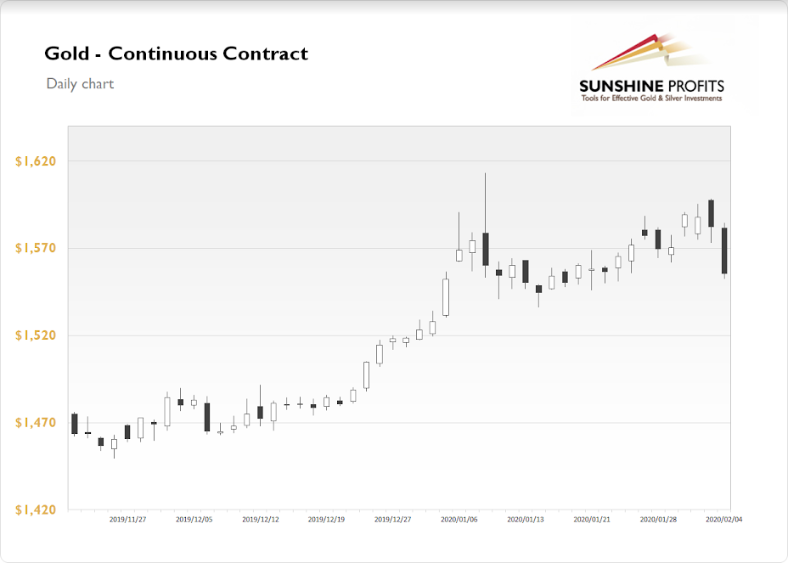

The Gold Futures contract lost 1.70% on Tuesday, as it retraced most of the recent weeks’ advances in just one day of trading. The market has reached a local high of $1,598.50 on Monday and yesterday it fell to a daily low of $1,552.80. The sentiment towards risk-on assets much improved following coronavirus fears easing, U.S. tech-stocks-led euphoria run-up.

Gold is currently up 0.1%, as it fluctates following yesterday’s decline. What about the other precious metals? Silver lost 0.6% yesterday, as it continued to retrace the recent advances. It is currently unchanged. Platinum lost 0.5% on Tuesday and today it gains 1.1%. However, the market is still below $1,000 mark following mid-January downward reversal. Palladium gained 4.6% on Tuesday and today it is gaining additional 2.0%, as it ratraces most of the recent decline off its new record high.

The financial markets are still looking at China virus crisis developments. However, the sentiment has further improved following yesterday’s U.S. stock market’s rally. The markets will wait for today’s economic data releases. We will get the ADP Non-Farm Employment Change number release at 8:15 a.m., Trade Balance at 8:30 a.m., and the important ISM Non-Manufacturing PMI at 10:00 a.m. Investors will surely wait for this week’s Friday’s Nonfarm Payrolls release. Where would the price of gold go following the NFP news? Take a look at our Monday's Market News Report to find some clue.