The gold miners will soon report their best quarter ever, smashing all records! Profits will skyrocket on the highest gold prices ever witnessed combined with stable or lower mining costs. Yet gold stocks are still trading as if both their earnings and gold were way lower, an extreme valuation anomaly. Upcoming stellar Q4 and 2024 results should help reverse that, growing investors’ interest in this high-flying sector.

Quarterly earnings seasons are an essential fundamental reality check on stock prices. These results dispel the sentimental fogs usually enshrouding stocks, revealing how companies are actually faring. As most operate on calendar years, Q4 results are included in way more comprehensive annual reports. While the extra data and analyses are welcome, those take longer to prepare stretching out reporting deadlines.

After normal quarters not ending reporting years, US-listed and Canadian-listed stocks are required to file full results within 40 and 45 calendar days. But those are extended to 60 and a whopping 90 following quarters ending reporting years! So most gold miners’ Q4 operational and financial results are released slower and later than earlier quarters. That’s unfortunate, affecting the timeliness and utility of this data.

For the past 34 quarters in a row, I’ve painstakingly analyzed the latest operational and financial results from the 25 largest component stocks in the leading benchmark (NYSE:GDX) gold-stock ETF. These are detailed in quarterly essays right after earnings seasons. Those are published in the second halves of the second months after quarter-ends for Q1s, Q2s, and Q3s, but in the middle of the third months for Q4s ending years.

Mostly thanks to Q4’24’s stupendous record gold prices, the gold miners’ latest results are going to prove epic. But sadly we have to wait until mid-March or so to collate and study them all. Yet after spending the better part of a decade analyzing every quarterly earnings season, how gold miners are actually doing is predictable. While much data feeds my massive GDX-top-25-results spreadsheet, it can be distilled down.

The best proxy I’ve found for how gold miners are faring is their implied sector unit profits. That construct simply takes the quarterly average gold prices and then subtracts the GDX top 25’s quarterly average all-in-sustaining costs. That results in quarterly average earnings per ounce, which is much cleaner over time than either bottom-line profits or earnings per share. Those are often distorted due to accounting rules.

If companies believe any carrying values of assets on their books are overstated, they are required to immediately write those down and flush the resulting non-cash losses through their income statements. With 25 gold miners, nearly every quarter sees a handful of record such impairment charges on deposits or mines. Their values are typically diminished by either lower gold prices or operational or geopolitical challenges.

Because of all these unusual non-recurring items distorting some varying subset of gold miners’ income statements, actual earnings and earnings per share aren’t comparable without plenty of adjustments. I do and discuss those in my quarterly results essays. But by excluding such items which can also be big non-cash gains, implied sector unit profits are superior for comparisons. And Q4’s are going to prove epic!

Gold averaged $2,661 on close in Q4’24, soaring 34.7% year-over-year! The former is the highest gold has ever achieved, while the latter is the biggest gain in the last 34 quarters I’ve been advancing this research thread. In the previous five quarters ending Q3, gold averaged $1,926, $1,976, $2,072, $2,337, and $2,477 which surged 11.6%, 14.2%, 9.5%, 18.2%, and 28.6% YoY. Last quarter utterly trounced all that!

While Q4’s average gold price is set in stone, estimating the GDX-top-25 gold miners’ all-in-sustaining costs is more involved. During those same previous five quarters, those averaged $1,325, $1,317, $1,277, $1,239, and $1,431 per ounce. Averaging those in turn results in $1,317. In their latest reported results for Q3’24, the majority of the GDX-top-25 gold miners forecast that Q4 would see their lowest AISCs of 2024.

That was mainly due to higher production with newer gold mines and expansions ramping up. AISCs are highly inversely correlated with outputs, due to the big fixed costs of gold mining. Mills processing gold-bearing ores costs about the same to operate every quarter. So more overall throughput or higher-grade ores yield more ounces to spread those expenses across, lowering unit costs. That should happen in Q4.

The first three quarters of 2024 saw GDX-top-25 AISCs averaging $1,315 per ounce. So given these major gold miners’ own Q4 guidances, it would be reasonable to expect those to drift closer to $1,300. But whenever I do estimates, I always try to be conservative with less favourable assumptions. So for our purposes today, let’s assume these elite gold miners average considerably worse $1,350 AISCs in Q4.

Last quarter’s record $2,661 average gold prices less $1,350 projected AISCs yield phenomenal record sector profits of $1,311 per ounce! That would make for enormous 98.8%-YoY growth from Q4’23 levels. You read that right, the major gold miners’ earnings almost certainly doubled last quarter! Yet GDX’s average share price across these same quarters merely rose 31.1%, lagging far behind soaring profits.

And massive earnings growth is nothing new for the gold miners. The previous five quarters ending in Q3 saw GDX-top-25 implied sector unit profits running $601, $659, $795, $1,099, and $1,046 per ounce. That $1,099 in Q2’24 was the previous record. These same five quarters achieved amazing year-over-year growth of 87.2%, 42.3%, 34.9%, 83.7%, and 74.0%! Q4’24 will be the sixth consecutive quarter of this.

Average all these, and the major gold miners have been achieving crazy 70%-YoY profit growth for the last year-and-a-half! No other sector in all the stock markets is remotely close. Q2’23 was gold stocks’ last normal quarter before this extraordinary run. Assuming my Q4’24 assumptions are in the ballpark, GDX-top-25 implied sector unit profits have soared 119% in that span! Stock prices should’ve followed.

Yet the quarterly average GDX levels between those two quarters merely climbed 17.7%, just 1/7th of what earnings growth supported! This extreme valuation anomaly can’t and won’t last. Eventually all stock prices mean revert to some reasonable multiple of underlying corporate earnings. Odds are no other stock-market sector is more undervalued than gold stocks today, which makes them screaming buys.

The upcoming stellar Q4 gold miners’ results should help galvanize a bullish sentiment shift among all-important institutional investors. Unlike the retail guys who mostly chase momentum, the fund guys have to do their research and understand underlying fundamentals. When gold miners’ best quarter ever prods the professionals to dig deeper, the case for allocating capital into gold stocks will prove super-compelling.

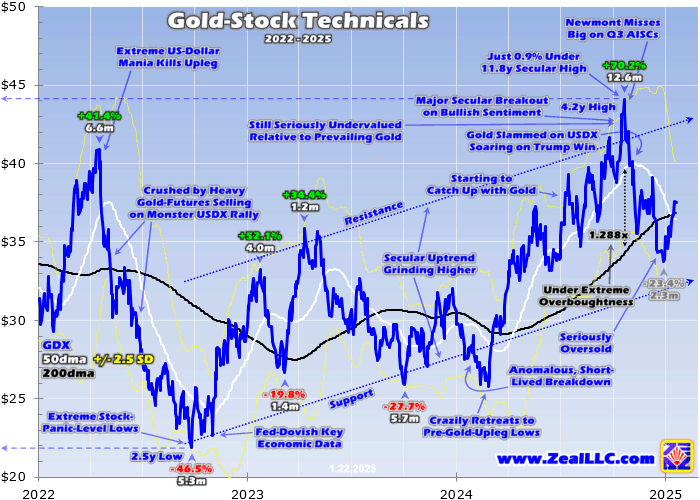

With the gold miners so incongruously out of favor today, it won’t take much institutional buying to catapult them way higher. The resulting upside momentum will fuel mounting bullishness, attracting in more funds and retail investors. Interestingly GDX isn’t far from a major secular technical breakout, which should really accelerate that overdue sentiment shift. This chart illuminates GDX over the past several years or so.

Despite mostly still being ignored, the major gold stocks just carved a solid upleg. From early October 2023 to late October 2024, GDX powered 70.2% higher in 12.6 months! Yet while those would’ve been great gains for most sectors, they weren’t for high-flying gold stocks. The major gold miners of GDX usually amplify material gold moves by 2x to 3x. In nearly that same span, gold skyrocketed up 53.1%! So by gold stocks’ own modern standards, GDX should’ve soared 106% to 159% leveraging gold’s huge upleg. Just 70% made for very-poor 1.3x upside leverage to their metal. That’s way too low to justify gold miners’ big additional operational, geological, and geopolitical risks heaped on top of gold price trends. Somewhere under 2x investors are better off reallocating any capital in the miners into gold itself.

Interestingly this past year’s gold upleg was the first achieving 40%+ monster status since mid-2020. Emerging from the pandemic-lockdown stock panic, gold soared 40.0% in 4.6 months back then. This same GDX comprised mostly the same major gold miners at similar weightings and rocketed up 134.1% in that span! That amplified gold a great 3.4x, better than normal. There’s no reason that can’t happen again.

After its utterly remarkable year in 2024, in recent months gold defied a massive US Dollar rally to largely consolidate high. While gold did pull back on that which was very healthy after late October’s extremely overbought levels, that selloff merely extended to 8.0% at worst in mid-November. Well under the 10%+ formal-correction levels, that proved gold’s monster upleg remains alive and well! This week bolstered that.

Gold’s initial bounce out of that post-election-dollar-surge pullback blasted it to a $2,708 close in late November. A few weeks later in mid-December, gold marginally bested that at $2,717. Then the dollar shot higher again after top Fed officials slashed their rate-cutting outlook in 2025 in response to Trump’s resounding victory. That hammered gold back down to $2,593, which was a higher low than mid-November.

To decisively break out of that post-election high-consolidation trading range, gold needed to close 1%+ above its high within it. That worked out to $2,744. This Tuesday gold surged 1.6% to $2,742, and then Wednesday rallied another 0.4% to $2,754! So gold has just decisively broken out to the upside, closing merely 1.2% under late October’s latest nominal record high. More new records will really boost bullishness.

The more gold itself attracts investors, the more interest will grow in its miners’ stocks. As gold surged back in late October before this recent pullback, GDX achieved a $44.09 close. That was a 4.2-year high in this leading gold-stock ETF, and just 0.9% under a monumental 11.8-year secular high! Any close above there should accelerate bullish financial-media coverage of gold stocks and capital inflows into them.

Ironically the reason gold stocks started correcting hard in late October wasn’t gold rolling over, since that didn’t start until nearly a week later. While gold miners were reporting epic Q3’24 results then, arguably the most-important one pooped in the punch bowl. Newmont is the world’s largest gold miner with the biggest market capitalization, and thus GDX’s biggest component with a whopping 12.3% weighting midweek!

As I analyzed in depth in my GDX-Q3’24-results essay in mid-November, Newmont had been forecasting lower AISCs all year. But Q3’s proved a huge disappointment, surging 13.0% YoY to a very-high $1,611. In order to meet its own full-year guidance, those would’ve had to average $1,300 in Q3 and Q4. Newmont somehow screwed up the best of times for gold mining spawned heavy selling, its stock crashed 14.7%!

That was this company’s worst down day in 27 years, in the then-best quarter ever for gold stocks. That dragged down GDX and unfairly damaged institutional investors’ view of this sector. As the only gold stock included in the mighty S&P 500, Newmont is the only gold stock plenty of professionals loosely follow. Sadly it has a troubled history of serious mismanagement of production, mining costs, and buyouts.

While Newmont certainly isn’t representative of gold miners, its Q3 costs debacle really tainted sector sentiment. Smaller fundamentally superior mid-tier and junior gold miners are thriving, achieving record earnings while generally growing production with stable or lower mining costs. Newmont won’t report its Q4’24 results until after the close on February 20th, so it isn’t an immediate threat to sentiment.

That gives gold stocks nearly a month to surge higher with gold, building upside momentum and bullish psychology. And again as GDX reaches a dozen-year secular high over $44, that overdue shift should really accelerate. As gold miners’ utterly phenomenal record Q4’24 results start trickling in, investors will increasingly realize how radically undervalued this sector is. Heck, Newmont might even help for a change.

After a long streak of quarters way underperforming its peers, the world’s largest gold miner is due for an upside surprise. In its Q3’24 results, it upped its Q4’24 AISC guidance to $1,475 per ounce. If they come in anywhere near there, that could ignite sizable institutional buying propelling NEM and GDX nicely higher. Couple that with GDX’s coming secular breakout, and gold stocks should return to favor in a big way.

As 2025 dawned, I wrote an essay predicting this year would be gold stocks’ revaluation year. The main thesis is gold’s much-higher prevailing prices are becoming the new normal, leaving gold miners’ fat-and-rich profits durable. That will force their stock prices to revert way higher to reflect those high earnings. So far that is playing out nicely, with GDX up 10.7% year-to-date midweek amplifying gold by 2.2x.

With gold miners about to report their best quarter ever, and gold stocks deeply undervalued, all investors ought to have sizable allocations in this high-potential sector. That doesn’t mean not owning gold itself, or going overboard. For centuries a 5%-to-10% portfolio allocation in gold was universally considered wise and essential. And another 10% to 20% in fundamentally superior smaller gold miners should yield big gains.

For over a quarter-century now, trading these great mid-tiers and juniors has been our specialty at Zeal. In 2024 our pair of subscription newsletters realized 84 stock trades, averaging great +43.1% annualized realized gains! We’ve recently rebuilt our trading books with excellent smaller gold miners, many having big production growth coming from mine builds and expansions. Their stocks remain awesome buys today.

Successful trading demands always staying informed on markets, to understand opportunities as they arise. We can help! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

The bottom line is gold miners will soon report their best quarter ever! Gold’s dazzling record prices in Q4 combined with stable or lower mining costs will fuel the fattest-and-richest gold-mining profits in history. Those coming epic results should prove a wake-up call for investors long ignoring this high-potential sector. Professionals should increasingly realize gold-stock prices are far too low relative to phenomenal fundamentals.

It won’t take much fund buying to propel GDX to dozen-year secular highs above $44, accelerating the overdue mean-reversion back to bullish sentiment. Upside momentum attracts more buyers, amplifying it. Gold’s decisive upside breakout from its recent high consolidation will help, which portends more nominal records coming. Deeply undervalued gold stocks still need to surge massively to reflect this abundant goodness.