From Sean Brodrick: The trading action in gold and silver has been bad in the past month. The action in miners and explorers has been worse.

But now, miners and explorers are sending a different message: Hold on to your hats! We’re headed higher.

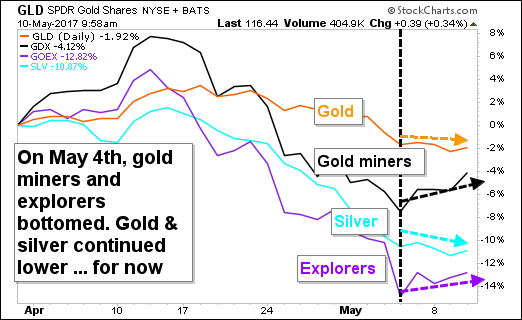

Here’s a chart tracking the action in gold, silver, miners and explorers over the last month.

What an ugly month. Explorers, as tracked by the Global X Gold Explorers ETF (NYSE:GOEX), lost 14% in just three weeks. Terrible!

But on May 4, something changed.

Gold and silver continued lower. Miners and explorers did not. They headed higher.

This isn’t true of all miners, or all explorers. Some continue to get crushed under fortune’s wheel. But the majority of miners and explorers are seeing some relief.

And now we’re seeing a disconnect in the action between the metals and the miners.

This is significant, because miners often lead the metals.

I think the miners are keying off news about growing physical demand in other parts of the world. Particularly India and China.

Raging Gold Bulls

The fact is, this punishment in metals is a paper phenomenon. Physical demand is ramping up.

There are signs of growth in the two most-important physical markets: India and China. There are raging gold bulls in both countries right now.

That sounds good. Now let’s talk great.In India, gold imports soared to 106 metric tons in March. That’s the highest level since November. Market chatter suggested that seasonal demand was “strong.”

In April, India’s gold imports jumped fourfold! Shipments rose to 98.3 metric tons, from 22.2 tons a year ago. That’s according to provisional finance ministry data reported in Bloomberg.

Sure, part of this is because the government isn’t repeating the same shenanigans that suppressed gold-buying last year. But good news is still good news.

Meanwhile, China’s total gold imports for March came in at a strong 142 metric tons.

Imports through Hong Kong were particularly good. Reuters reported that China’s net-gold imports through Hong Kong more than doubled in March on a monthly basis, to 111.647 metric tons.

I’ll tell you one thing. We know Chinese buyers in particular love bargains in gold. So, do you think they’re running from recent prices … or are they buying with both hands?

I guess we’ll see when the April and May numbers come out.

However, I’ll add that the China Gold Association has made its own forecast. It says, due to many factors, gold demand in that country should hit a four-year-high this year!

You know who else is buying gold weakness? The Germans.

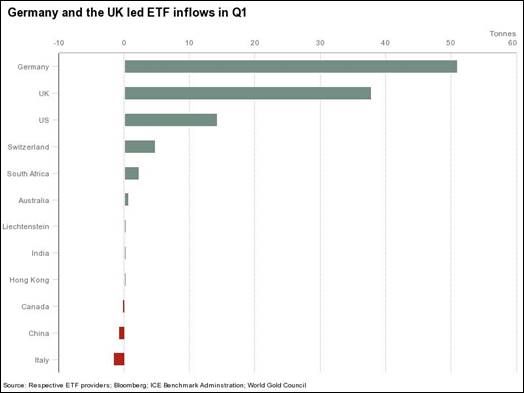

In fact, Germany’s physical gold ETF led the world in purchases by ETFs in the first quarter, according to the World Gold Council.

|

Source: World Gold Council, Gold Demand Trends

Frankfurt-listed Xetra-Gold is the fastest growing commodity ETF this year. It saw inflows of cash every month since the end of 2015. And its total assets have grown to $6.49 billion. That’s five times the cash the SPDR Gold Trust (P:GLD) (NYSE:GLD) has attracted this year.

So sure, gold prices were weak. That’s due to pressure in paper gold, and strength in the U.S. dollar. But physical gold demand is strengthening.

The U.S. dollar got a boost as the U.S. Fed talked about hiking rates, and the European Central Bank seemed less-certain. But we’ll see how that goes. There are plenty of forces that could push the dollar around, too.

As I explained to investors at the Metals Investor Forum 2017 in Vancouver this past weekend, it seems clear President Trump wants a weaker dollar. To boost the economy. And President Trump tends to get what he wants.

Meanwhile, I keep coming back to that first chart I showed you. The miners stopped leading the metals lower. Now, they seem to want to lead the metals higher.

Bounce Or Start Of A Rally?

I’m placing my bets. Market volatility is at an all-time low. Bull markets tend not to die of boredom. Instead, something big and nasty shows up to rip faces off.

I think investors around the world have good reason to stock up on gold. I also think miners have a good reason to start pointing the path higher for the metals.

The next move could be big, indeed.

The VanEck Vectors Gold Miners ETF (NYSE:GDX) was trading at $22.09 per share on Thursday morning, up $0.16 (+0.73%). Year-to-date, GDX has gained 5.59%, versus a 7.00% rise in the benchmark S&P 500 index during the same period.

GDX currently has an ETF Daily News SMART Grade of D (Sell), and is ranked #18 of 33 ETFs in the Precious Metals ETFs category.