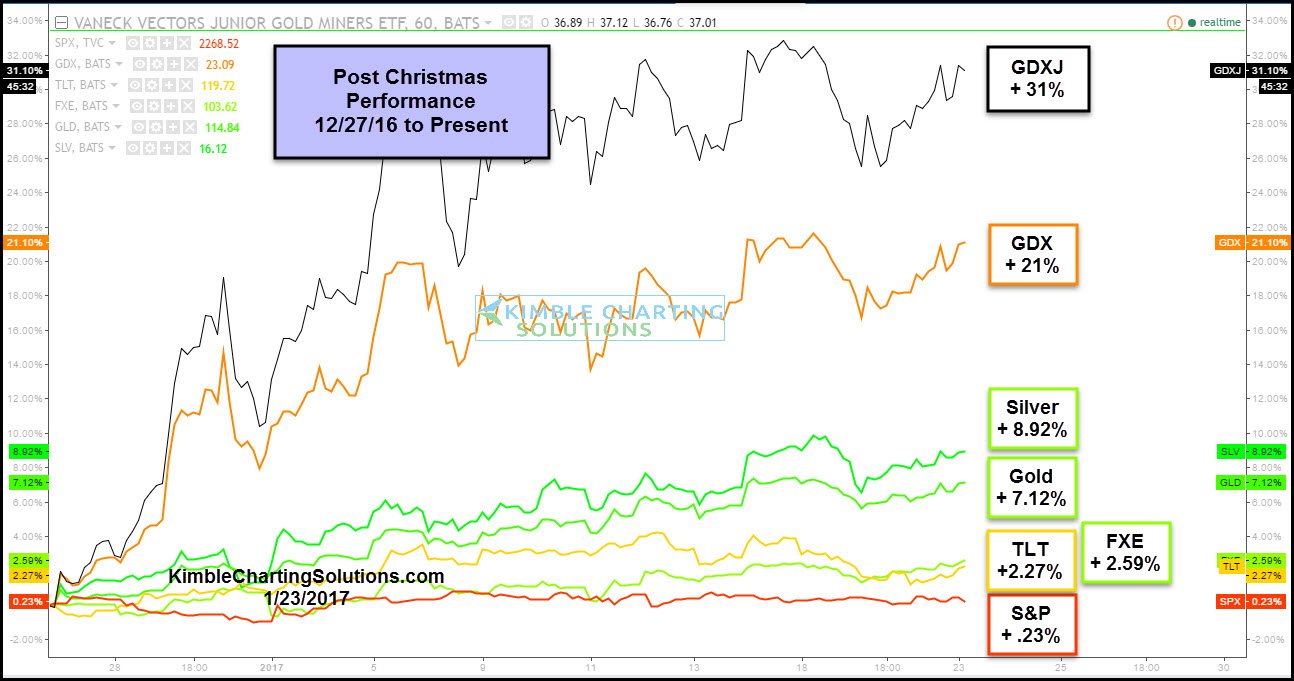

Much like Santa Claus, the S&P 500has been taking it easy in the month since Christmas.

Not so much for a few other high-flying assets.

Since the first day of trading after the Christmas break, the broad market has been pretty quiet, up .23%. Bonds (NASDAQ:TLT) and the Euro (NYSE:FXE) have made a little bit more than the broad markets.

However the Metals Sector, for its part, has done pretty well since Christmas, with gold and silver gaining around 7% more than the S&P and the Miners outpacing by a much larger margin.

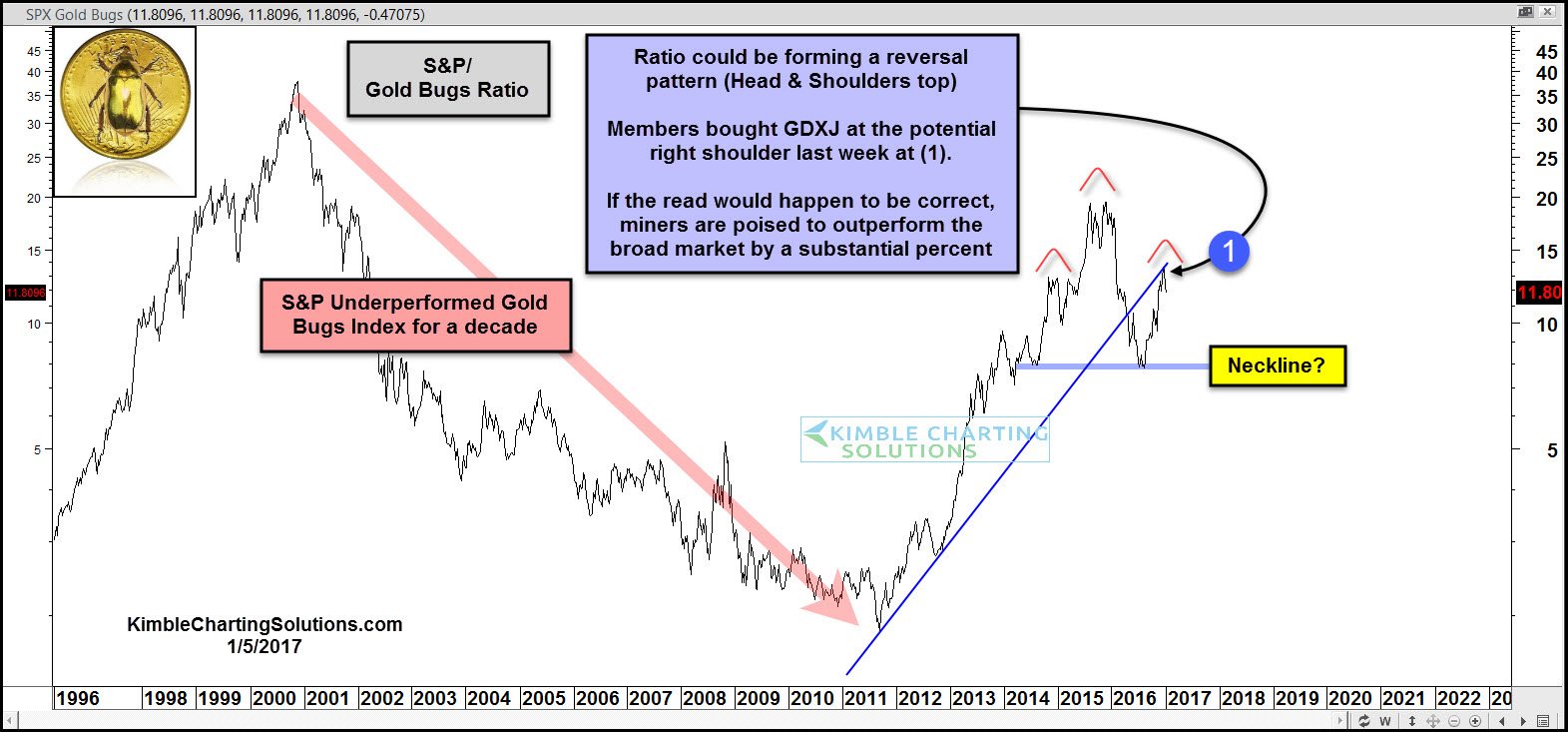

We shared the chart below of the S&P 500 Gold bugs index at the start of this year.

Pair Trade

This chart looks at the S&P 500/Gold Bugs Ratio over the past 20 years. We've been highlighting this pattern to members, suggesting it could be a long-term topping pattern -- potential Head & Shoulders. If this read is correct (not proven so far), the pattern created would suggest that the Miners could out perform the broad market for a good while. If the ratio is correct, it is suggesting a pair trade of long miners/short S&P.

Full Disclosure; Premium and Metals members are long miners at this time.