It’s been a heck of a year for precious-metal bulls as gold has outperformed in 2016 after several years of underperformance. And that has lifted the Gold Bugs' spirits, providing a huge tailwind for the Gold Miners.

Today we're looking at the incredible comeback in the Gold Bugs Index and what the gold bugs' performance may mean for investors going forward.

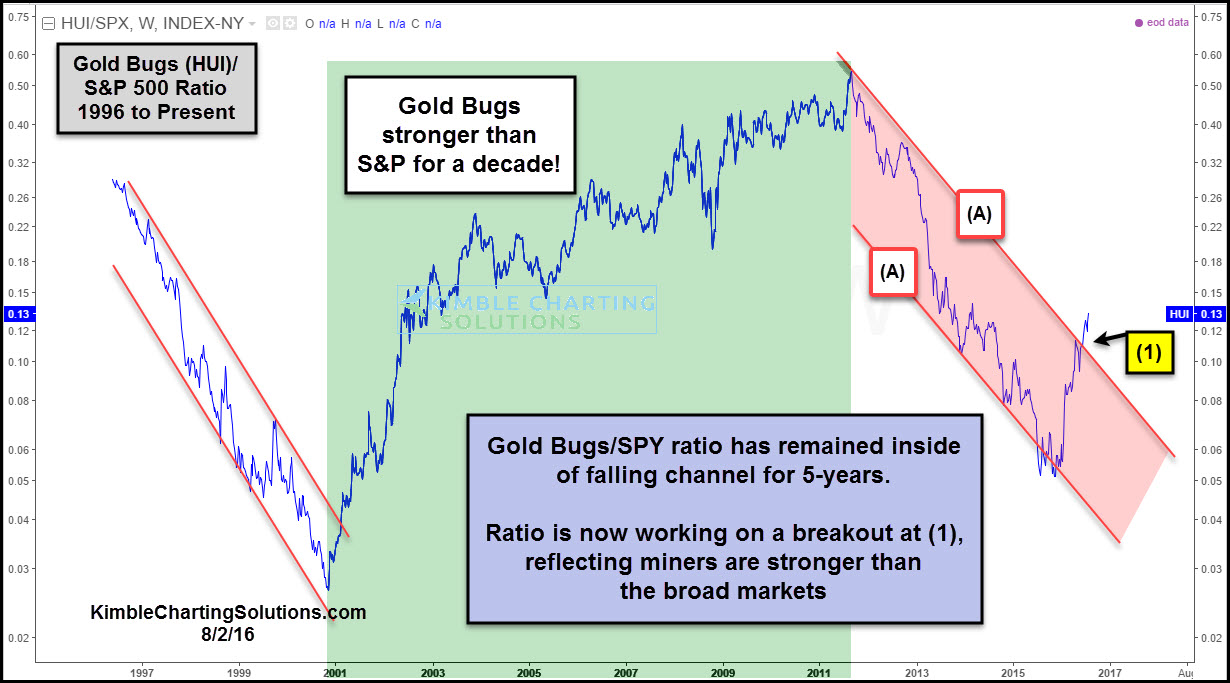

In the chart below, we plotted the ratio of the Gold Bugs Index with the S&P 500. This provides us with a broad view of the how the gold miners have performed versus large-cap equities over the past two decades. As you can see below, the Gold Bugs Index outperformed the broader equities market between 2001 and 2011. But that performance gave way to a period of significant underperformance.

Focusing on the red-shaded channel below, you can see how the decline formed (and respected) its descending channel – marked by points [A]… that is, until 2016.

That’s when the gold miners turned on their engines and hit the gas pedal. A sharp reversal higher (outperforming equities) began to take shape just as the clock turned 2016.

In fact, the comeback has seen the Gold Bugs Index breakout (relative to equities) above channel resistance. Although the miners may be due for some cooling off, it’s worth noting that if this trend-change resembles recent turns, it may last a while longer yet.