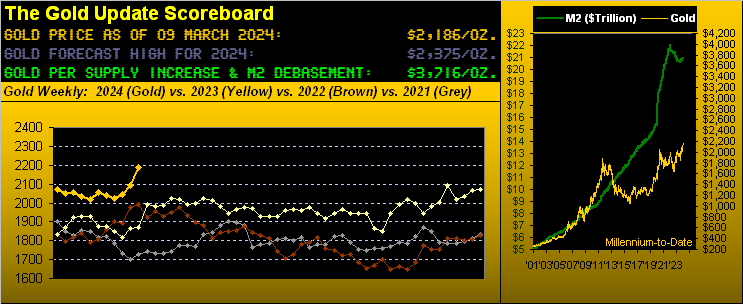

With The Gold Update now in its 16th calendar year and price having just made a series of marginal fresh All-Time Highs these past three trading days (2161 Wednesday, 2172 Thursday, 2203 Friday), on the surface we deem this as a somewhat exciting event, Gold having then settled out the past week yesterday at 2186.

However: from a more studied purview, it is admittedly adequate to couch it all as rather “ho-hum” given how vastly undervalued Gold remains vis-à-vis the above Scoreboard. Therein, the current market level of 2186 is -41% below the Dollar debasement valuation of 3716. Or for you WestPalmBeachers down there, Gold still has a very long way to go up — and moreover — that it will so do given price historically always catches up to prior high levels of valuation. This is starkly shown in the above right-hand panel, wherein clearly Gold whilst now nicely getting some up-curl remains well behind the money supply green line’s continuing to unfurl. And to be sure: this time around such catch-up process is seemingly taking forever.

Still, we take heart in Gold’s having thus far traveled this year some 38% of the route from last year’s settle (2072) toward this year’s forecast high (2375). And from the “Wishful Thinking Dept.”, extrapolating the current year-to-date pace would place Gold at our 2375 forecast high come 21 June, followed by 2764 for year-end. ‘Course, hardly are we holding our breath for it to all go that exquisitely perfect, but ’tis nonetheless a tasty technical tidbit.

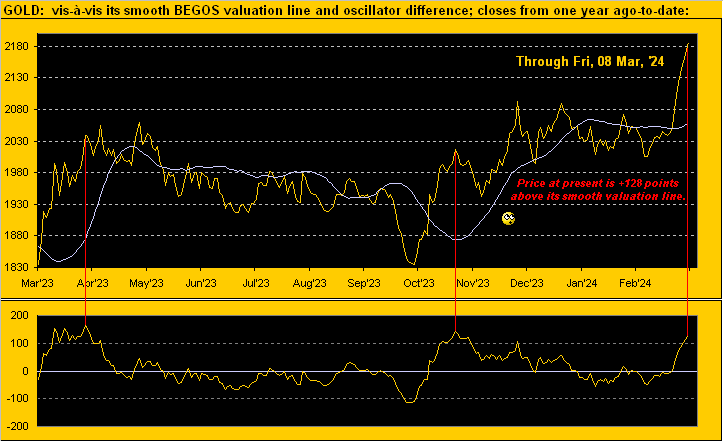

Further from the “Keeping One’s Feet on the Ground Dept.” whilst such an extensive BEGOS Market (Bond / Euro / Gold /Oil / S&P) movement (be it up or down) naturally pulls price away from our proprietary “smooth valuation line”, as this next graphic shows, reversion to said smooth line eventually recurs over time. And per the lower panel oscillator (price less valuation), at present, Gold (2186) is +128 points above that line (2058): obviously the prior two such extremes (red vertical lines) from a year ago-to-date in turn both lead to at least some material near-term price retrenchment. That cited, Gold’s recent peaks across the past three months in the 2090-2070 area appear supportive, (or more optimistically: gone are the days of the 1900s). Here’s the graphic:

Next let’s turn to Gold’s weekly bars and parabolic trends from one year ago-to-date. This past week’s price upthrust comprehensively hoovered away the remnants of the ever so short-lived red-dotted parabolic Short trend, flipping it to Long in fine style per the new rightmost blue dot. Therein, we can’t help but notice the past two parabolic Short trends could not manage more than three weeks of red-dotted duration. Gold’s +5.5% low-to-high intra-week gain was the best in nearly a year, since that ending 17 March 2023, and the +4.5% net weekly gain the best since that ending this past 13 October. Think the buyers are in charge? “YES!!!” indeed:

Meanwhile in charging along with the stagflation theme nauseatingly herein detailed a week ago, the Economic Barometer’s set of 13 incoming metrics produced — as surmised — just five period-over-period improvements, notably with respect to job creation, albeit the rate of February’s Unemployment (despite the increase in Payrolls) jumped two pips from 3.7% to 3.9%. Still, there were some sore stinkers in the past week’s bunch: January’s Factory Orders sank at a -3.6% pace, the month’s Trade Deficit was the worst since that of last April, and credit cards rocketed into orbit as January’s Consumer Credit level leapt from $0.9B in December to $19.5B. “When ya don’t gots da dough, get out da plastic!” After all, there was almost no growth in February’s Hourly Earnings. And as for the Econ Baro itself, straight down continued as well straight down, even as Federal Reserve Chairman Jerome Powell in his Humphrey-Hawkins Testimony remained non-committal toward any near-term change in his Bank’s Funds Rate, (for which as you regular readers know the case can be made to actually increase it). “Oh, say it ain’t so!” Here’s the Baro:

“But the S&P 500 keeps sailing right along, eh mmb?“

So it would appear, Squire, albeit the mighty Index did just (barely) record a down week (-0.3%), only its third such demise of not just the past ten weeks year-to-date, but indeed since that ending 23 October which for those of you scoring at home means the Casino 500 has spun 16 up weeks of the last 19. How rare are such streaks? On a mutually-exclusive basis, before this run, it had only occurred on two other occasions across the past 25 calendar years (during 2018 and 2011, prior to which was during 1989). And following the 2018 stint, the S&P then “corrected” as much as -18.3% within three months, whilst after the 2011 stint, the Index similarly dumped -16.9%. Also, this Casino 500 is now characterized as 35 consecutive trading days “textbook overbought”. So “Get Ready”–[The Temptations, ’66].

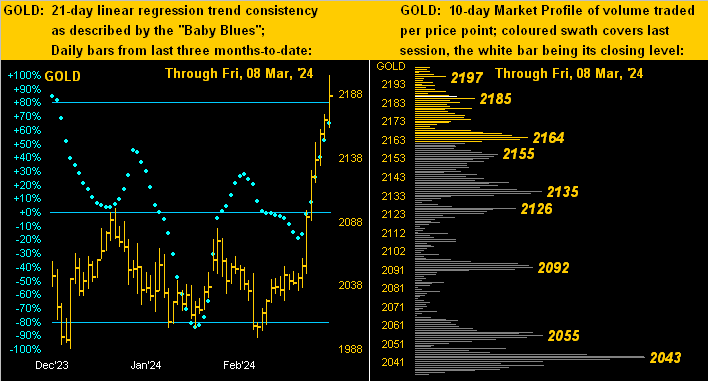

Tempting, too, is the track of Gold, certainly so since mid-February from the rightmost dominant low (1996) in the following left-hand panel of price’s daily bars from three months ago-to-date. In the right-hand panel we’ve Gold’s 10-day Market Profile with its bevy of volume-dominant support levels as labeled:

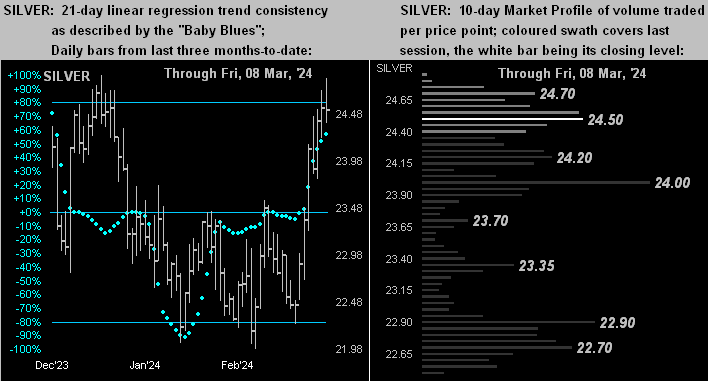

Silver’s setup is quite similar with her daily bars (below left) and Profile (below right). Again to expound upon that which we regularly harp, Silver — given the Gold/Silver ratio now at 89.1x — remains CHEAP! The ratio’s century-to-average is 68.1x: plug that into your HP 12C to see where Silver “ought” be(!)

To finish, with 15 metrics due next week for the Econ Baro including the Bureau of Labor Statistics’ reads on the pace of February inflation at both the retail and wholesale levels, we can’t resist going with this closing graphic as — after all — ’tis The Gold Update No. 747:

What fuels your financial jet? We trust ’tis Gold!

Cheers!