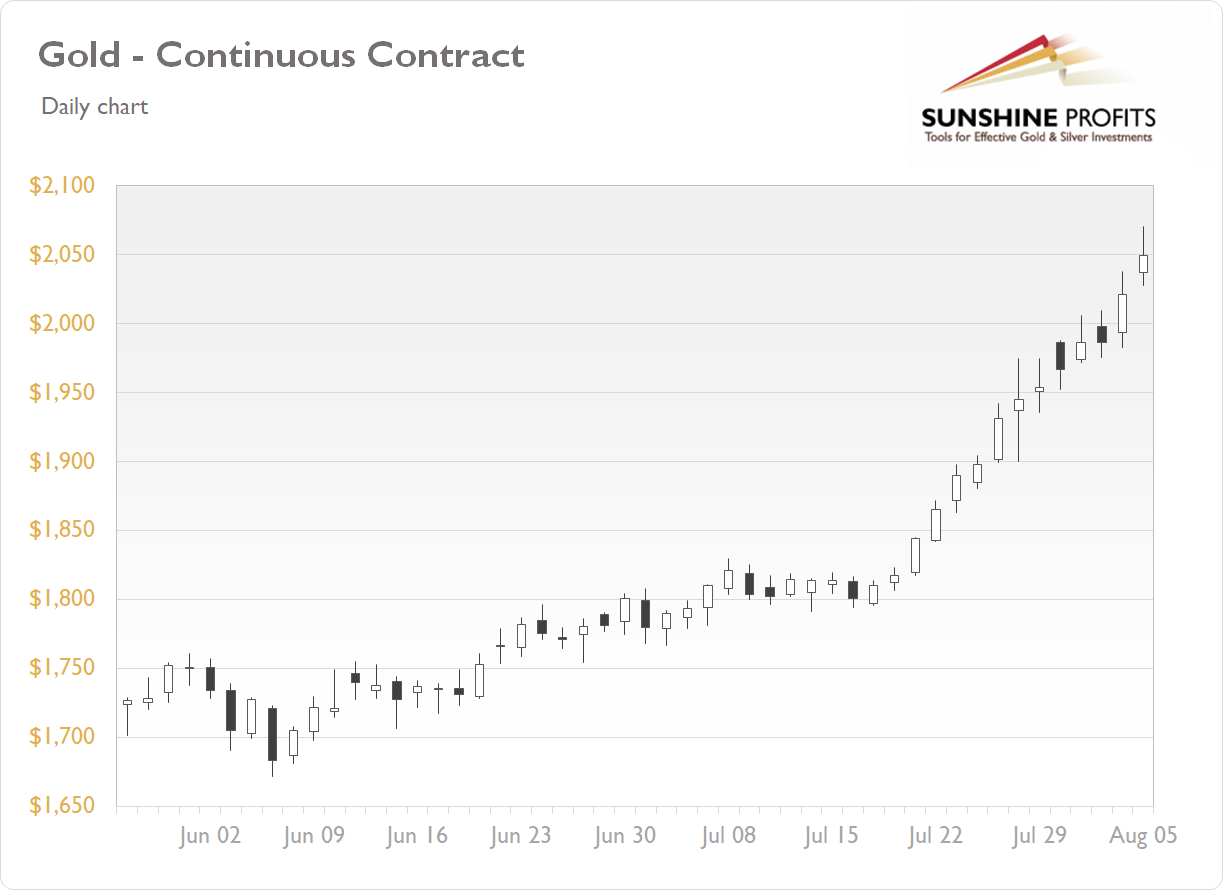

The Gold futures contract has further accelerated its long-term uptrend on Wednesday following the recent short-term consolidation along $2,000 mark. The market reached new record high at the level of $2,070.30 yesterday and it closed 1.40% above Tuesday's closing price. Gold price remains the highest in history following U.S. dollar sell-off, among other factors.

Gold is 1.2% higher this morning, as the market is trading along the record high. What about the other precious metals? Silver rallied 5.31% on Tuesday and today it is 3.7% higher. Platinum gained 3.55% and today it is 1.8% higher. Palladium gained 2.07% yesterday and today it's 0.4% higher. So precious metals are trading along their new highs this morning.

Yesterday's ADP Non-Farm Employment Change release has been much worse than expected at just +167,000. But the ISM Non-Manufacturing PMI has been better than expected.

Today we will get the weekly Unemployment Claims number, among others. And the markets will be waiting for the important monthly jobs data release tomorrow.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, August 6

- 7:30 a.m. U.S. - Challenger Job Cuts y/y

- 8:30 a.m. U.S. - Unemployment Claims

- 10:00 a.m. U.S. - FOMC Member Kaplan Speech

- 9:30 p.m. Australia - RBA Monetary Policy Statement

- Tentative, China - Trade Balance, USD-Denominated Trade Balance

Friday, August 7

- 8:30 a.m. U.S. -Non-Farm Employment Change, Unemployment Rate, Average Hourly Earnings m/m

- 10:00 a.m. U.S. - Final Wholesale Inventories m/m

- 3:00 p.m. U.S. - Consumer Credit m/m