- Gold hits $2,000 as Israel begins ‘second stage’ of war in Gaza, oil jumps too

- But safe haven demand eases on Monday as focus turns to central banks

- Dollar slips below 150 yen as yields consolidate ahead of Treasury announcement

Markets on edge but no panic as Gaza conflict escalates

Israel’s long-expected ground offensive into the Gaza Strip got underway over the weekend, raising the stakes in an ever-escalating conflict that is looking increasingly like it's turning into a long-drawn-out war. Gold shot higher on Friday even as calls for a ceasefire gathered pace. Israel’s delay in mounting ground incursions into Gaza had raised hopes of a possible truce. But it seems that many traders were

anticipating some kind of an intensification of Israel’s military response to Hamas’ attacks on October 7.

However, even though the war has now entered a more dangerous second phase, it hasn’t been followed up by significant risk aversion in the markets. It’s likely that some of the risks have already been priced in but perhaps there’s also a perception that Israel is proceeding with its military objectives somewhat cautiously, thereby lowering the likelihood of a wider regional conflict.

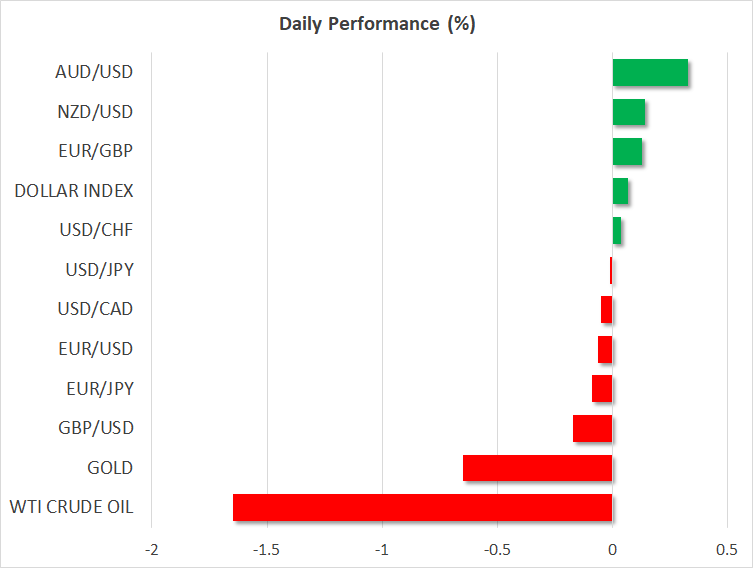

Gold prices scaled a more than five-month high on Friday $2,009.29/oz on Friday but had pulled back to around $1,993 on Monday. Oil futures also edged lower today after spiking higher on Friday.

BoJ rumours keep yen supported

Another reason for the unusual calm in the markets is that traders are possibly distracted by even bigger events that are on the agenda this week. The Fed is due to announce its latest policy decision on Wednesday, followed by the Bank of England on Thursday, although the real highlight will likely be the Bank of Japan’s announcement on Tuesday.

Speculation has been building in the run up to the BoJ’s meeting that policymakers will further adjust their controversial yield curve control policy, amid Japanese government bond yields joining in the global rally. The 10-year JGB yield has been steadily rising since the last tweak in the target band in July and is fast approaching the 1.0% upper cap even with regular purchases by the Bank of Japan to keep yields down.

Yet, Japanese yields haven’t been able to keep apace with US yields, pressuring the yen, which last week brushed a one-year low of 150.77 per dollar.

It didn’t take long for the greenback’s advance to stumble, however, likely due to fears of an imminent intervention by the Japanese authorities to prop up the yen. The pair is trading around 149.60 today.

Fed decision may get overshadowed by Treasury announcement

The US core PCE price index printed at 3.7% in September, which was in line with expectations and down from a revised figure of 3.8% in August. There seems to have been a bit of a relief that there was no upside surprise in the core PCE reading and this may have also weighed on the US dollar on Friday, even though personal consumption continued to grow at a robust pace.

The Fed is not expected to announce any changes in policy on Wednesday, nor is Powell anticipated to alter his language much on the rates outlook. After the recent plethora of Fed commentary, the November FOMC meeting may turn out to be a non-event and what could be a bigger driver of the markets this week is the statement by the US Treasury Department later today at 19:00 GMT on its refunding needs for the current quarter and next, while a detailed issuance plan will be unveiled on Wednesday. US borrowing levels have become a major focal point for the markets lately as the high debt issuance is seen as the main source for pushing Treasury yields higher.

The 10-year Treasury yield has come off 16-year highs above 5.0% but remains elevated around 4.85%, keeping equities on the backfoot.

Investors will also have to digest the October jobs report on Friday where another strong payrolls figure might dampen rate cut bets for 2024, even if the Fed signals this week that they’re likely done hiking.

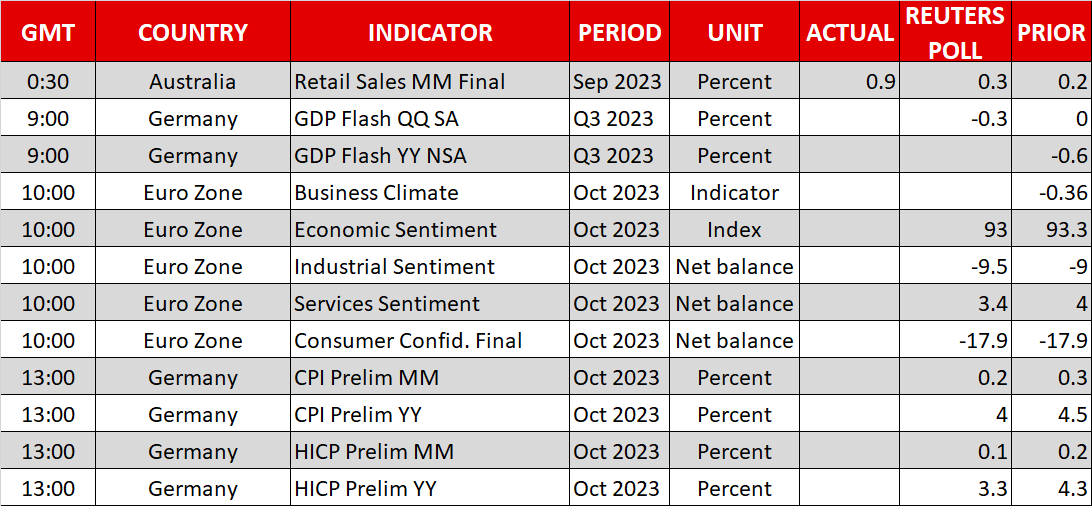

The softer dollar along with slightly better-than-expected Q3 GDP data out of Germany helped the euro to inch higher to $1.0580 on Monday, while sterling was marginally firmer at $1.2130.

Stocks rebound after dreadful week

In equities, European shares tracked Wall Street futures higher ahead of earnings by McDonald’s and Western Digital (NASDAQ:WDC) due before the market open. Both the S&P 500 and Nasdaq Composite are officially in a correction territory following the steep losses this month. With most of the Big Tech having already reported their earnings, it’s hard to see Apple’s results on Thursday turning things around amid the sky-high yields.