P 500 ratio which has made a lower high since Gold gained another 10%.

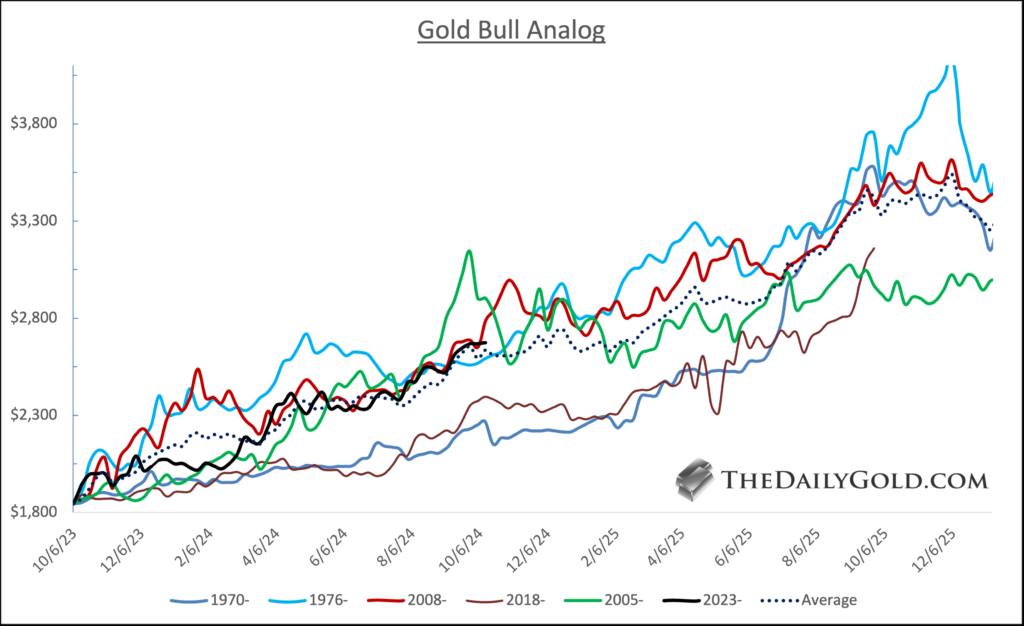

The Gold Bull Analog chart plots Gold against the four best cyclical bulls and an average (dotted line). The current bull in Gold is hugging the average.

Moving to $3000/oz anytime in the next four months would signal (by the chart) that Gold is stretched relative to history.

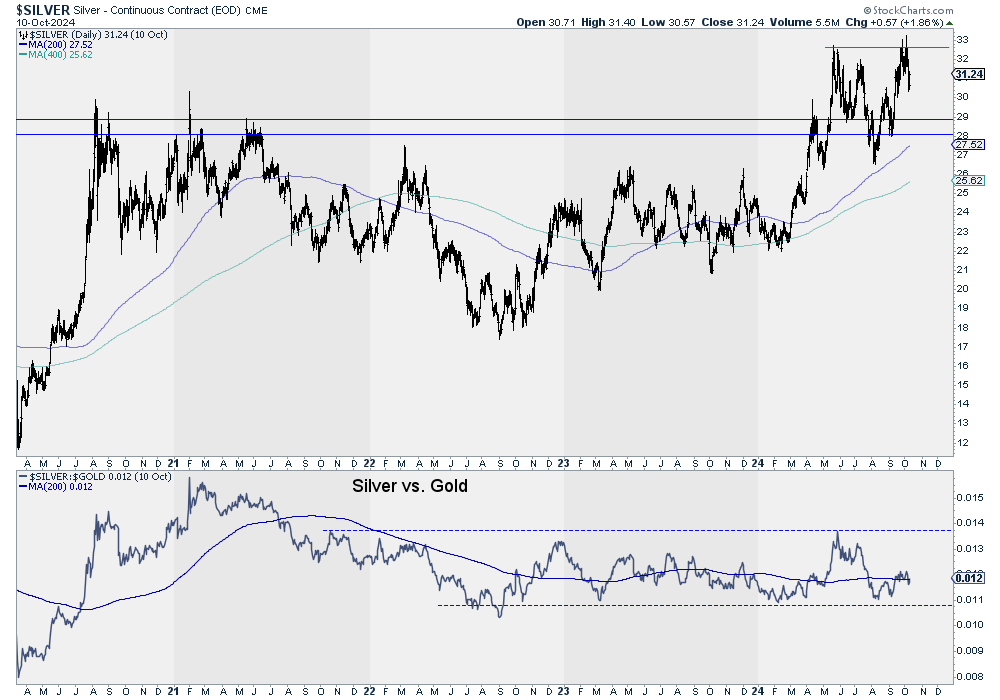

Meanwhile, Silver has established support around $28-$29/oz but is now dealing with daily resistance at $32.50.

Silver has already closed at new highs in monthly and weekly terms, which is positive.

On the other hand, despite Gold’s move from $2000 to $2700, Silver has been unable to outperform Gold. The Gold/Silver ratio (inverted in the chart) peaked in the spring and remains range-bound.

Nonetheless, a convincing daily close above $32.50 could allow Silver to test $35 and perhaps as high as $37.

Gold remains in blue sky territory after breaking out of its 13-year cup and handle pattern. Although it is overbought and not outperforming the stock market, it should continue higher to its measured upside target of $3000.

Silver is not outperforming Gold, but it closed last week and last month at a new 11-year high. Even if it cannot outperform Gold, strength in Gold should drag it to $35 and possibly $36-$37.

To invest in gold and silver stocks, continue to focus on quality assets and value. Avoid leveraged plays that appear undervalued but are struggling to perform at these prices.

High-quality juniors remain a good value and will continue outperforming GDX and GDXJ.