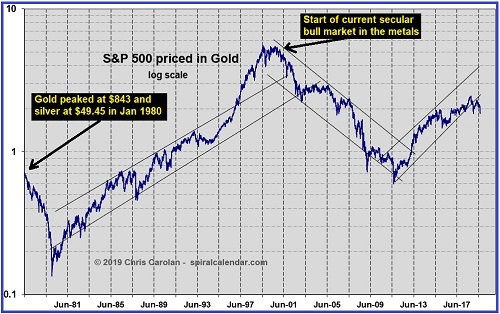

The chart above was sourced from spiralcalendar.com with a couple edits of mine. It shows the S&P 500/gold ratio going back to 1980, when the 1970’s gold bull market culminated. I believe before the a complete financial “reset” is imposed on the global financial system, we could see the SPX/gold ratio fall to the level it hit in 1980.

A subscriber asked me if I thought that the fact that stocks like AG, EXK and HL, among many others, are only 50% as high in price as they were when silver hit $20 in the summer of 2016 is a red flag.

I said that I do not see it as red flag for the sector. Rather, I see it as just one measure by which mining shares are extremely undervalued relative to gold and silver and to the rest of the stock market. I always thought that the mining shares ran up in price too quickly during the 2016 rally. The VanEck Vectors Junior Gold Miners (NYSE:GDXJ) rose 300% in six months and investor sentiment had become far too frothy.

In my observation of the moves in the sector from 2001 to mid-2006 and from November 2008 to mid/late 2011, gold and silver lead the sector at first, followed by the large cap producers, with the juniors lagging and then outperforming gold/silver/large caps. That seems to be the progression unfolding now.

If I’m right, and if the metals continue moving a lot higher, we should start to see stocks like AG move well above their 2016 highs. Eventually many of the juniors will be 3-5x higher than their current level. We got a taste of the type of moves juniors will start to make this week.