- Gold near top of 2024 asset class returns despite strong dollar.

- Correlations with Nasdaq and bitcoin outshine traditional drivers.

- Bias remains to buy dips as higher lows reinforce bullish momentum.

Overview

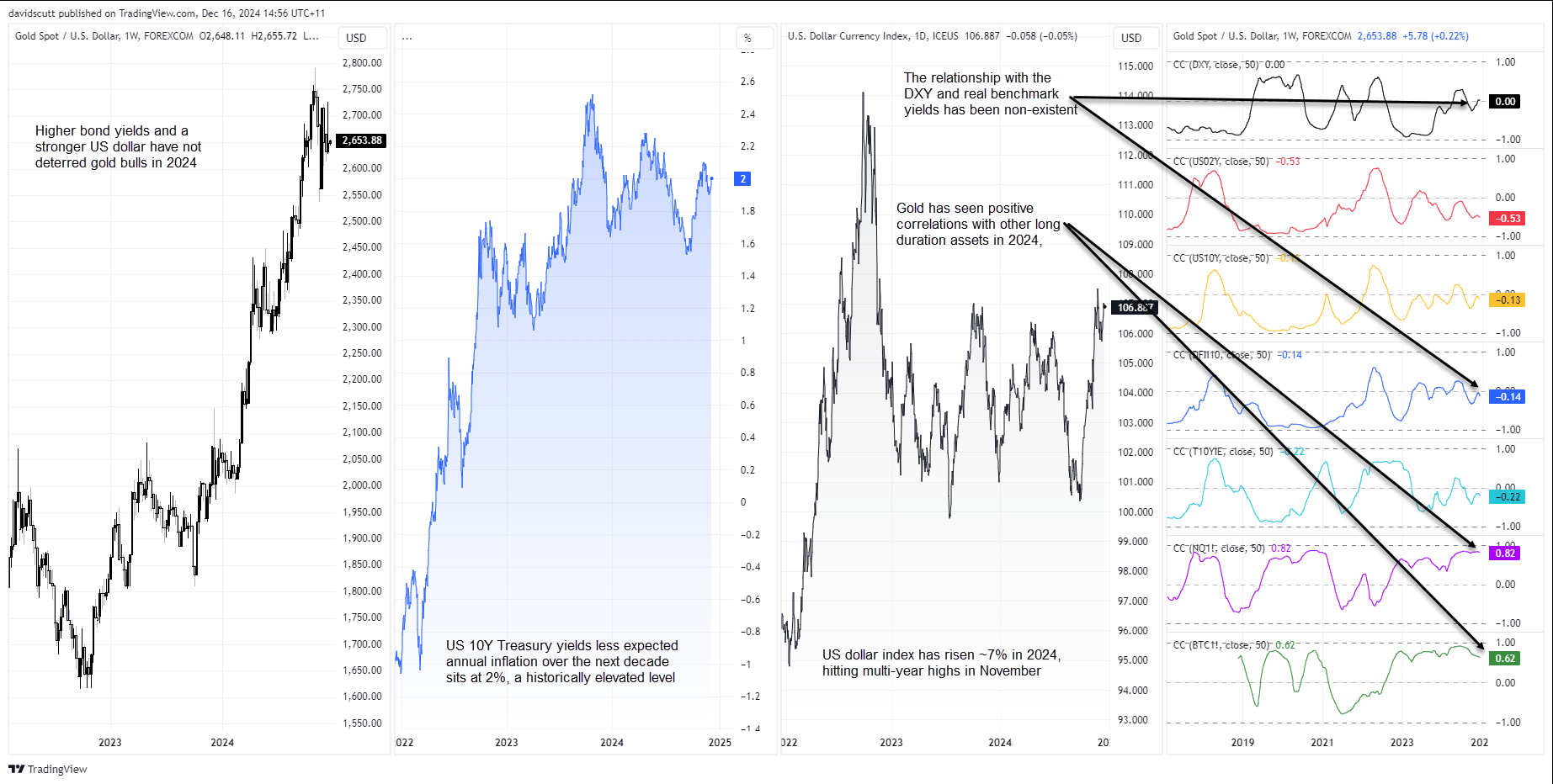

A stronger US dollar and elevated US bond yields is an environment rarely enjoyed by gold bulls, but not this year. Instead, bullion has marched higher, setting multiple records and sitting near the top of year-to-date returns for major asset classes. It’s been as remarkable as it’s been relentless, making it my biggest market surprise of 2024.

Of course, geopolitical tensions in Europe and the Middle East may explain some of the outperformance, but one glance at the following chart suggests gold has been less of a safe haven and more of a long-duration risk play this year.

Gold: Safe Haven or Risk Asset?

Source: TradingView

The rolling weekly correlation over the past year with Nasdaq and bitcoin futures sits at at 0.82 and 0.62 respectively, far stronger than with traditional drivers like the US dollar and real, inflation-adjusted 10-year Treasury yields. As a metal offering no yield and quoted in US dollar terms, gold often has an inverse relationship with those variables.

However, with weekly correlation coefficient scores of 0 and -0.14 in 2024, traditional relationships have been nowhere to be seen, continuing the pattern established since the coronavirus pandemic.

Gold has seen a loose inverse relationship with short-end US Treasury yields, suggesting the Fed monetary policy outlook may be having some influence on the price action, but the influence of long-end yields and longer-term US inflation expectations have been non-existent.

Whether due to concerns about the fiscal trajectory in developed nations, a method to diversify away from the US dollar or a way to circumvent capital controls, or even other factors, the gold game looks to have changed.

Bias Remains to Buy Gold Dips

Source: TradingView

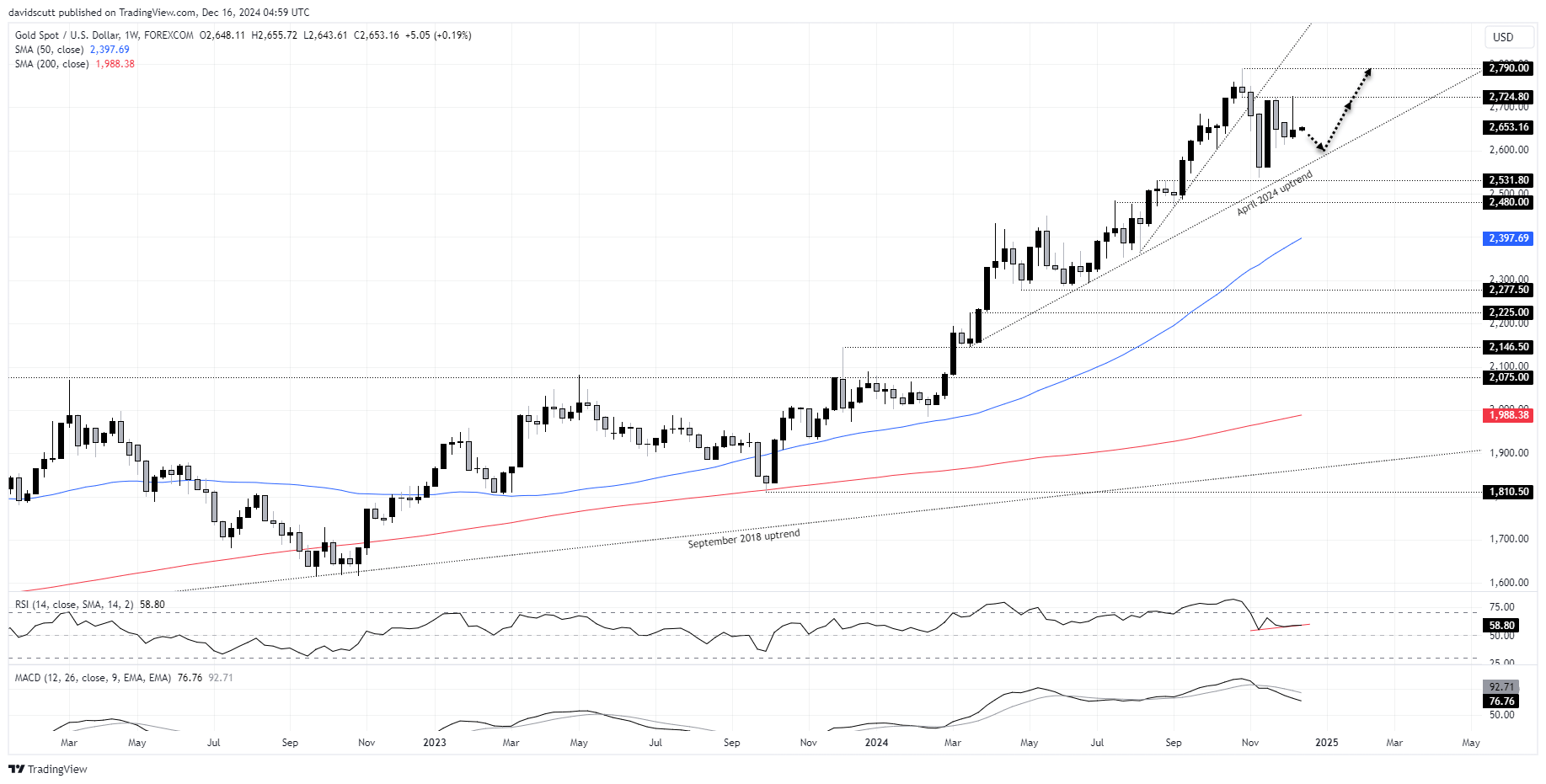

While gold remains below the record high of $2790 set in October following a steep reversal from $2724.80 in early December, the series of higher lows on the weekly timeframe reinforces the bias to buy dips towards known support levels when they occur.

The April 2024 uptrend is one such level with $2531.80 and $2480 the next after that. On the topside, $2724.80 and $2790 are initial resistance levels of note.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI