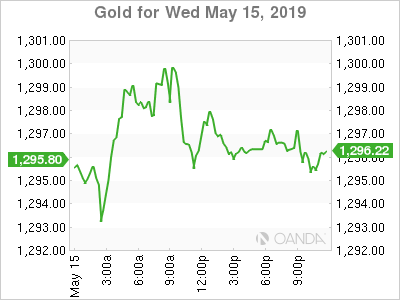

Gold prices finished modestly higher Wednesday, although remained below the psychologically significant price of $1,300. Benchmark U.S. stock indexes shook off earlier losses to move up by the time gold futures settled.

The precious metal saw support “as tensions increased with Iran, worries persist in trade and tariff talks with China—with…Brexit still unresolved,” said George Gero, managing director at RBC Wealth Management. “Continuing global uncertainties support gold as a haven, from economic [to] political global woes.”

June gold GCM9, +0.05% edged up $1.50, or 0.1%, to settle at $1,297.80 an ounce, though finished off the day’s high of $1,301.70.

The SPDR Gold Shares ETF (NYSE:GLD), -0.09% was down less than 0.1% and the gold-miners focused exchange-traded VanEck Vectors Gold Miners ETF (NYSE:GDX), +0.04% traded little changed.

July silver SIN9, -0.05% ended unchanged at $14.812 an ounce, following Tuesday’s 0.2% rise.

The Dow Jones Industrial Average (DJIA), +0.65% and the S&P 500 index (SPX), +0.78% finished sharply higher in Tuesday dealings, depressing gold’s price in that session, as volatility persists after a trade war-related drubbing for equities to start the week. The ICE U.S. Dollar Index (DXY), +0.03% traded nearly flat as gold futures settled Wednesday.

U.S. stocks, which tend to rise as gold falls, gave up earlier losses Wednesday to trade higher, but caution around a U.S.-China trade spat and weaker-than-expected U.S. retail sales data kept bullish sentiment in check.

Sales at U.S. retailers fell in April for the second time in three months, down 0.2%. Expectations for a Federal Reserve interest-rate cut “grew following the softer than expected retail sales reading,” said Edward Moya, senior market analyst at Oanda.

U.S. industrial production in April slumped 0.5% and capacity utilization fell sharply to 77.9% from an upwardly revised 78.8%, the Fed announced Wednesday.

Jeff Wright, executive vice president of GoldMining Inc., said gold managed to hold on to a modest gain as the Atlanta Fed model showed second-quarter real GDP growth at 1.1% on Wednesday, down from 1.6% on May 9. “This along with retails numbers give credibility to possible interest rate reduction in Q3-Q4, 2019 if trend continues,” said Wright.

Separate data out of China showed its industrial output slowed sharply from 8.5% to 5.4% year-over-year in April, while retail sales grew at the weakest rate in 16 years. The data highlighted the tensions around the trade talks but also rekindled fresh talk that China could keep up economic stimulus.

“The immediate market fear over the escalation in the trade dispute seems to be calming down once more. Donald Trump has been upbeat over the prospects of an agreement. it is just that is may take a few weeks to know,” said Richard Perry, an analyst at Hantec Markets. “Trump says three or four weeks, but with the G-20 summit at the end of June, where he and President Xi are sure to meet, it could be longer. For now, markets look subdued, like an injured animal licking its wounds.”

For gold bulls, Perry says, holding $1,289/$1,291 and breaking back above resistance at $1303 is now key.

Elsewhere on Comex, July PL PLN9, -1.23% fell $11.40, or 1.3%, to $847.70 an ounce following a climb of 0.5% Tuesday, while June palladium PAM9, +0.42% gave up a dime to $1,332.90 an ounce, after a 1.2% rise a day earlier.

Meanwhile, July copper HGN9, +0.79% which has been sensitive to the Sino-American trade tensions, edged up 1.8 cents, or 0.7%, to $2.743 a pound, held on to a week-to-date loss of around 1.3%. Trade jitters between the world’s largest economies have the potential to hurt demand for the industrial metal.