A double header news day for tomorrow as the Federal Reserve and Bank of Japan make policy announcements. We could see wild swings in either direction. The cycles support further downside, but unexpected asset purchasing from either central bank could send precious metals higher. I wish I had an inside source. Nevertheless, it will make for an exciting day. I'll do my best to post an update before the market close.

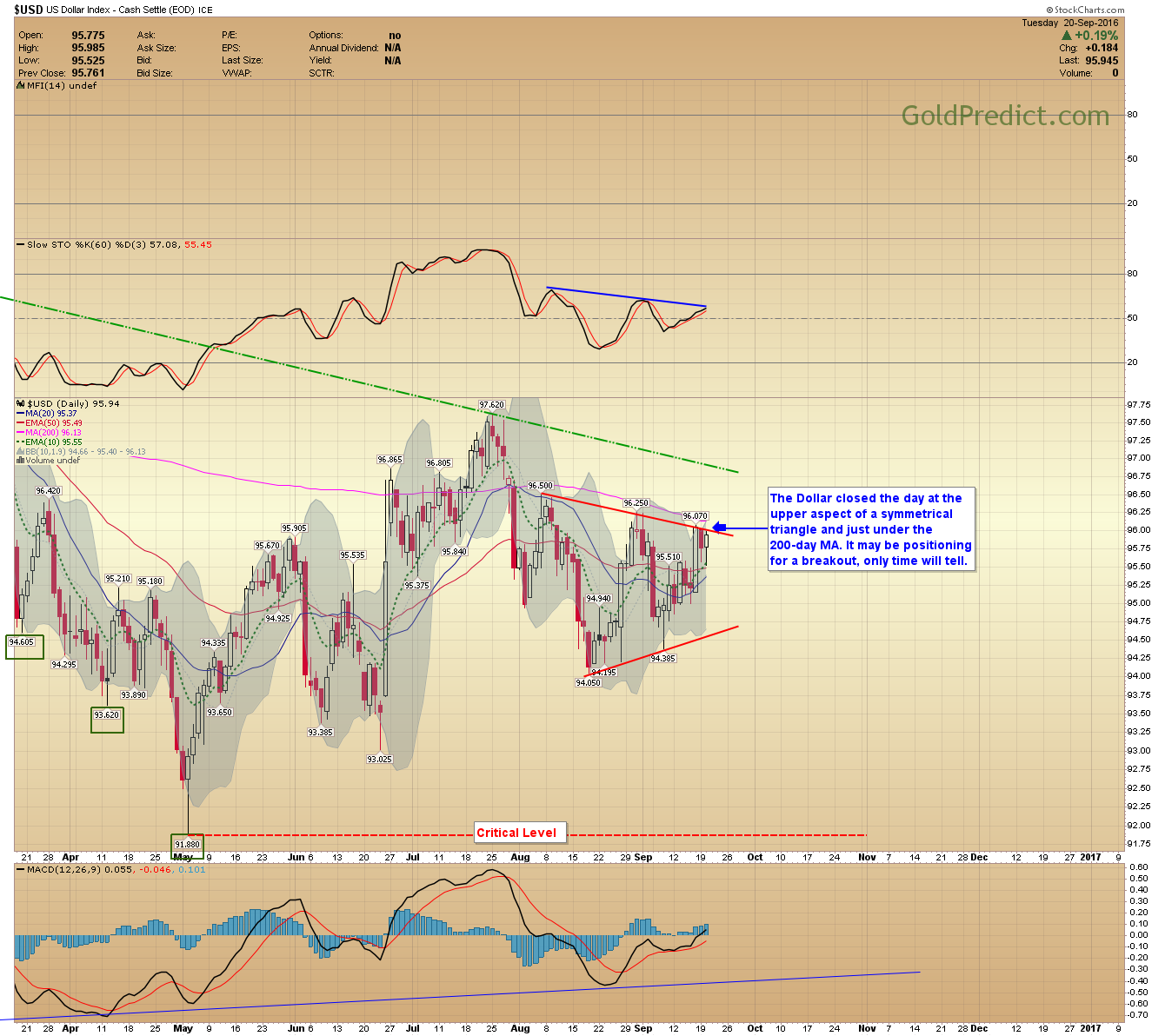

-US dollar- The dollar closed the day at the upper aspect of a symmetrical triangle and just under the 200-day MA. It may be positioning for a breakout, only time will tell.

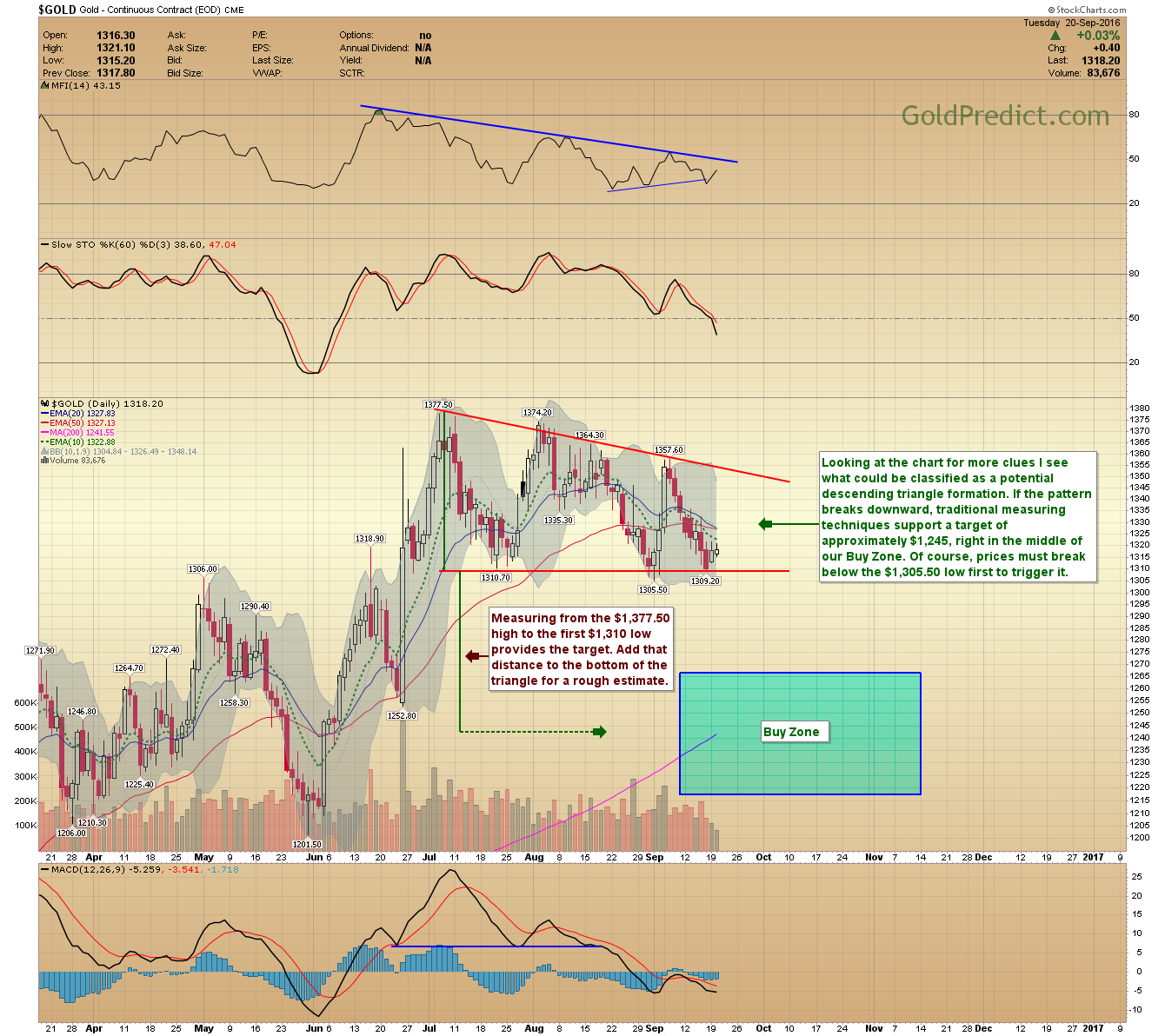

-Gold- Looking at the chart for more clues I see what could be classified as a potential descending triangle formation. If the pattern breaks downward, traditional measuring techniques support a target of approximately $1,245, right in the middle of our Buy Zone. Of course, prices must break below the $1,305.50 low to trigger it first.

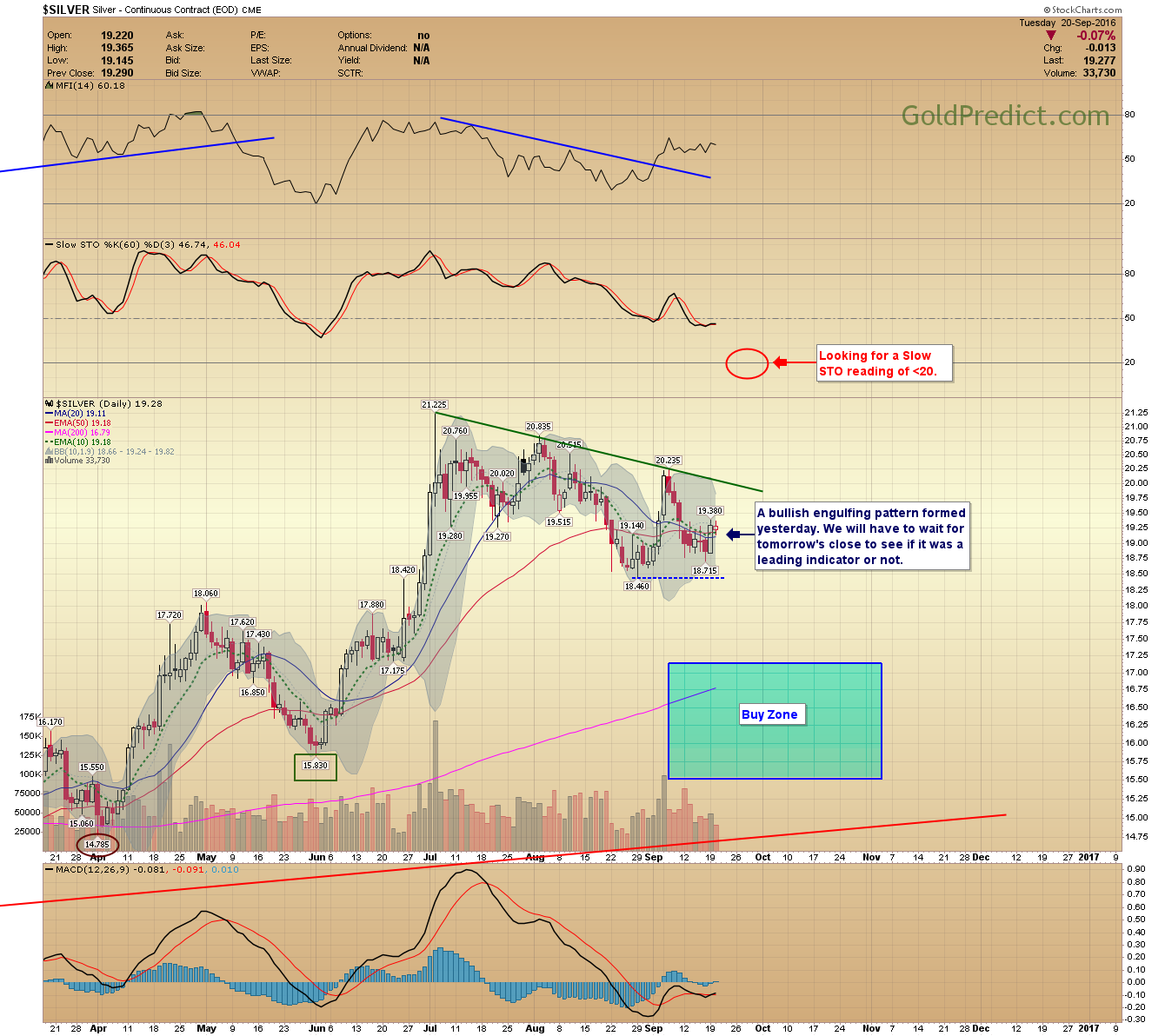

-Silver- A bullish engulfing pattern formed yesterday. We will have to wait for tomorrow's close to see if it was a leading indicator or not.

-VanEck Vectors Gold Miners (NYSE:GDX)- No clues in the chart, prices are mostly unchanged the last few trading days.

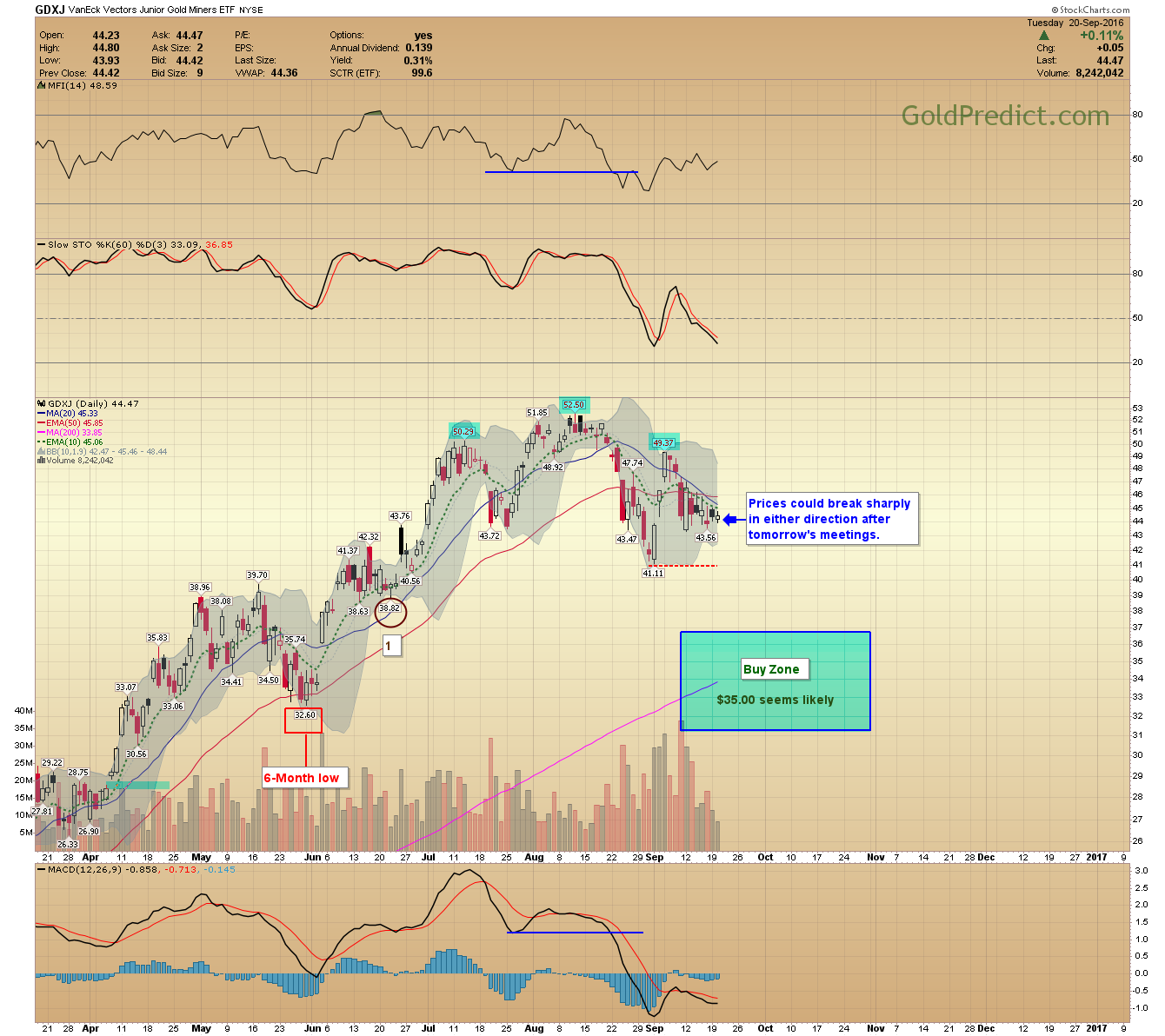

-VanEck Vectors Junior Gold Miners (NYSE:GDXJ)- Prices could break sharply in either direction after tomorrow's meetings.

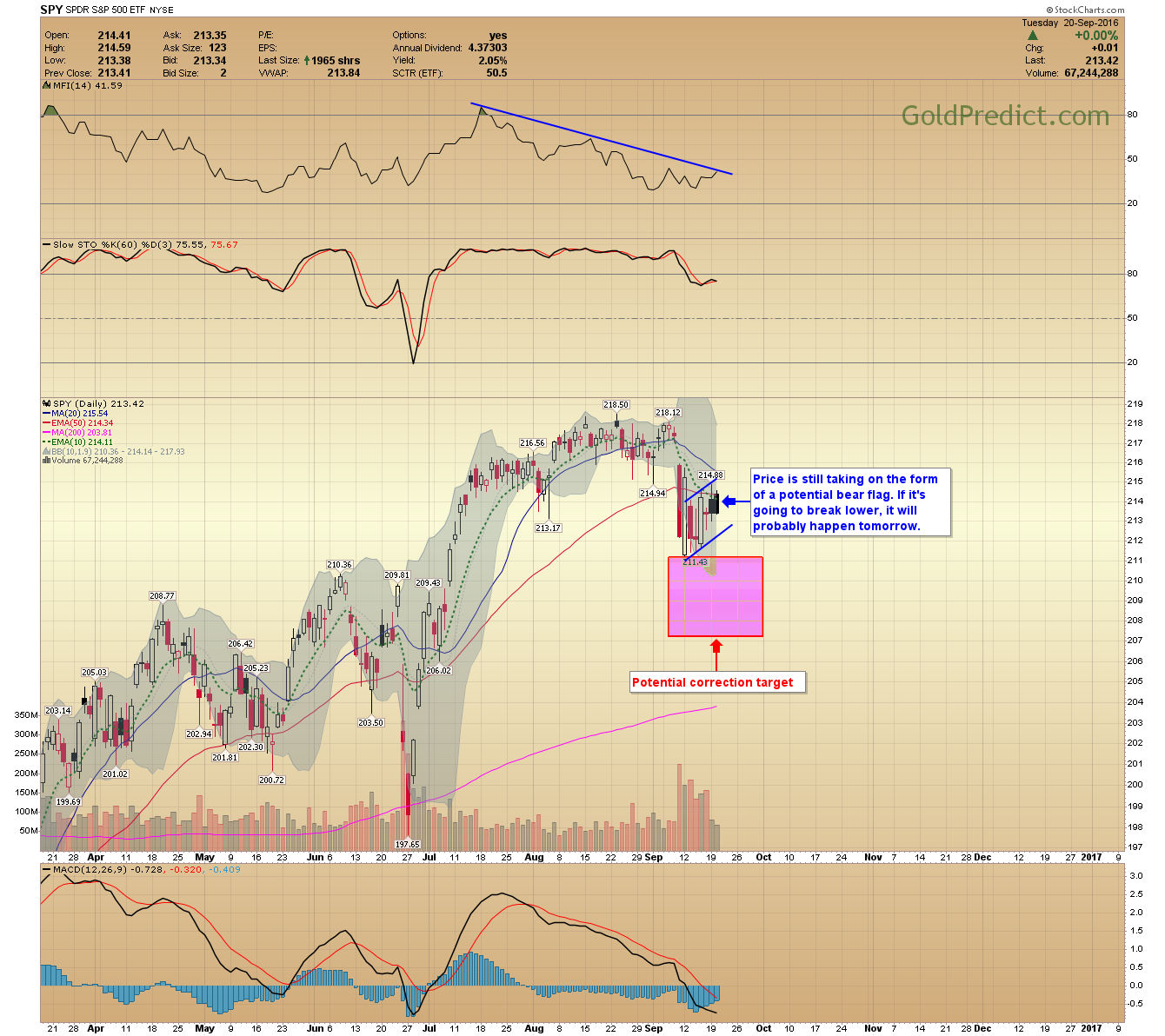

-SPDR S&P 500 (NYSE:SPY)- Price is still taking on the form of a potential bear flag. If it's going to break lower, it will probably happen tomorrow.

-WTIC- Oil prices dipped down to test the $43.00 low and then bounced. The path of least resistance still looks to be lower from here.

The Bank of Japan should announce around noon tomorrow, and the Fed's decision is scheduled for 2 PM with a press conference to follow. I will try to post an update before the close. Fasten your seatbelts, it could be a wild ride.