Gold Today –New York closed at $1,266.00 Friday after closing at$1,279.50 Thursday.London opened at $1,267.00 today.

Overall the dollar was weaker against global currencies, early today. Before London’s opening:

- The USD/GBP was weaker at $1.1220 after Friday’s$1.1178: €1.

- The Dollar Index was weaker at 97.13 after Friday’s 97.44.

- The yen was stronger at 109.94 after Friday’s 110.37:$1.

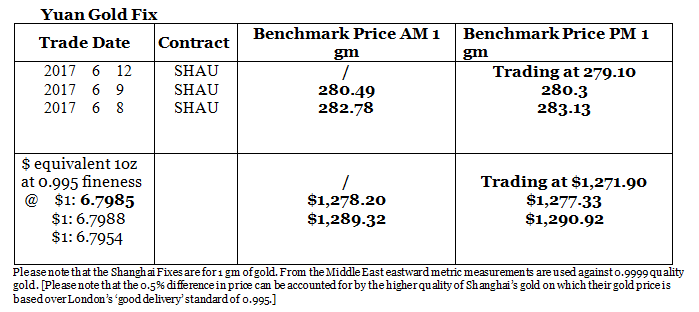

- The yuan was slightly stronger at 6.7985after Friday’s 6.7988: $1.

- The pound sterling was weaker at $1.2704 after Friday’s $1.2720: £1.

New York closed lower than Shanghai Composite on Friday but Shanghai was higher today as the U.S. dollar started to weaken again. London opened lower than Shanghai but was off its bottom. The London price setting lifted the gold price up above spot this morning.

Silver Today –Silver closed at $17.22 Friday after $17.41 at New York’s close Thursday.

LBMA price setting: The LBMA gold price was set today at $1,269.25 from Friday’s $1,274.25. The gold price in the euro was set at €1,131.44 after Friday’s €1,139.76.

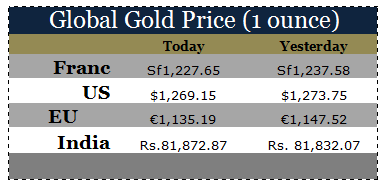

Ahead of the opening of New York the gold price was trading at $1,269.15 and in the Eurozone at €1,135.19. At the same time, the silver price was trading at $17.14.

Gold (very short-term)- The gold price should consolidate with a firm bias, in New York today.

Silver (very short-term)- The silver price should consolidate with a firm bias, in New York today.

Price Drivers

Technical picture

The pullback in the gold price was not heavy [so far] and the upward trend remains intact. We are watching the dollar weaken again which is why, today, the gold price is a little higher.

For the second time U.K.’s conservatives have backed the wrong horse and suffered because of it. But we see the result of the U.K. election as a consequence of their manifesto, not a rejection of Brexit.

France

The President elect, M. Macron is sweeping into power, consolidating the future of a united E.U. Only Italy remains a concern on this front. But markets are expressing the belief that this is not a concern.

The Fed for Wednesday

The Fed begins its 2-day deliberations on interest rates ahead of its announcement on Wednesday. With Janet Yellen such a cautious person she may well have been disturbed by the poor data of late. While 94% of the market believes a rate hike must come this week, there is room, we believe, for a delay in the rate hike until the data is more positive. If she does, you will see the dollar weaken and perhaps equity indices move too high. We see gold benefitting if this does happen.

The dollar has turned back lower this morning against most currencies [except the Pound]. We expect it to weaken further.

Central Banks and gold.

The central banks of Europe stopped selling gold in 2009 when the mining companies had bought back their vast hedges established before the end of the last century and gold ETFs had been well established. This was the time when the Chinese and the Russian central banks entered the market to buy gold. At the same time the Chinese government encouraged their citizens to buy gold for themselves. This they have been doing alongside the Chinese banking industry. Gold is not permitted to be exported from the country so one-way traffic into China sees the shift of gold into Asia. Likewise Indian gold does not return to the west.

This has put a brake on western central bank sales of gold as they know it will be bought by Asia. This appears to have happened as evidence has surfaced of a reduction in Bank of England stocks of gold. [but this has also happened as a result of gold being moved to home countries] We believe all central banks sales of gold will be halted. Consequently, the past power of western central banks to manipulate the gold price is considerably reduced, as they know that if they sell their gold it will move east.

As a result, we see the threat of future, announced central banks gold sales as being emasculated by this fact. We have no doubt that they will, at times, attempt to suppress the gold, using derivatives markets but only in the short term. After all, such maneuvers do not involve actual gold sales only cash transactions. We also don’t expect any announcements in the future of intentions to sell gold as per the Central Bank Gold Agreements.

We also doubt that the gold mining companies would ever again embark on an exercise to raise production at the request of and with the support of bullion banks with the backing of central banks as they did at the end of the last century.

This leaves global central banks on balance being buyers not sellers, in the future.

Gold ETFs – Friday, saw no purchases or sales into or from the SPDR Gold Shares ETF (NYSE:GLD), but a purchase of 0.45 of a tonne bought into the Gold Trust.

Their holdings are now at 866.998 tonnes and, at 206.61 tonnes respectively.

Since January 4th 2016, 261.86 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust. Since January 6th 2017 61.81 tonnes have been added to the SPDR gold ETF and the Gold Trust.