The US stock market bears eerie similarity to the market of 1929. The government’s macabre tariff tax tantrum could be the catalyst that sends this outrageously overvalued market into the abyss.

Many technology stock “hotties” are already down 50%+ since America’s exciting “Tariff Sheriff” got elected. Money managers and investors are concerned… as they should be, since most of them have no gold.

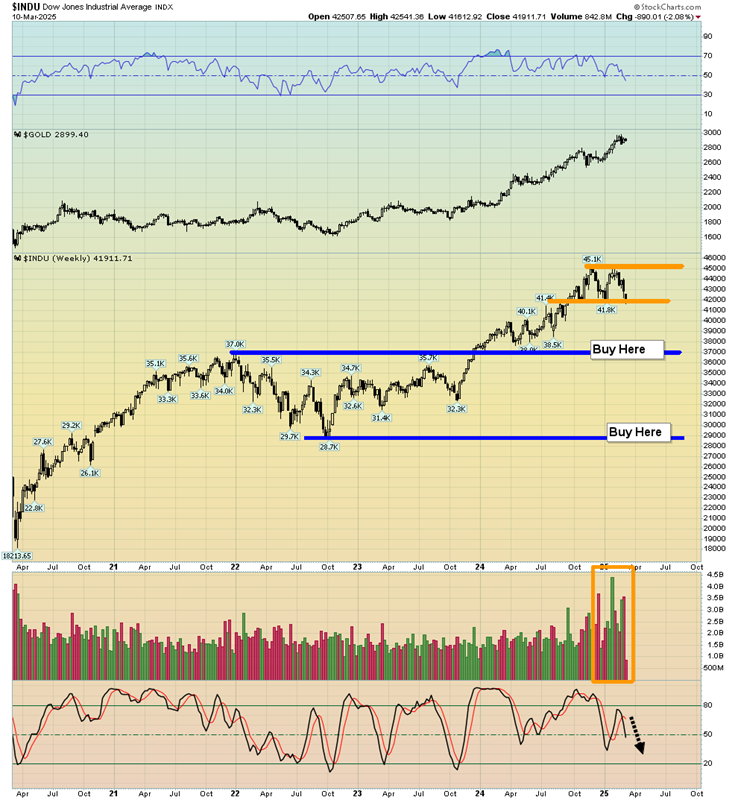

A look at the Dow and its advance/decline line. While many of the most touted Nasdaq stocks essentially look like rice paper on fire, the Dow itself has yet to generate a sell signal.

The Transports have broken down, but the advance/decline and the Dow itself have not. The 42,000 area is its line in the sand.

Tactics? Obviously, the most important tactic for stock market investors is to be sure they own lots of gold, and I’ll get to the tactics for doing that in a moment. First though, for a look at handling the stock market in isolation…

The weekly chart for the Dow. Most investors should be either out of the US stock market or only lightly invested. There are buy zones at about Dow 37,000 and Dow 30,000.

A swoon into the first buy zone at 37,000 would be a rough 17% drop. That’s a mild dip, but if it occurs… excessively allocated investors could see some of their Nasdaq holdings fall 90%, and they would feel an enormous amount of emotional pain.

In a nutshell: The Chinese stock market offers value. The US market does not.

What about gold? Well, gold is of course the greatest asset in the world, and all investors should be obsessed with getting more.

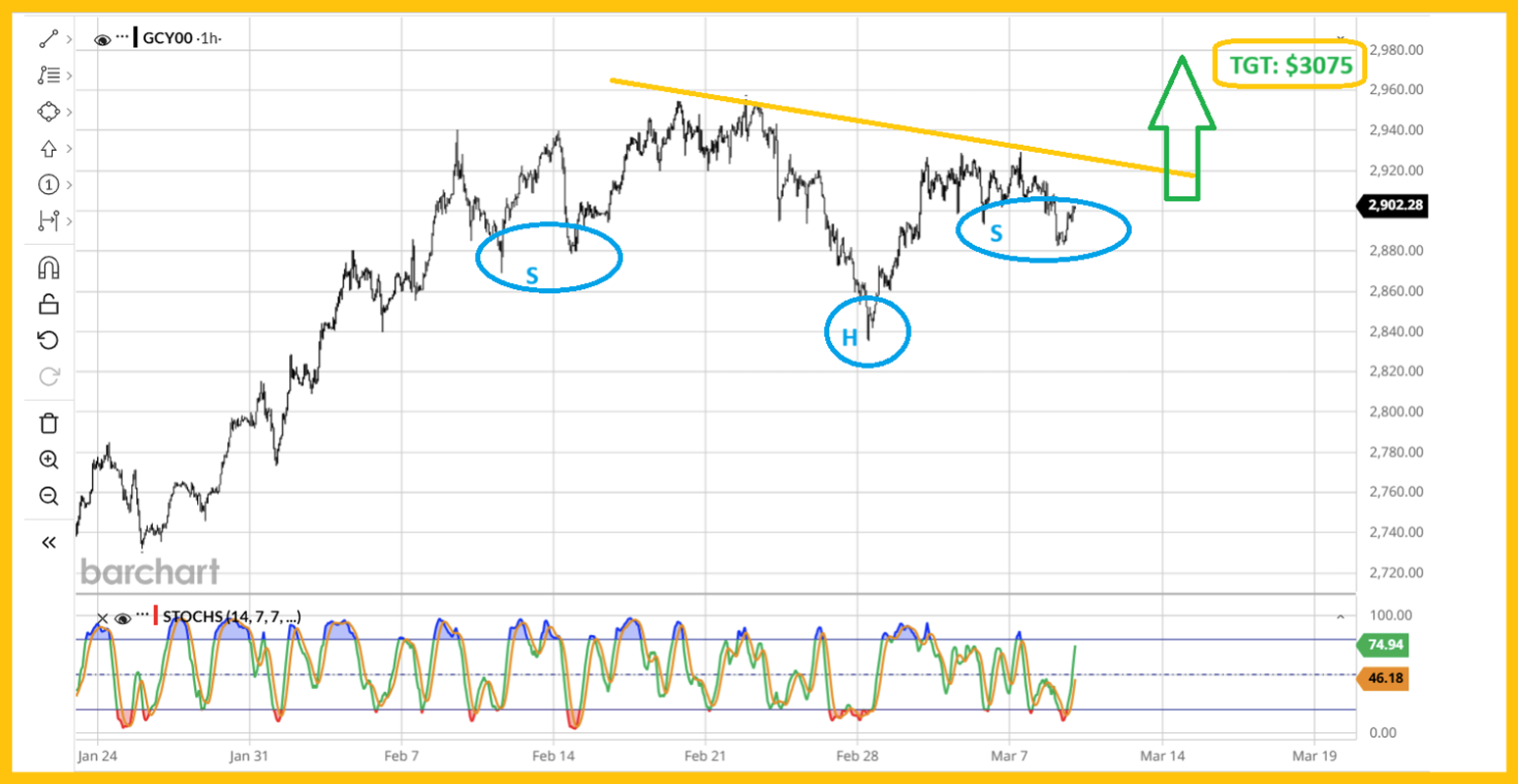

A look at the short-term hourly chart. Inverse (and bullish) H&S action is in play, and it targets the $3075 zone.

The daily chart is also impressive. Note that the dip towards support at $2800 ended above that zone. In a powerful market, this type of action is normal.

The key 14,7,7 Stochastics oscillator is bordering on a fresh buy signal in the momentum zone at about 50. That’s another very bullish sign for the price of gold.

The US rates chart. There could be a slight dip in rates if the Dow falls through 42,000 and begins to crash but…

In a stagflation cycle (which is likely underway and should last until about the year 2060) the relationship between gold and rates can shock mainstream investors, and even some gold bugs too.

In this situation, the stock market stagnates, and rates rise or decline only modestly, while gold, silver, and miners surge.

The grotesque US dollar index chart. As America’s “Tariff Sheriff” intensifies his tariff taxes assault on citizens while flying around America in his private jet, the big question is…

Does he really understand the plight of the average struggling citizen… who is going to find it harder and harder to afford basic food and a car?

Corporations will pass a lot of these taxes on to consumers, but not all, and earnings will fall. Money is already pouring out of America because nobody knows where or when the wild fiat-oriented tariff sheriff will fire his next shots… but they do expect the shots to occur. The bottom line for US fiat: The dollar could be at the beginning of a major bear market.

A falling dollar, rising rates, and rising prices of necessities are a disaster for the average citizen… and the mayhem could spur a major institutional money manager stampede into gold stocks.

Most of them can’t buy bullion and are mandated to be almost fully invested, so they’ll turn to the miners.

The GDX (NYSE:GDX) daily chart. A Stochastics buy signal is in play. There are a few different ways to interpret the inverse H&S action on this chart and… all of them are bullish.

The incredibly exciting GDX weekly chart. Mining stock investors need to think outside the Edwards & Magee classic technical analysis box. The bottom line: It’s a gold bull era, and it revolves mostly around the citizens of China, India, and the gold bugs of America. Traditional patterns (like this C&H) can morph into more bullish and unorthodox ones. The handle on this cup may be completed inside the cup itself, which is an outrageously bullish sign for GDX… and for most gold stocks.