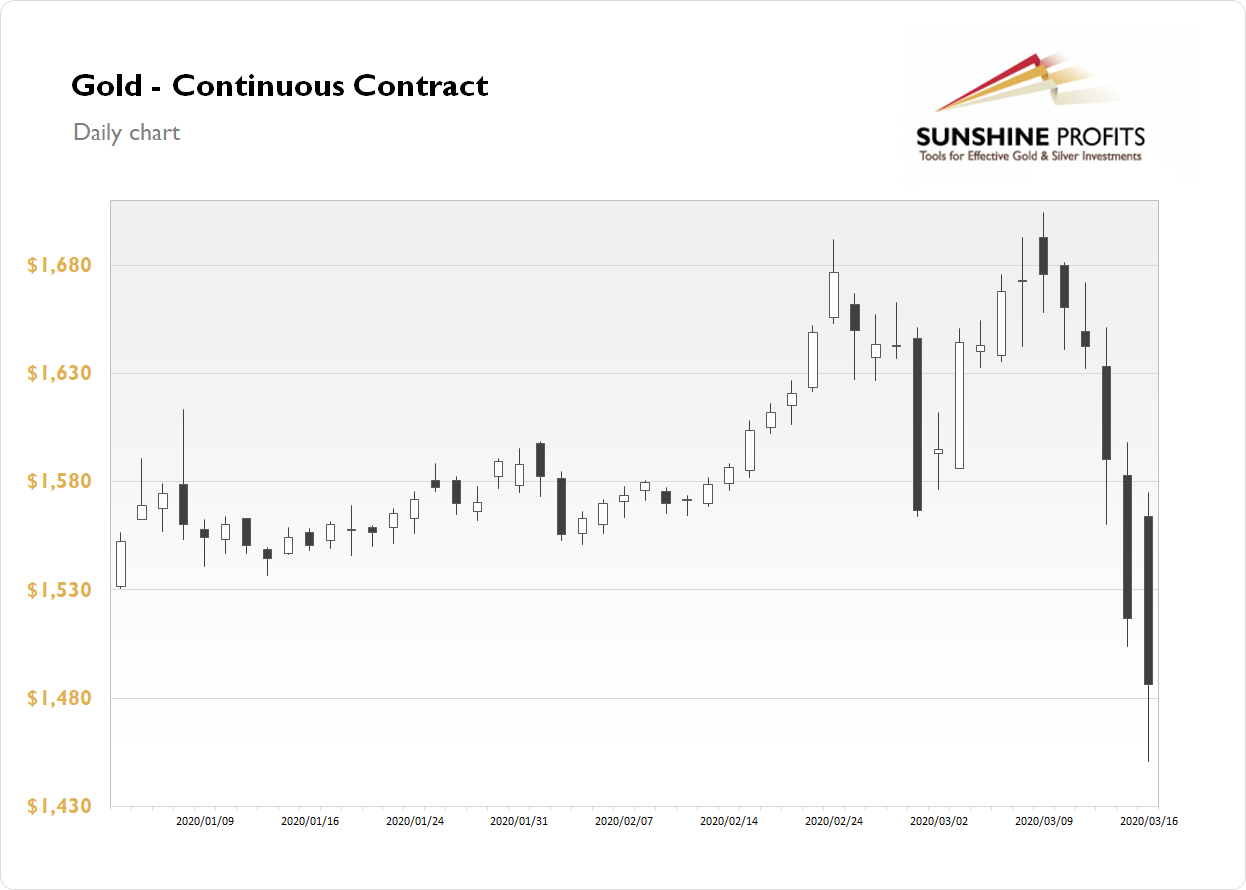

The Gold futures lost 1.99% on Monday, as it slightly extended its Friday's sell-off. The yellow metal fell the lowest since late November of 2019 yesterday, before bouncing off a daily low of $1,450.90. Earlier last week the market bounced off the new medium-term high of $1,704.30. Two weeks ago the gold price collapsed to the local low of $1,564 despite an ongoing coronavirus scare. However, the gold price retraced all of the declines recently, as virus fears reappeared. Then on Thursday and Friday, it has reversed sharply lower. Today gold continues trading below $1,500.

Gold is 1.6% down on Tuesday morning, as it hovers along its yesterday's daily low. What about the other precious metals? Silver lost another 11.61% on Monday and today it is 4.3% lower, as it trades below $13 per ounce. Platinum lost 11.59% yesterday and this morning it is down 3.4%. Palladium gained 0.22% yesterday and today it is 2.3% lower.

The financial markets have been reacting to a sudden Fed's interest rate cut decision and the new QE announcement yesterday. The stock market has basically crashed along with precious metals prices. The scheduled economic data releases have been much less important than virus crisis developments recently. However, take a look at yesterday's Market News Report to find out about this week's economic news releases!