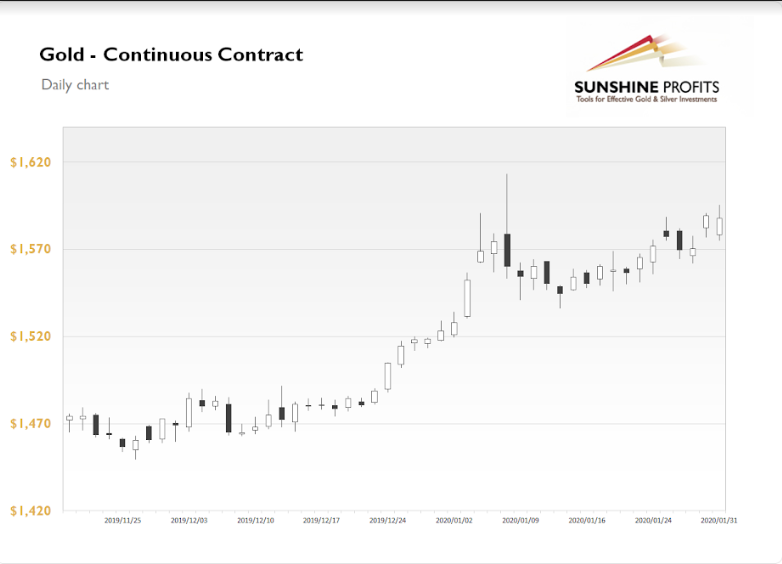

The gold futures contract lost 0.08% on Friday, as it fluctuated following the Thursday’s post-FOMC Statement release advance of 1.20%. The market went sideways despite the intensifying China virus crisis on Friday. However, it reached the new local high of $1,595.50 before giving back gains. The market remained below the resistance level of $1,600-1,615, marked by January 8 medium-term high of $1,613.30.

Gold is currently down 0.6%, as the virus crisis fears ease a bit this morning. What about the other precious metals? Silver gained 0.1% on Friday following Thursday’s rally of around 3%. And now it is declining by 1.25%. Platinum lost 1.9% on Friday and it is currently 0.2% lower. The market goes further off the $1,000 mark following mid-January downward reversal. Palladium gained 0.4% on Friday, but it continues to trade within a short-term consolidation after reversing its recent uptrend on January 23. It is 0.3% down.

The financial markets are still looking at the China virus crisis developments. However, the sentiment has slightly improved since Friday’s intensification. Overall, precious metals take a little breather today, as volatility is dropping. The markets will wait for today’s ISM Manufacturing PMI release at 10:00 p.m. It is supposed to be the most important economic data market mover today. But we will also get Google’s quarterly earnings release today after the stock market’s close. And last week’s better-than-expected Amazon’s release has managed to push the price of gold lower in the short-term. Investors will surely wait for this week’s Friday’s Nonfarm Payrolls release. Where would the price of gold go following the NFP news? Take a look at our today’s Market News Report to find some clue.