- The decline in Gold prices is attributed to technical selling pressure, profit-taking, and a strong US GDP print.

- The bull run in Gold may not be over due to anticipated Central Bank demand, increased demand from India, and geopolitical factors.

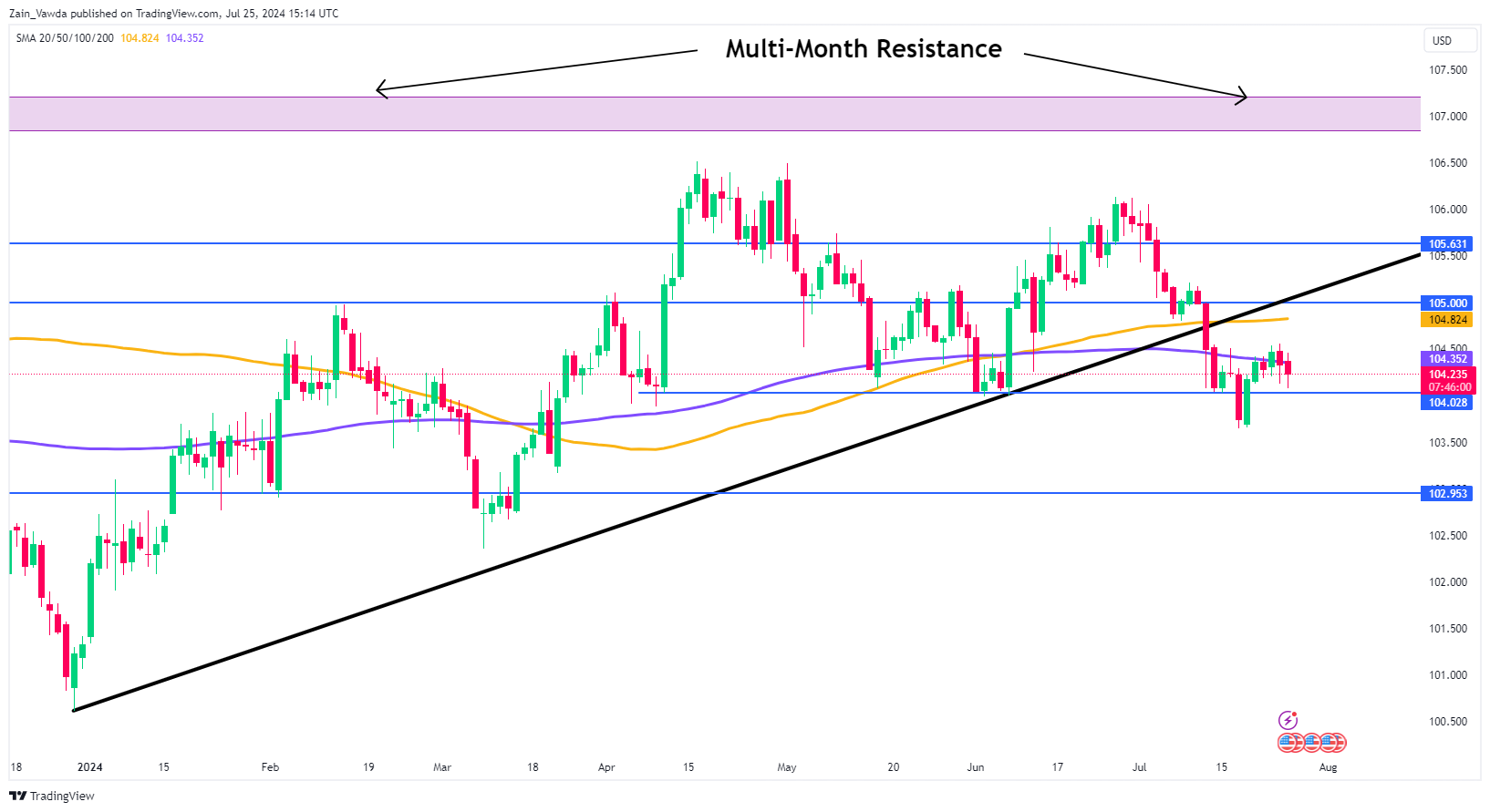

- The US Dollar Index (DXY) has found support around 104.00 but is struggling to close back above the 200-day MA.

A tale that needs some unraveling of late has been the decline in the price of Gold as well as the surprising reaction by the US Dollar to strong data. The US GDP print smashed estimates, although many believed it would, the actual print of 2.8% still caught many off guard.

The US GDP print gave Gold a final push toward a key support zone around the $2360/oz mark but the US Dollar Index (DXY) has failed to push on, struggling to break above the 200-day MA.

US Dollar Index Daily Chart, July 25, 2024

Source:TradingView.com

Given the widespread concern in markets around global growth and weaker earnings, in theory, one would expect Gold and the US Dollar to benefit from their safe haven appeal. As things stand, however, both the DXY and Gold have faced selling pressure as well.

A lot has been made of so-called technical selling pressure with Gold due to a deep correction for some time. This coupled with potential profit-taking ahead of some key US data and Gold tapping fresh record highs could also be playing a role.

The pullback has been long overdue but bulls still remain hopeful that this bull run may not be over yet. Two reasons have been touted here, those are the anticipation of more Central Bank demand over the next 18 months and expectations of higher demand for physical gold from India, the world’s second-largest gold consumer, after the government reduced its gold import tax from 15% to 6%.

Gold is also likely to gain from long-term geopolitical factors, especially plans by BRICS+ countries to replace the US Dollar as the world’s reserve currency with their own gold-backed alternative. This move aims to stop the US from using the Dollar in geopolitical conflicts and sanctions against other countries.

To sum this up, the bull run may not be over just yet.

US Dollar Index

The US dollar has had a mixed few weeks as rate-cut bets increase. The disconnect at times between the data and the DXY has also contributed to the messy price action we have seen of late.

The DXY for now has found a support base around the 104.00 but is struggling to close back above the 200-day MA. Once this materializes then there is every possibility of some USD appreciation.

The US PCE data soon to be out could be the perfect catalyst for such a move. However, market expectations are for a slight drop in the PCE number, which could mean a weaker USD as rate-cut bets will almost certainly increase.

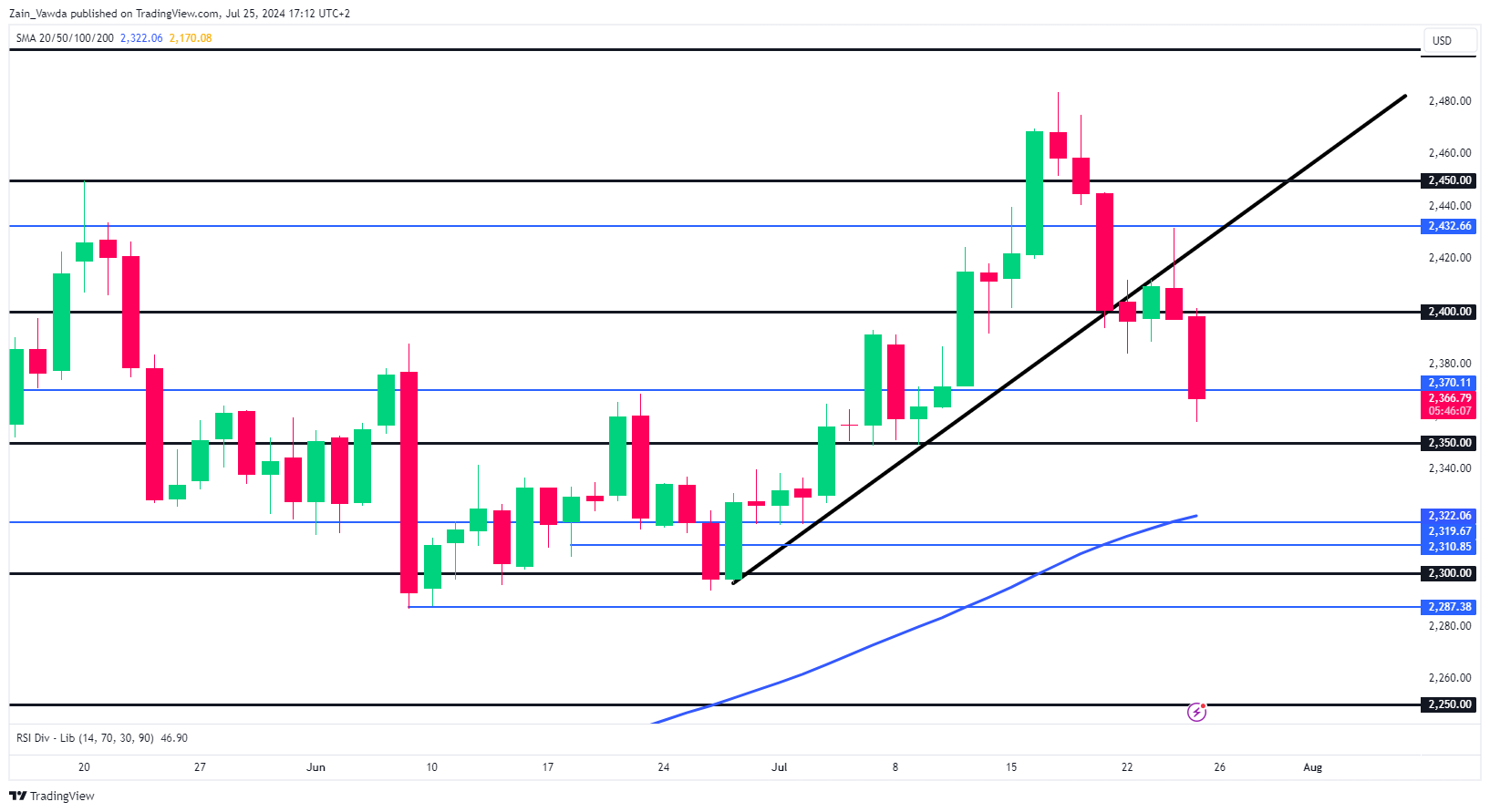

Technical Analysis Gold (XAU/USD)

From a technical standpoint, Gold put in an excellent rejection yesterday following the trendline retest and closing below the psychological $2400/oz level. The overnight selling pressure pushed the precious metal down to $2370 before the European session got into full swing.

Post the US GDP release, Gold gave another push toward the $2350 handle, finding support at $2360. If $2360 holds there is every chance Gold will begin to edge higher toward the $2400 mark.

GOLD (XAU/USD) Chart, July 25, 2024

Source: TradingView (click to enlarge)

Support

- 2360

- 2350

- 2322

Resistance

- 2370

- 2400

- 2432