The scheduled economic data releases were much less important than monetary policy updates or governments’ interventions news last week. Shocking Fed’s Interest Rates cut and the QE announcement on Sunday is leading to another risk-on assets’ sell-off today. What about the near future? Will the economic data releases move markets more than virus news? Probably not. But let’s take a look at the details.

The week behind

Global financial markets continued to react to news about the ongoing coronavirus crisis last week. The economic data releases have been overshadowed by spreading pandemic fears again. Thursday’s ECB Rate Decision led to EUR/USD currency pair sell-off, but overall, last week’s economic news didn’t bring much attention of the markets.

The week ahead

What about the coming week? We won’t have particularly important economic data releases in the coming days. So it is very likely that investors will continue to react to the mentioned virus scare. However, the market will likely await the U.S. Retail Sales and Philly Fed numbers on Tuesday and Thursday. On Tuesday we will also get the important German ZEW Economic Sentiment number. Then there will be economic data releases from Australia and Canada. Let’s take a look at key highlights:

- We will get some relatively important economic data releases from the U.S. this week – Retail Sales on Tuesday, Philly Fed Manufacturing Index on Thursday.

- On Tuesday there will be German ZEW Economic Sentiment release.

- We will also get the important economic data releases from Australia and Canada, including Monday’s Monetary Policy Meeting Minutes from the Reserve Bank of Australia.

- Oil traders will await Tuesday’s and Friday’s inventories data releases.

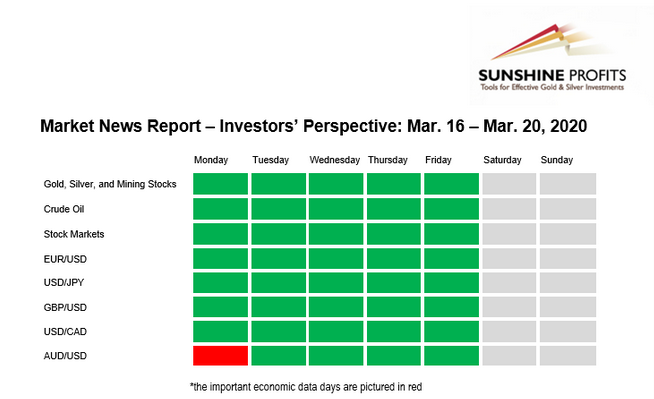

You will find this week’s key news releases below (EST time zone). For your convenience, we broke them down per market to which they are particularly important so that you know what to pay extra attention to if you have or plan to have positions in one of them. Moreover, we put particularly important news in bold. This kind of news is what is more likely to trigger volatile movements. The news that is not in bold usually doesn’t result in bigger intraday moves, so unless one is engaging in a particularly active form of day trading, it might be best to focus on the news that we put in bold. Of course, you are free to use the below indications as you see fit. As far as we are concerned, we are usually not engaging in any day trading during days with “bold” events on a given market. However, in the case of more medium-term trades, we usually choose to be aware of the increased intraday volatility, but not change the currently opened position.

Our Market News Report consists of two different time-related perspectives. The investors’ perspective is only suitable for long-term investments. The single economic data releases rarely cause major outlook changes. Hence, we will only see a handful of bold markings every week. On the other hand, the traders’ perspective is for traders and day-traders, because the assets’ prices are likely to react on a single piece of economic data. So, there will be a lot more bold markings on potentially market-moving news every week.

Investors’ Perspective

Gold, Silver, and Mining Stocks

Tuesday, March 17

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

Crude Oil

Tuesday, March 17

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

- 4:30 p.m. U.S. - API Weekly Crude Oil Stock

Wednesday, March 18

- 10:30 a.m. U.S. - Crude Oil Inventories

Thursday, March 19

- 8:30 a.m. U.S. - Philly Fed Manufacturing Index

Stock Markets

Tuesday, March 17

- 6:00 a.m. Eurozone - German ZEW Economic Sentiment

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

Thursday, March 19

- 8:30 a.m. U.S. - Philly Fed Manufacturing Index

EUR/USD

Tuesday, March 17

- 6:00 a.m. Eurozone - German ZEW Economic Sentiment

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

- No important economic news scheduled

- No important economic news scheduled

Tuesday, March 17

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

Wednesday, March 18

- 8:30 a.m. Canada - Core CPI m/m

Thursday, March 19

- 8:30 a.m. U.S. - Philly Fed Manufacturing Index

Friday, March 20

- 8:30 a.m. Canada - Retail Sales m/m, Core Retail Sales m/m

Monday, March 16

- 8:30 p.m. Australia - Monetary Policy Meeting Minutes

Wednesday, March 18

- 8:30 p.m. Australia - Employment Change, Unemployment Rate

Summing up, the financial markets continue to react to scary news about globally spreading coronavirus. The scheduled economic data releases seem much less important than sudden monetary policy updates or news about governments’ interventions. However, if you’re an investor and not a trader, you should pay extra attention to Monday's Monetary Policy Meeting Minutes from the Reserve Bank of Australia. Plus, on Tuesday and Thursday, we will also get relatively important economic data releases from the U.S. and Germany.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.