While artificial intelligence and robots may replace many workers at some point, inflation can still rise in that environment, and central banks will continue to hike rates to fight it. Commercial banks follow the Fed when it hikes rates, and they restrict fiat money loans to businesses. Then, as the rate hikes take effect, the central banks pause the hikes and that’s good for Gold.

It appears that the Fed’s hikes are beginning to create a restrictive bank loans environment, and a Fed pause won’t change that fact. Got gold?

Today is the first day of August, which is the first day of my Aug 1-Oct 31 US stock market “crash season”. Also, the market has rallied from my Dow 30k buy zone to the 35k-37k sell zone. It’s a great time for investors to take a break from the US stock market.

In America, investors celebrate good stock market times by selling or ignoring gold. In India, a rising stock market is celebrated with solid purchases of gold (when the gold goes on sale of course). It looks like India is poised for good economic growth, a solid stock market, and that’s great news for gold.

A week ago, I suggested the Chinese stock market was poised for a major upside breakout, and it happened on cue.

Chinese citizens also celebrate good times in the stock market with hefty purchases of gold and the good times for China and India investors are occurring just as the US market reaches a major sticking point. US investors often turn to gold as rate hikes are paused, the stock market stalls and the nation moves towards recession. All stock market lights are green for gold.

What about oil? As oil formed a nice bull wedge, I urged energy market investors to focus on my $65 buy zone and be prepared for significant base building before the price moved higher in a major rally.

The base building continues, and the chart is bullish. The Fed claims the oil price, like food, is “volatile” and doesn’t need to be included in inflation calculations. That’s true, but once gas and grocery prices skyrocket and the citizens get angry, the Fed takes action.

The bottom line: From here, oil likely spends more time in the base building zone, but once it begins to rally more significantly, a new wave of stagflation will crash into America.

The Fed will stay in pause mode as long as it can, but eventually, more hikes will be needed, and gold bugs will witness (and enjoy) the arrival of their long-awaited and much-deserved, “1970s on steroids”.

This could last several decades, with rates being steadily raised higher. There would be waves of panic selling and investor demoralization in the stock market and aggressive buying of gold.

The stunning US rates chart. As rates rise in one wave after another, it’s only a matter of time before the American government’s ability to finance itself (and its evil wars) comes to a glorious standstill.

As stock and bond markets swoon, money managers and the average citizen have only one place to turn to, and that of course is gold.

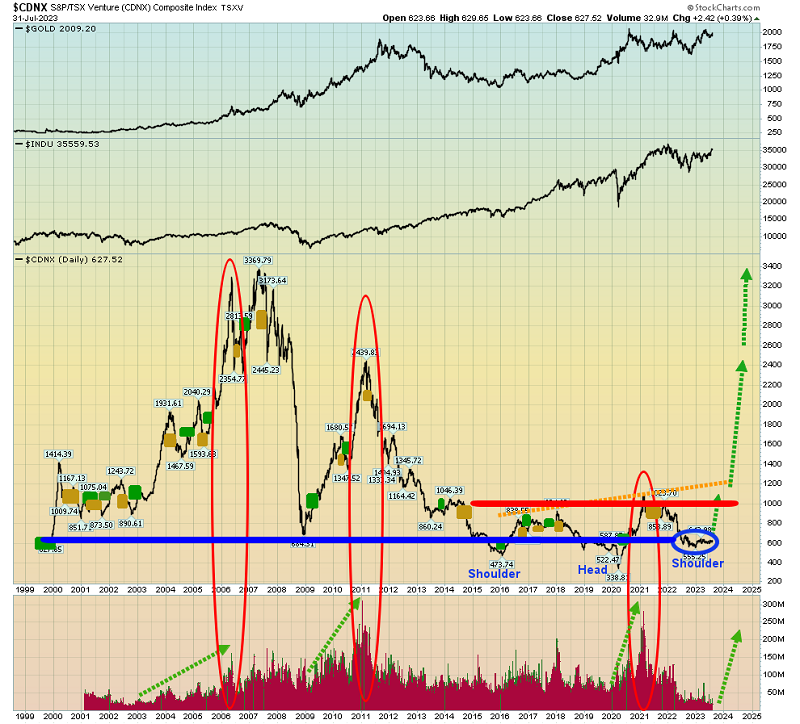

The CDNX sports a seven-year base pattern, and I’ll dare to suggest that the long-awaited big upside breakout appears to be underway right here and now. Junior gold and silver stock investors deserve what lies ahead (very golden times).

What about gold itself? The important weekly gold chart. Note the fabulous position of Stochastics, the double bottom for RSI at 50, and the rising MACD histograms. There’s also a loose broadening pattern in play with a nice $2500 price target. Ominously, broadening patterns indicate situations that are out of control.

Looking at the debt obsession, war-mongering, and global meddling insanity showcased by the US government, I’ll dare to suggest the out-of-control technical action on the weekly gold chart is in perfect sync with US government fundamentals.

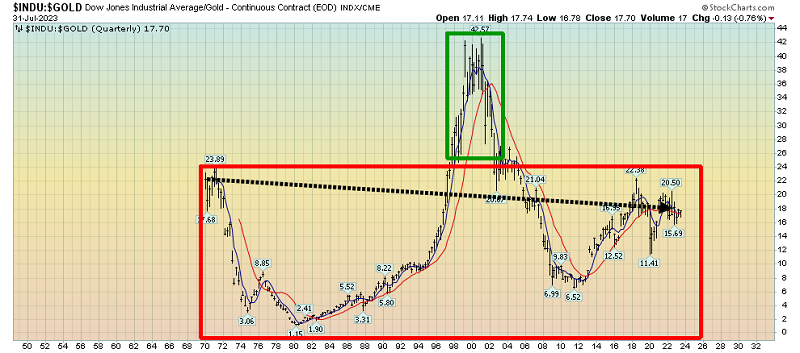

What is easily the most important chart for American stock market investors and perhaps for gold stock investors too. This chart shows the 30 mightiest companies in America, combined, producing no sustained gains for the past 50 years, when their performance is measured in gold currency. If these companies have failed after 50 years of trying, well…

Gold bugs need to be careful about trying to outperform the ultimate currency (gold) with a simple buy-and-hold approach to the miners and they need to be even more careful about buying high rather than low.

Gold stocks (and the Dow) outperform gold on rallies, but they falter on declines. Over time, simply put, gold stands alone. Gold is the ultimate asset and the world’s Queen of currency.

So, gold stock core positions must be bought on truly extreme weakness. The rest can be bought on modest weakness like my recent $1900 buy zone for gold and $30 for GDX. These gold stock positions then need to be sold into strength or they will start to falter against gold.

The beautiful GDX chart. Once the typic price gyration into Friday’s US jobs report is out of the way, GDX should quickly be en route to $37, which is a 20%+ move from the $30 area low.

The overall rally for gold, silver, and the miners should continue (albeit with shakeouts) for the next several months, likely until the Sep 20 Fed meet.