Congratulations to everyone who waited out the corrective rally. The profits in this short position are bigger than ever!

Profits Soar for Investors

Some will say that today’s slide in Gold, Silver, stocks, and mining stocks is just a result of better-than-expected CPI readings, and while it is true that this was the direct trigger for the decline, it’s also true (and much more important) that this kind of move was in the cards for many days – just like I wrote at the beginning of February.

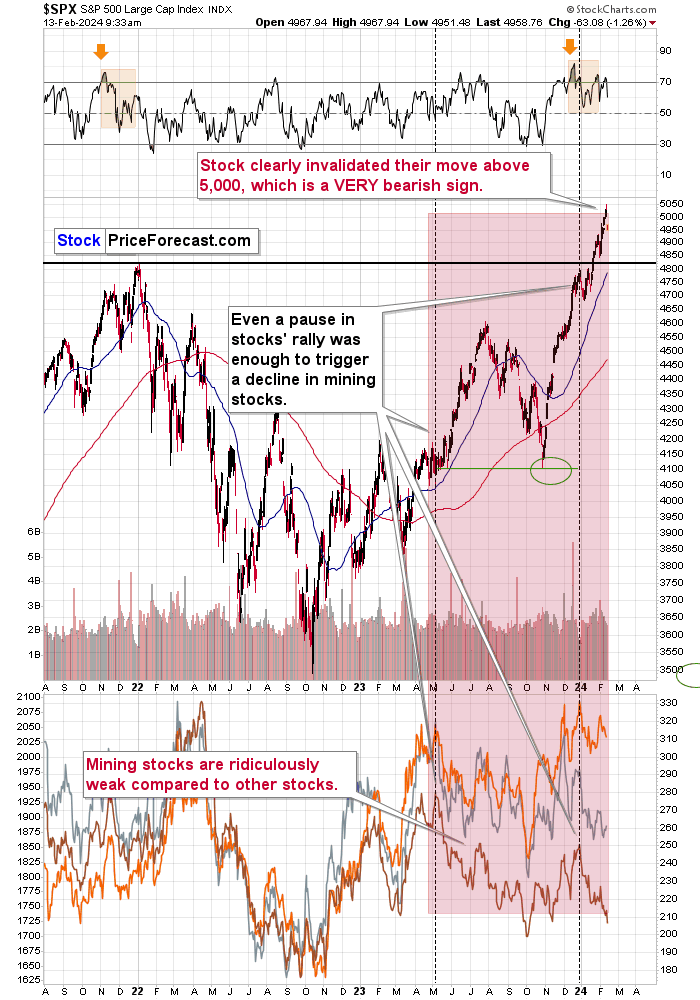

That’s what the technical analysis has been pointing to. I previously wrote that the S&P 500 was likely to invalidate its move above 5,000, and that’s exactly what we saw today.

Yesterday’s session took the form of a daily reversal, and this, along with today’s decisive slide below 5,000, serves as a clear confirmation that the top is in. Is this a top that will hold for many months? I’d say that this is quite likely, but it’s not the key thing from the point of view of gold and silver investors and traders.

After all, precious metals and mining stocks can decline even while stocks are rallying, and that’s certainly been the case with mining stocks this year.

I previously wrote that the decline in stocks would push miners’ prices lower and accelerate their decline. Here’s what’s happening today:

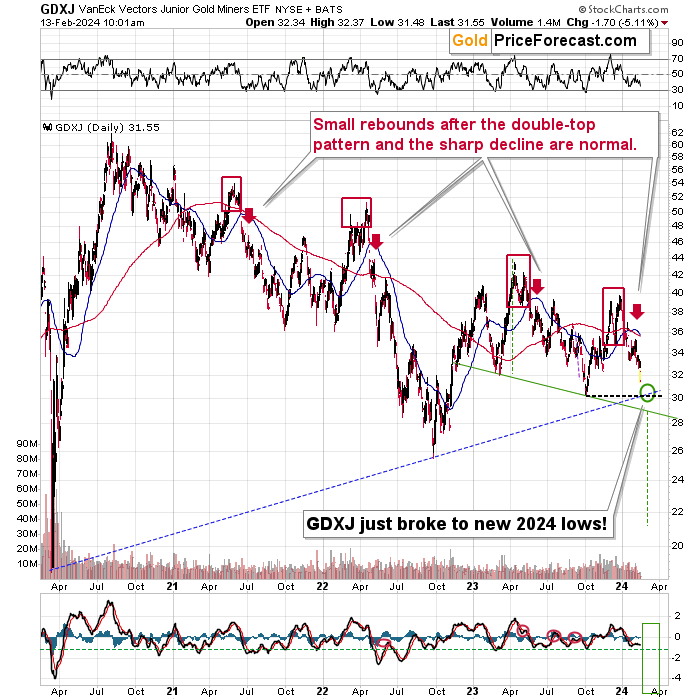

Miners plunged.

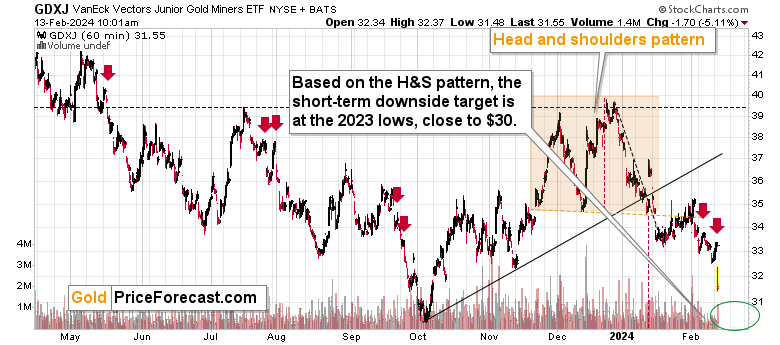

After a tiny daily – and normal – corrective upswing, the decline accelerated, catching by surprise everyone that believed that a daily rally is something bullish. It’s not. A daily rally has no implications on its own – it is the context in which we see it that makes it bullish or bearish. In VanEck Junior Gold Miners ETF (NYSE:GDXJ's) case, the context and trend remained bearish.

Opportunity Beckons

Junior miners are moving close to my downside target area, which might serve not only as a profit-take opportunity but also as a buying opportunity. I’ll send an intraday Gold Trading Alert with a confirmation regarding details once we get there.

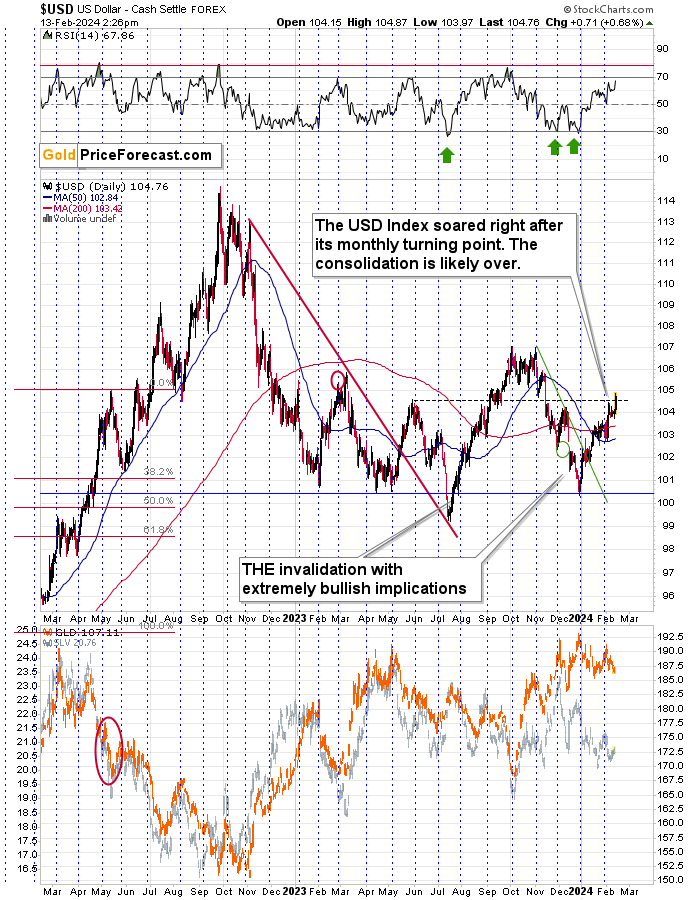

Gold price plunged, as well, and it’s once again approaching the $2,000 level. Without help from the stock market and given the rising US Dollar Index, gold might not be able to hold above $2,000 this time.

Will it slide below $2,000 and then drop like a stone in water immediately? It’s not clear at this time. I’d say that a corrective upswing (nothing huge, though) right before a breakdown below the December 2023 lows or right after this breakdown would be likely.

Either way, just as a move back below 5,000 in the S&P 500 got many heads turning, gold’s move below $2,000 is likely to have the same result.

Speaking of the USD Index, it just moved above its mid-2023 high in a rather decisive manner.

The RSI indicator based on the USDX (the upper part of the above chart) is not yet at 70, but it’s getting very close to it.

This might trigger a corrective upswing after an additional rally, which this pullback might correspond to a rebound in gold and mining stocks. We are not there yet, though.

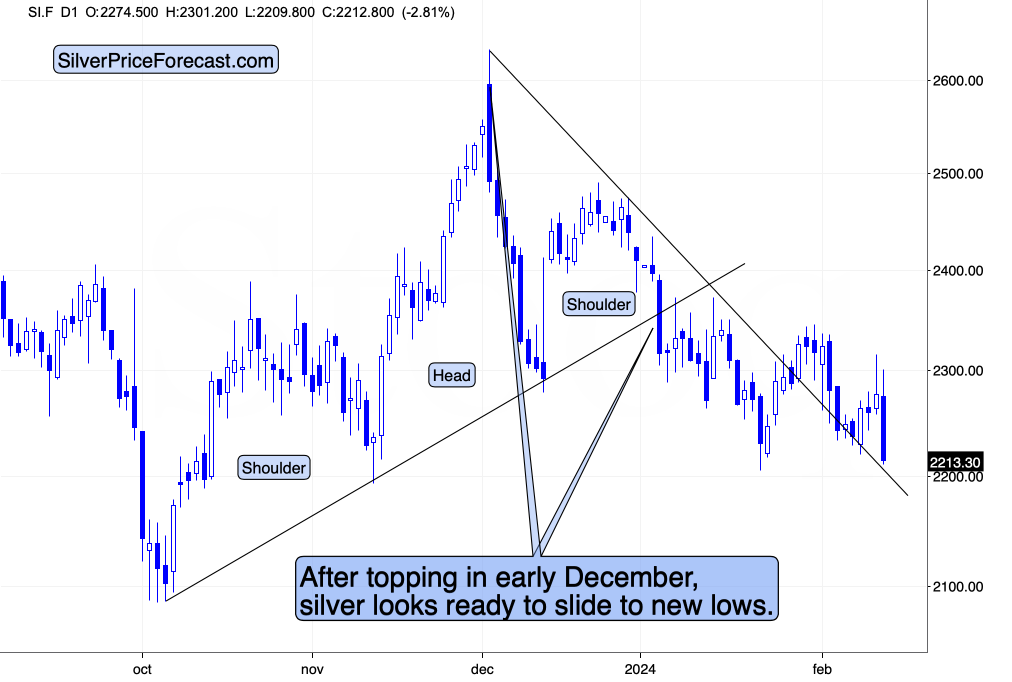

I previously wrote that silver’s short-term outperformance of gold was not a bullish thing but rather a sell signal. Indeed, both: gold and silver are now moving considerably lower.

Silver’s breakout once again turned out to be a fakeout. Instead of a major rally, we saw declines.

All in all, the very short-term outlook for gold, silver, and mining stocks remains bearish, but it’s likely that a take-profit and a buying opportunity are just around the corner.