Investing.com’s stocks of the week

The GDXJ:GDX ratio can often signal when key turning points are about to take place for gold and silver miners.

The chart above looks at this ratio, which shows that a multi-year narrowing pennant pattern has been forming (higher lows and lower highs).

Despite gold, silver, GDX and GDXJ heading much lower over the past several months, this important ratio has actually been heading higher and is facing a key breakout test at (1).

If this ratio breaks out, it will send a short-term bullish message to the out-of-favor mining sector.

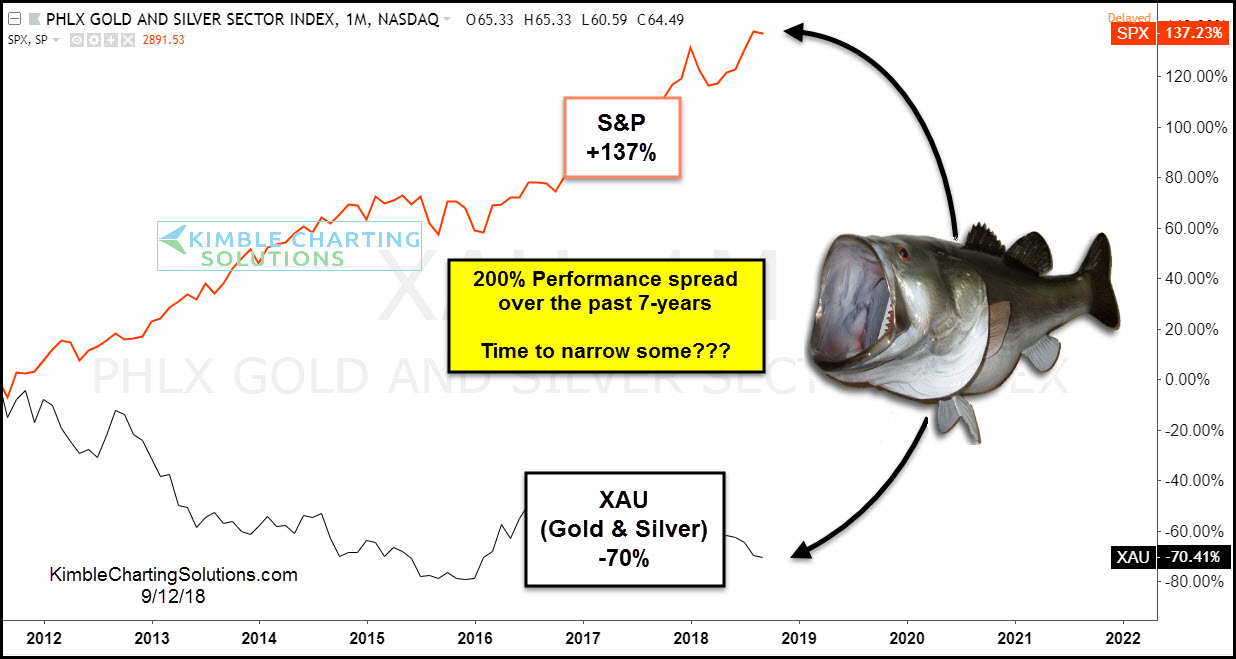

The chart below shows the spread between the S&P 500 and Philadelphia's Gold/Silver Index (XAU) over the past 7 years

If the GDXJ/GDX ratio breaks out, the odds increase that the large spread between the S&P and XAU will narrow.