Gold Today –New York closed yesterday at $1,224.70.London opened at $1,221.65 today.

Overall the dollar was weaker against global currencies, early today. Before London’s opening:

- The EUR/USD was weaker at $1.1414 after yesterday’s$1.1353: €1.

- The US Dollar Index was weaker at 95.98 after yesterday’s 96.22.

- The yen was weaker at 113.70after yesterday’s 113.33:$1.

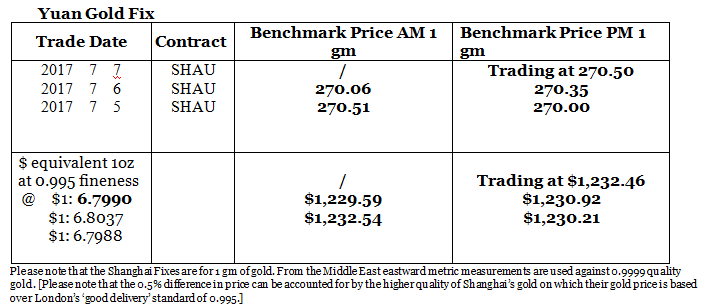

- The Yuan was strongerat 6.7990after yesterday’s 6.8037: $1.

- The pound sterling was weaker at $1.2897 after yesterday’s $1.2935: £1.

Shanghai is stabilizing again today, but not by much. New York traded at $6 lower than Shanghai following Shanghai’s close yesterday. Today London opened $11 lower than Shanghai. Until gold makes a firm break one way or another we consider it directionless as it has been for most of the second quarter.

Today, once again, remains a critical day for the gold price in all three global centers as the direction forward is still to be established.

Silver Today –Silver closed at $16.01 yesterday after $16.03 at New York’s close Wednesday. The silver price has formed a double bottom, but, while a double bottom remains in place, traders are trying to push it down. It is refusing to go down and keeps turning back to $16.00. The way forward remains uncertain!

LBMA price setting: The LBMA gold price was set today at $1,220.40 from yesterday’s $1,224.30. The gold price in the euro was set at €1,069.40 after yesterday’s €1.075.13.

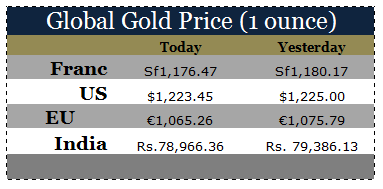

Ahead of the opening of New York the gold price was trading at $1,223.45 and in the euro at €1,065.26. At the same time, the silver price was trading at $19.91.

- Gold (very short-term) Again, we wait for the gold price to confirm direction, in New York today.

- Silver (very short-term) Again, we wait for the silver price to confirm direction, in New York today.

Price Drivers

The gold and silver prices have us all on tenterhooks while their direction forwards remains to be confirmed. While some believe that rate tightening will still happen and stimuli be dropped by the main developed world central banks, the date, while so far slightly encouraging could well disappoint and the tightening direction postponed.

So global financial uncertainty remains a concern in the developed world in particular. While the jobs numbers were encouraging at 222,000 wages stayed flat, adding to concerns that inflation is just not rising, a major worry of the Fed. The dollar weakened immediately after that.

What is now constantly overlooked in the financial world is that it is governments that bear the prime responsibility for economic growth, but since the financial crisis of 2008 they have either been unable to promote it or found the political gridlock has prevented them from doing so. The burden has fallen unfairly but squarely on the back of their central banks equipped only with blunt tools to do the job. That’s why today we see so much importance placed on data [past not present] that will influence central bank’s decisions. At times our focus is pushed onto too few factors and too intensely for us to have the balanced perspective on what is likely to happen, in the near future. This adds to the risks facing the developed world economies.

Gold ETFs – Yesterday saw no sales or purchases from or into the SPDR Gold Shares ETF (NYSE:GLD) but a purchase of 0.45 of a tonne into the Gold Trust (NYSE:GLDW). The SPDR gold ETF and Gold Trust holdings are at 840.669 tonnes and at 210.76 tonnes respectively.

Since January 4th 2016, 201.708 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust. Since January 6th 2017 39.015 tonnes have been added to the SPDR gold ETF and the Gold Trust.