Gold Today –New York closed the day before yesterday at $1,248.40.London opened at $1,262.00 today.

Overall the dollar was weaker against global currencies, early today. Before London’s opening:

The USD/EUR was weaker at $1.1728 after the day before yesterday’s$1.1654: €1.

The Dollar Index was weaker at 93.50 after the day before yesterday’s 93.97.

The yen was unchanged at 111.25 after the day before yesterday’s 111.25:$1.

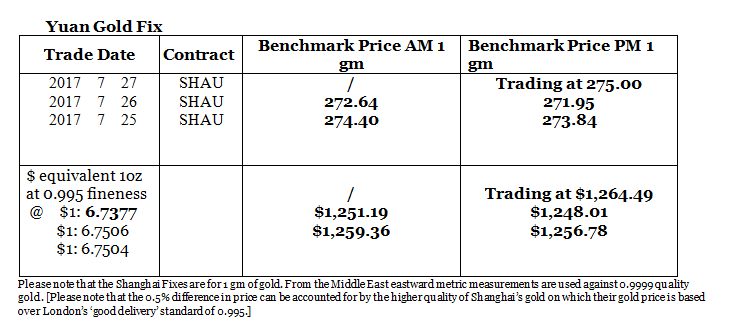

The yuan was stronger at 6.7377after the day before yesterday’s 6.7506: $1.

The pound sterling was stronger at $1.3138 after the day before yesterday’s $1.3031: £1.

The reaction to the Fed’s inaction not just on rates but on the timing of the contraction of the Fed’s Balance Sheet, interrupted the gold price relationship between global markets. New York closed at the same level as Shanghai yesterday, but London opened at just $2.50 below Shanghai’s trading level this morning. The price differentials between the global markets were nearly eliminated on the back of the Fed’s inaction.

We look today to see just how global markets interact and to see if they are really narrowing their differences.

If you had been following our commentary in the Gold Forecaster newsletter on China and the shift of pricing power to the east, you would not have been tempted to sell your holdings of gold or silver!

It is clear that it is now necessary to understand what drives each gold market across the world if one is to understand the gold price and where it is going. To focus on just the US market, as if it is the only gold price driver, is to make yourself vulnerable to grave portfolio mistakes on gold. One cannot be this parochial any more, as the US lost that pricing power a while ago.

To ignore the deep fundamentals driving each market would do the same. To ignore other global gold markets would do the same too.

Silver Today –Silver closed at $16.45 the day before yesterday after $16.40 at New York’s close Monday.

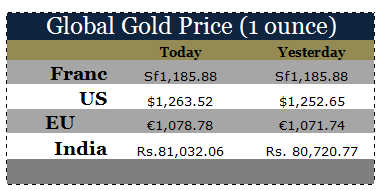

LBMA price setting: The LBMA gold price was set today at $1,262.05 from yesterday’s $1,245.40. The gold price in the euro was set at €1,077.11 after the day before yesterday’s €1.074.68.

Just after the opening of New York the gold price was trading at $1,263.52 and in the euro at €1,078.78. At the same time, the silver price was trading at $16.78.

Gold (very short-term) The gold price should consolidate with a positive bias, in New York today.

Silver (very short-term) The silver price should consolidate with a positive bias, in New York today.

Price Drivers

The Fed decided not to raise rates, as expected but only said they would start lowering the Fed’s Balance Sheet, relatively soon. This disappointed markets including the global gold markets that are taking the gold price above previous resistance levels into the $1,260 region.

But once again the biggest feature of the day was the softening dollar. It has confirmed it is in a ‘bear’ market and will decline over the next few years. More and more analysts including major institutions are now talking the dollar down, over the long term.

Bear in mind the analogy that the currency world has had the dollar, almost as the tree trunk, while other currencies have been the branches of that tree. If the trunk withers what will happen to the branches? The only way to save the tree is to replace it with several trunks. These will come from the main trading blocks of the world. The euro will be joined by the Yuan [which now accounts for just under 2.00% of global trade pricing - it could be more is we include oil] with the dollar in a diminished role.

Gold will then become the facilitator between currencies to reinforce confidence in them.

Gold ETFs – In the last two days we have seen sales of 14.20 tonnes of gold from the SPDR Gold Shares ETF (NYSE:GLD) sales of 0.99 of a tonne from the Gold Trust. The SPDR gold ETF and Gold Trust holdings are a 785.424 tonnes and at 210.87 tonnes respectively.

Despite these ongoing, heavy, persistent gold sales from the SPDR gold ETF the gold price has risen through more levels of heavy resistance. There is no doubt in our minds that if the gold price holds above $1,260 and rises, these investors will return to gold and drive gold prices higher.

With US sales of gold now greater than has been acquired in 2017 and accounting for longer term holders of gold, we believe that US gold investors are now close to being sold out.

Since January 4th 2016, 156.347 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust. Since January 6th 2017 No tonnes of gold have been added to the SPDR gold ETF and the Gold Trust. In fact, in this year 2017 the level of gold in those funds is now -6.168 tonnes.