Gold is still running on the war fumes, but its last moves bring to mind only bearish associations. Worse yet, a rising dollar appeared on the horizon.

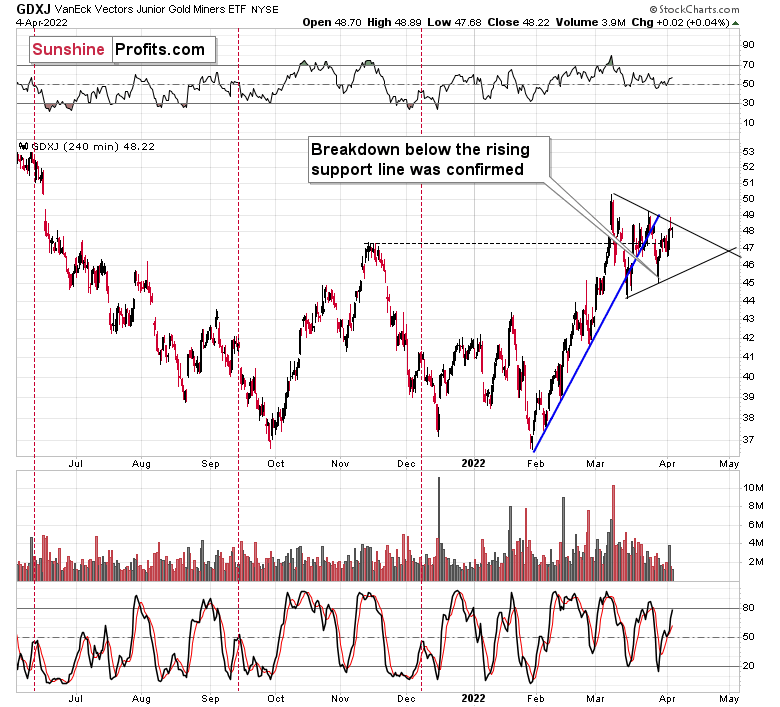

On the technical front, we saw that the Junior Miners (NYSE:GDXJ) moved higher in the first part of the session but then declined and ended the day practically unchanged.

Why did junior miners rally initially? Perhaps for technical reasons. They were moving higher in their immediate-term trend, and thus, it might have been necessary for them to reach a resistance level before returning to their downtrend.

Junior miners just found the resistance in the form of the declining line based on the previous March highs. After a tiny attempt to break above this line, the GDXJ declined, and the breakout was invalidated, suggesting that the rally is over.

The resistance mentioned above appears to be the upper border of the triangle pattern, which might concern you because triangles are usually a “continuation pattern.” In other words, the move that preceded the triangle is usually the type of move that follows it. The preceding move higher was up, so the following move could also be to the upside.

However, junior miners would first need to confirm the breakout above the line for this to happen. We saw the opposite taking place yesterday – the breakout above the line was invalidated.

If – instead – we see a decline below the lower border of the triangle, the pattern would likely be followed by a decline. Please note that I wrote “usually” and now “always” concerning the bullish implications of triangles.

The bearish case is more justified than the bullish one if we look beyond the above chart.

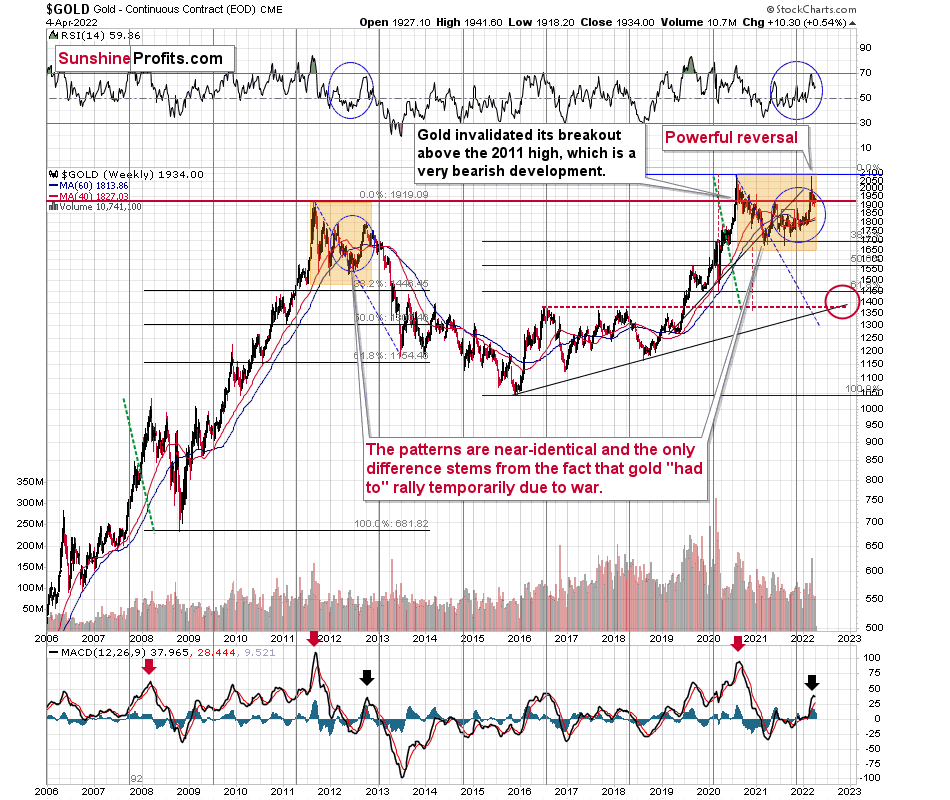

I don’t mean just the extremely bearish situation in gold’s long-term chart, where it’s clear that gold is repeating its 2011-2013 performance, with the recent top being analogous to what we saw in 2012.

If it wasn’t for the Ukraine-war-tension-based rally, gold would have likely topped close to its current levels, which would be a perfect analogy to where it topped in 2012 – close to its preceding medium-term highs.

The RSI indicator recently moved lower after being close to 70 indicates that the top is already behind us.

If history is about to rhyme (and that’s very probable in my view), gold is likely to decline in a back-and-forth manner before it truly slides without looking back. Basically, that’s what we’ve seen recently. The recent consolidation is not a bullish development but something in perfect tune with the extremely bearish pattern from 2012.

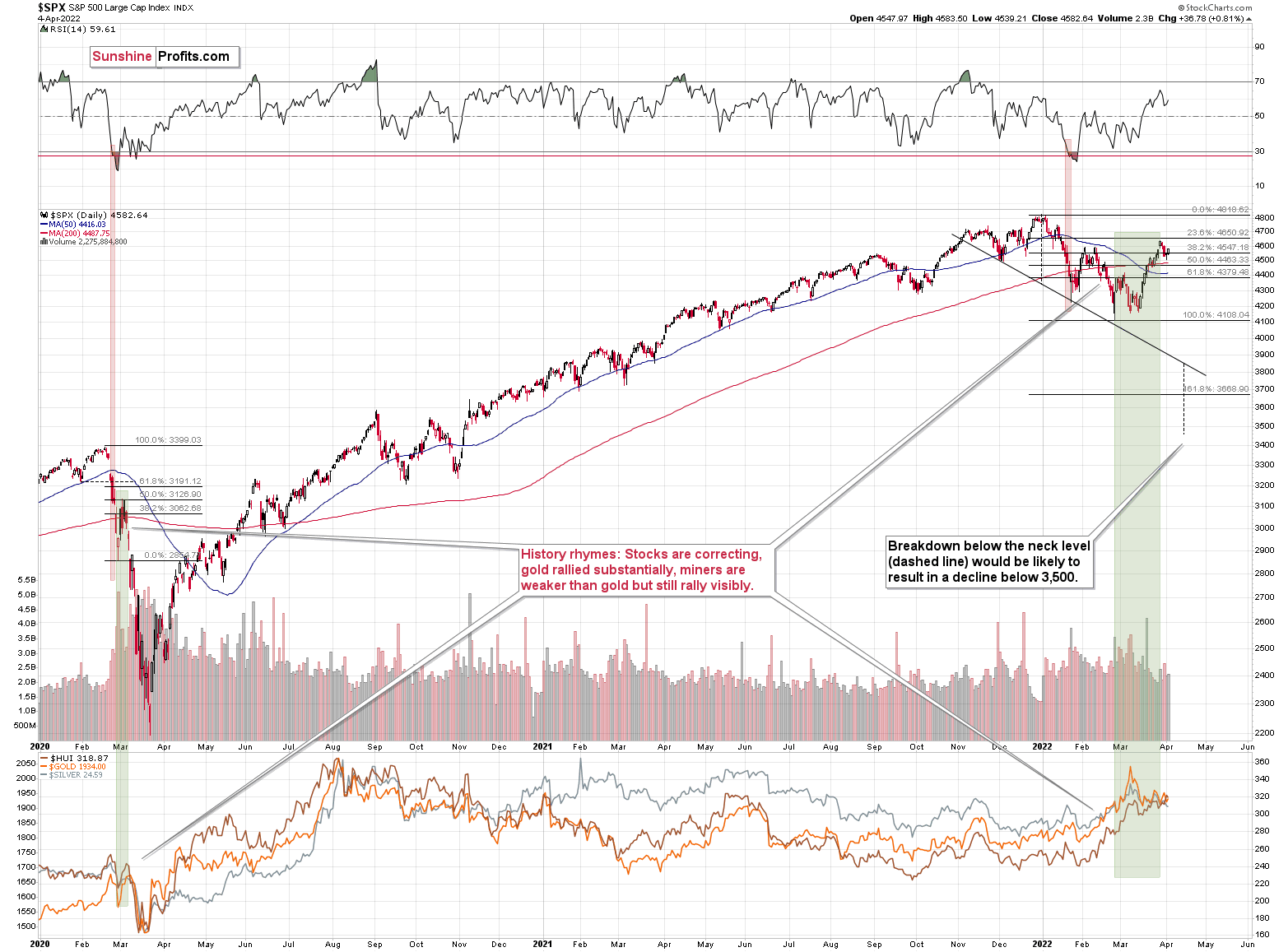

I don’t mean the above only because we see similar analogies in silver and gold stocks (the HUI Index), and we get other indications (of more short-term nature) from the US Dollar index and the general stock market. The technical picture of the S&P 500 index suggests that the final top and the initial corrective upswing are over.

The general stock market closed the week below its February highs, which invalidated the small breakout above them. This is a very bearish indication for the following weeks. Many more investors are likely to become aware of the new interest-rate-hike-driven medium-term bear market once the S&P 500 breaks to new 2022 lows. That’s when the decline is likely to accelerate, quite likely also in silver and mining stocks that are usually most vulnerable to stock market moves.

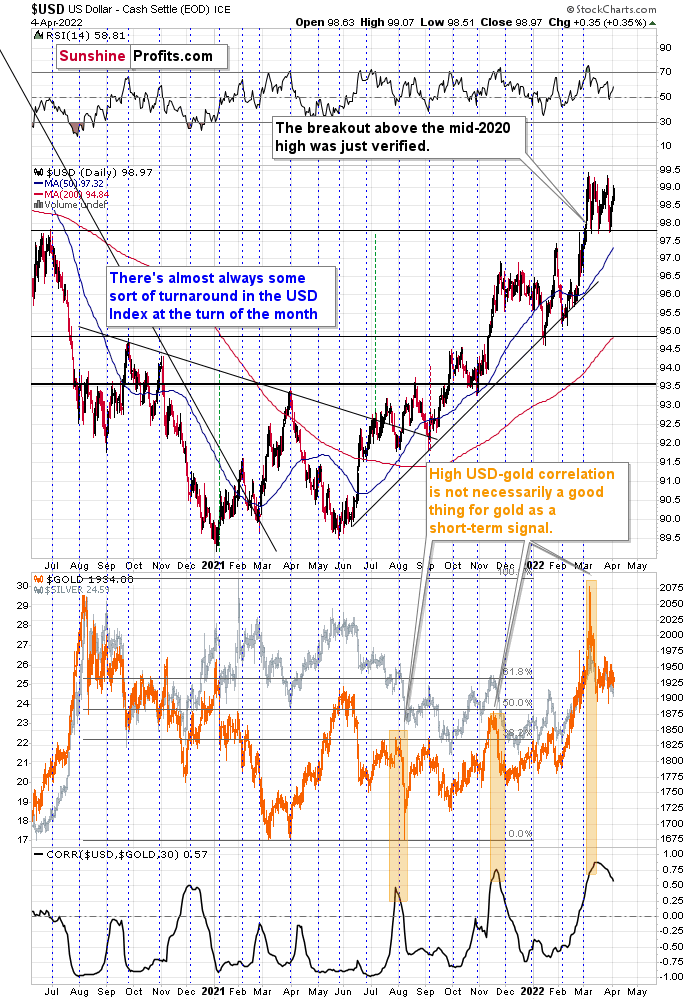

Moreover, let’s keep in mind that the USD Index is likely to soar once again soon, triggering declines in the precious metals market.

In my previous analyses, I commented on the USD Index in the following way:

If we focus on the USD Index alone, we’ll see that yesterday’s decline was absolutely inconsequential with regard to changing the outlook for the USDX. It simply continues to consolidate after a breakout above the mid-2020 highs. Breakout + consolidation = increasing chances of rallies’ continuation. A big wave up in the USD Index is likely just around the corner, and the precious metal sector is likely to decline when it materializes.

As the war-based premiums in gold and the USD appear to be waning, a high-interest-rate-driven rally in the USD is likely to trigger declines in gold. The correlation between these two assets has started to decline. When that happened during the last two cases (marked with orange), gold plummeted profoundly shortly thereafter.

The USD Index rallied recently, once again clearly verifying the breakout above its mid-2020 high. This means that the USD Index is now likely ready to rally once again. Naturally, this has bearish implications for the precious metals sector.

All in all, technicals favor a decline in the precious metals sector sooner rather than later.