The majority of stock indices in the states are doing great this year and most are either hitting all-time highs or very near them. The Power of the Pattern noted at the beginning of the year that the Gold Bugs Index (HUI) and miners could be poised to out perform the S&P 500 for years to come.

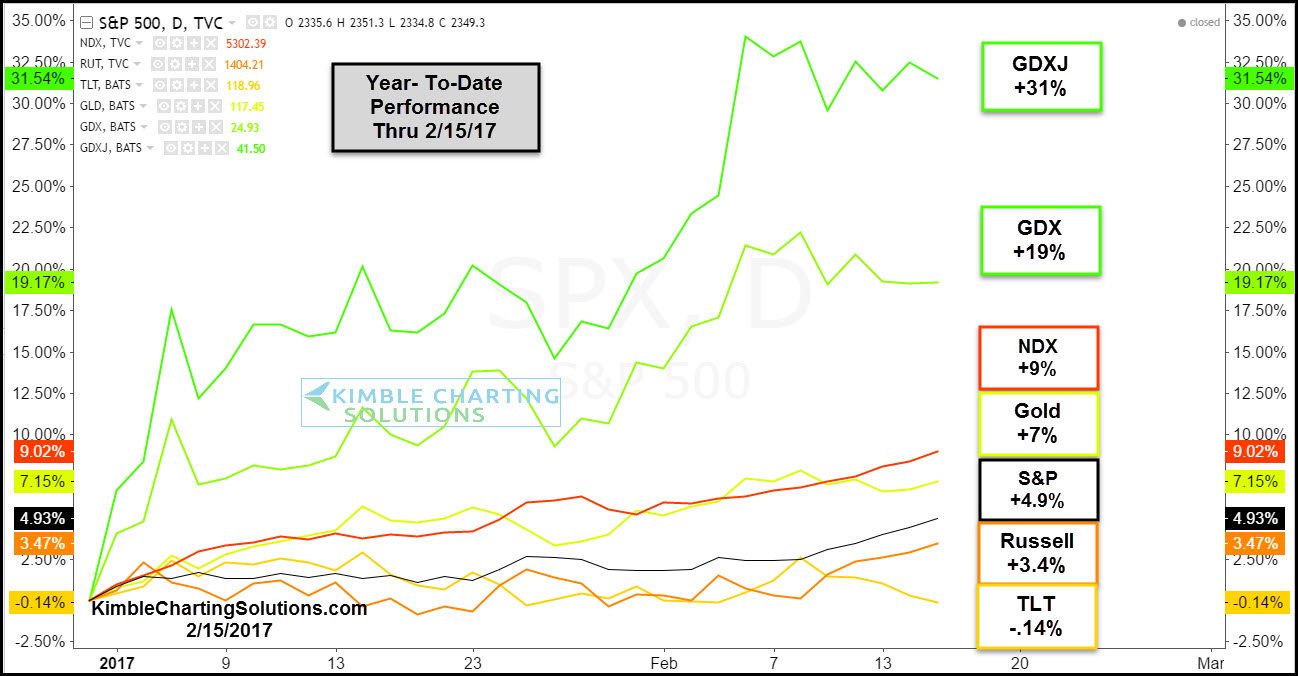

Below looks at year-to-date performance of bonds, gold and mining stocks along with several stock indices.

The broad market (S&P 500) is up nearly 5% in the first 6-weeks of the year, which is an outstanding start to 2017. On 1/5/2017 we suggested that Miners ETF’s GDX and GDXJ could do very well going forward due to a potential multi-year reversal pattern -- a head-and-shoulders topping pattern -- in the SPY/Gold Bugs Ratio.

Even though the broad market has done well, price movement still suggests that the miners could continue to outperform the broad markets, as GDX is up around 19% on the year and GDXJ is up over 30%.

If the SLV/GLD and GDXJ/GDX ratios break from 6-year falling channels, both would suggest that the metals sector could be breaking long-term down trends (bear trends), which would suggest more strength is to come, in the metals arena.

Full Disclosure: Premium and Metals members bought GDXJ on 12/27/16