Gold Today – New York closed yesterday at $1,285.60. London opened at $1,285.30 today.

Overall the dollar was almost unchanged against global currencies before London’s opening:

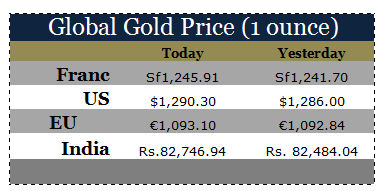

The $: € was almost unchanged at $1.1784 after the yesterday’s $1.1782: €1.

The Dollar index was almost unchanged at 93.39 after yesterday’s 93.36.

The Yen was almost unchanged at 109.36 after yesterday’s 109.33:$1.

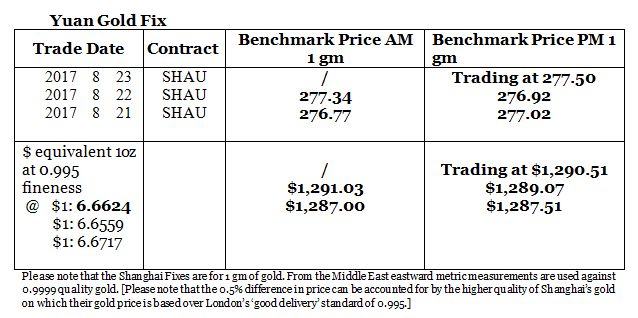

The Yuan was weaker at 6.6624 after yesterday’s 6.6559: $1.

The Pound Sterling was weaker at $1.2811 after yesterday’s $1.2850: £1

New York closed at $2.40 lower at Shanghai’s close yesterday. Today, sees Shanghai having traded at 278 for the earlier half of the day settling at 277.50 later in the day, which equates to $5 higher than London’s opening. London is now closing this gap in morning trade.

We are seeing prices pausing and building strength, ahead of breaking higher.

Silver Today –Silver closed at $17.00 yesterday after $17.00 at New York’s close both Monday and Friday.

LBMA price setting: The LBMA gold price was set today at $1,286.45 from yesterday’s $1,285.10. The gold price in the euro was set again at €1,090.86 after yesterday’s €1,093.52.

Just before the opening of New York the gold price was trading at $1,290.30 and in the euro at €1,093.10. At the same time, the silver price was trading at $17.06.

Gold (very short-term) The gold price should hold current levels or rise towards $1,300, in New York today.

Silver (very short-term) The silver price should hold current levels or rise, in New York today.

Price Drivers

The currency and precious metal prices are remarkably quiet today. With no purchases and only very small sales the SPDR gold ETF and the Gold Trust are giving no input to prices. While we do recognize that the Shanghai market has reduced volatility in the west, currency and precious metal prices are in calm waters. While the Jackson’s Hole meeting of central bankers on Friday is being touted as the next event to impact precious metal prices, we see this as having a positive, if any, effect on precious metal prices.

Gold Season

With only a week+ to go until September, we are about to move into the gold season when manufacturers of gold jewelry in the developed world take delivery of the gold they need to supply their markets with jewelry for the festive season at year’s end. This is the time for that industry when the summer holidays come to an end and its back to work.

In India the harvest is coming in after a good monsoon. Farmers don’t pay tax on the harvest and buy straight into the precious metals.

The festive and marriage season opens the door to the very large Indian gold market, which has already seen very high, near record, demand this year.

In China the gold season targets the Chinese New Year which is early in the western New Year. But there the middle classes continue to grow bringing with it gold investments for the new money.

Gold ETFs – Yesterday there were no purchases or sales of gold into or from the SPDR Gold Shares (NYSE:GLD) ETF but there were sales of 0.23 of a tonne from the Gold Trust. The SPDR gold ETF and Gold Trust holdings are at 799.286 tonnes and at 215.47 tonnes respectively.

Since January 4th 2016, 177.11 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust.

Since January 6th 2017, 15.51 tonnes to the gold ETFs we follow.