Gold is dropping as expected and near the $1,310 support level, I expect it to give way this week. The nonfarm payroll numbers are out Friday, and that could produce a bounce in metals or further an even sharper selloff. Nevertheless, I won't be looking for a bottom until there are Slow STO readings

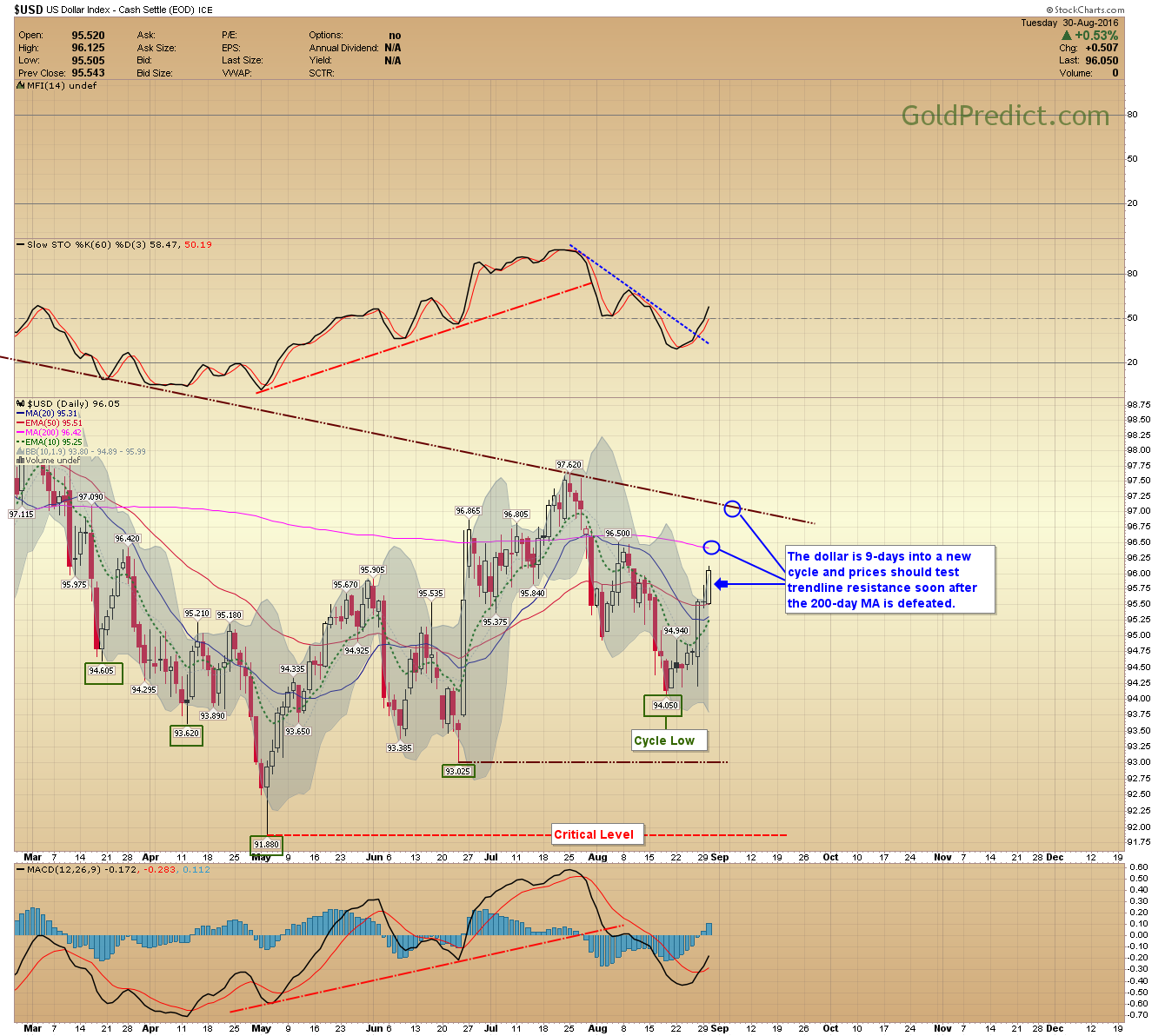

-US Dollar- The dollar is 9-days into a new cycle and prices should test trendline resistance soon after the 200-day MA is defeated.

-Gold- Prices are at support, and I won't be looking for a bottom until the Slow STO (above) is less than 20.

-Silver- Prices should drop to test the $18.00 support level next. Looking for a Slow STO reading of

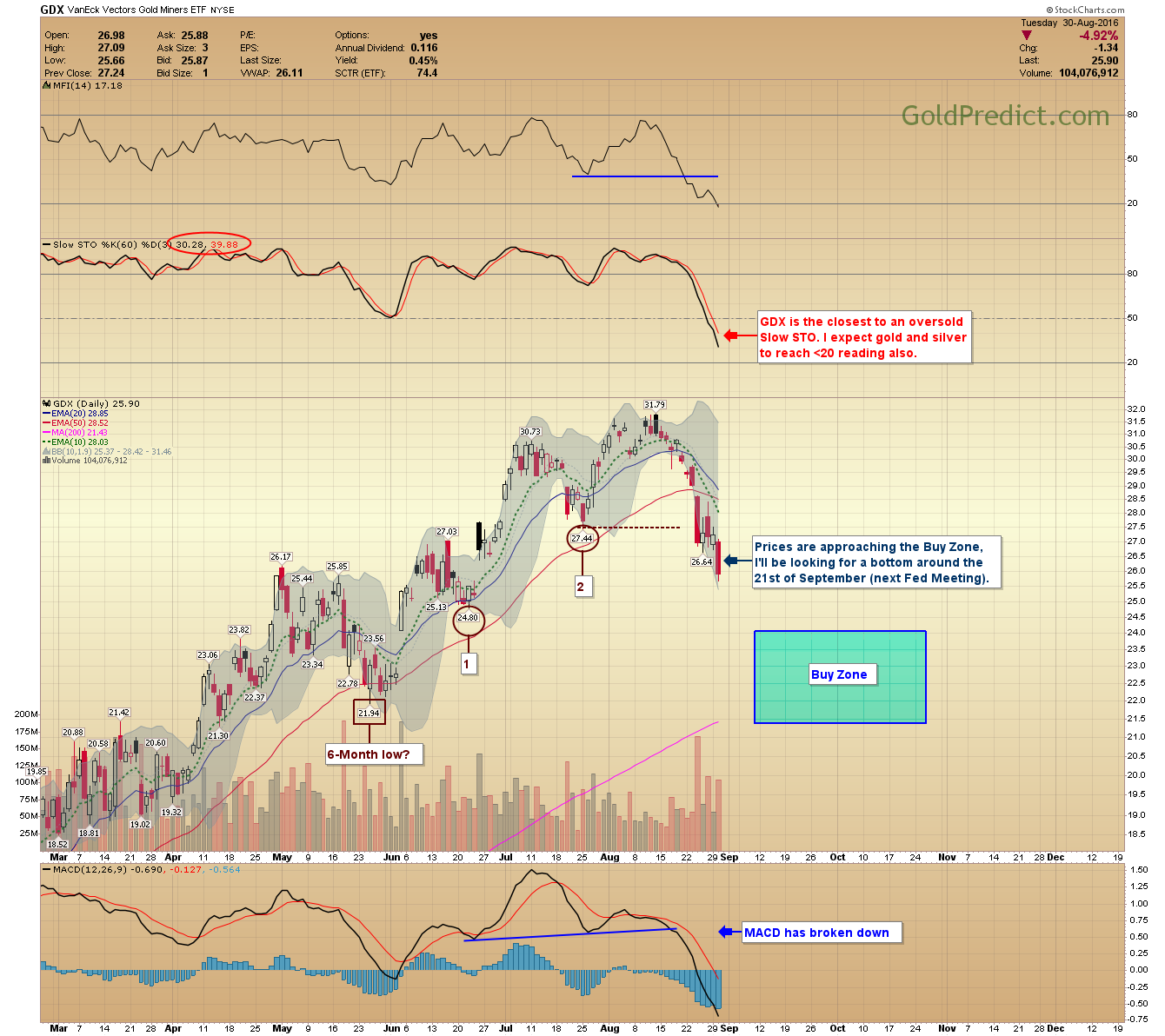

-GDX- Prices are approaching the Buy Zone, I'll be looking for a bottom around the 21st of September (next Fed Meeting). GDX (NYSE:GDX) is the closest to an oversold Slow STO. I expect gold and silver to reach

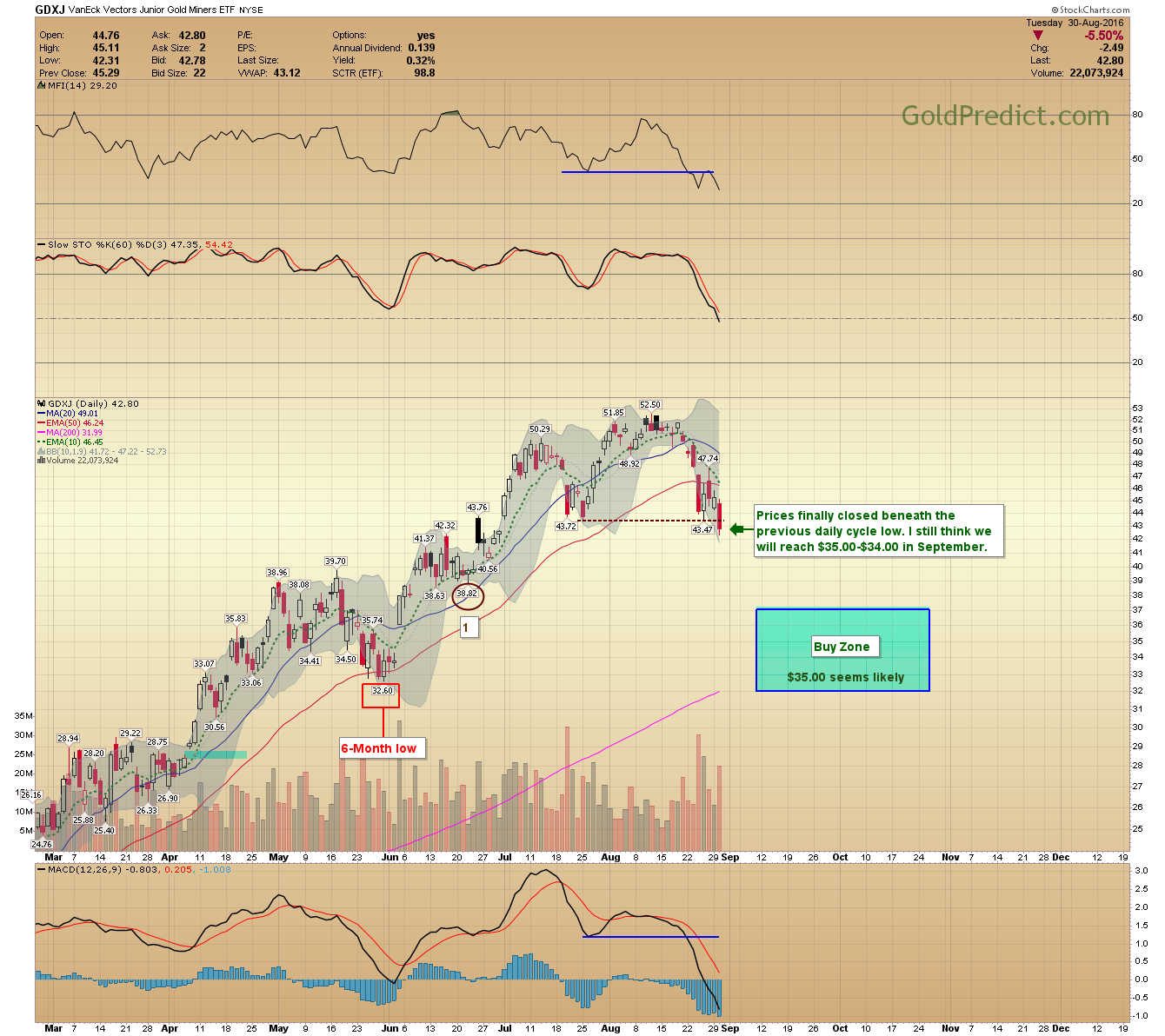

-VanEck Vectors Junior Gold Miners (NYSE:GDXJ)- Prices finally closed beneath the previous daily cycle low. I still think we will reach $35.00-$34.00 in September.

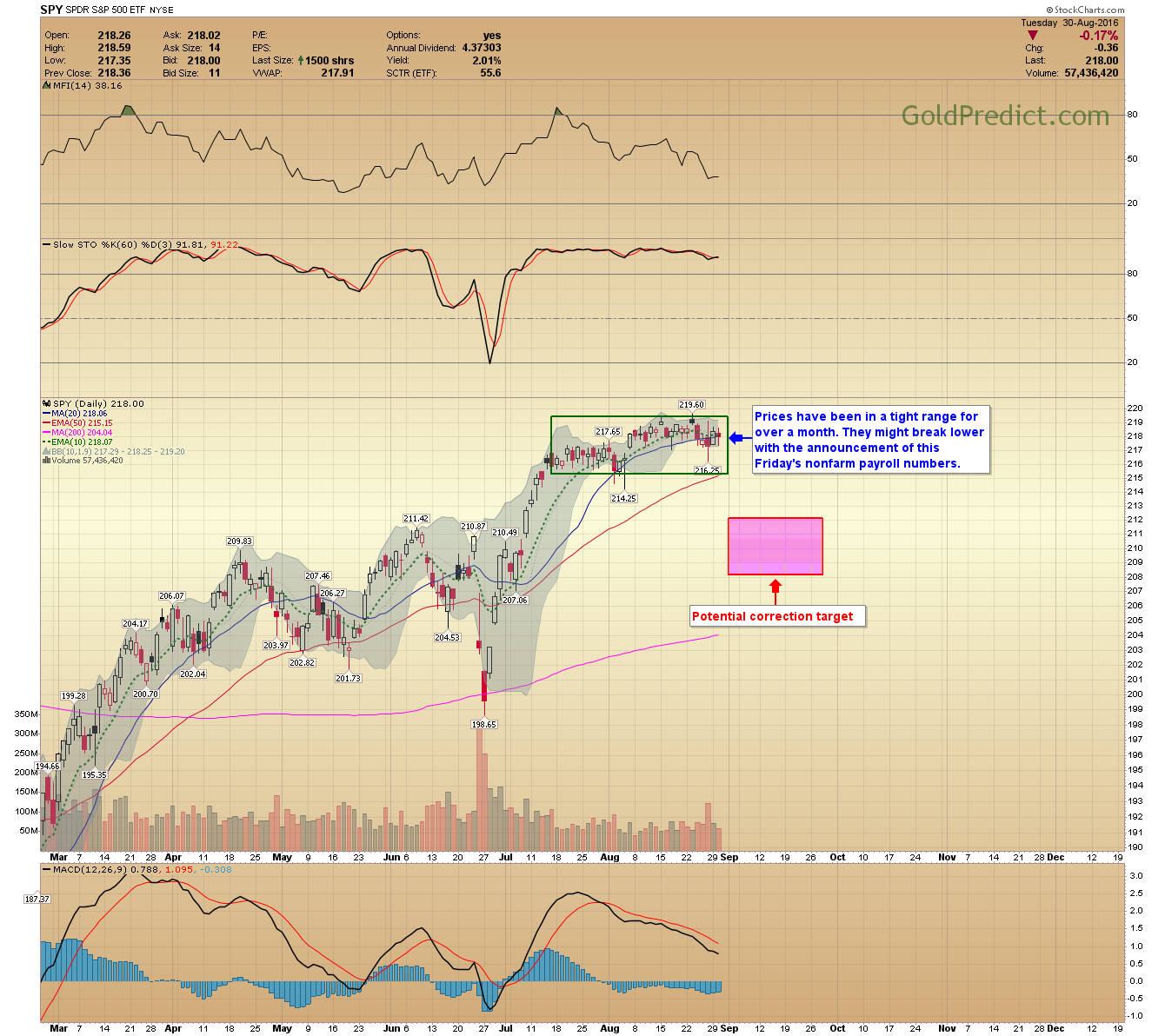

-SPDR S&P 500 (NYSE:SPY) - Prices have been in a tight range for over a month. They might break lower with this Friday's nonfarm payroll numbers.

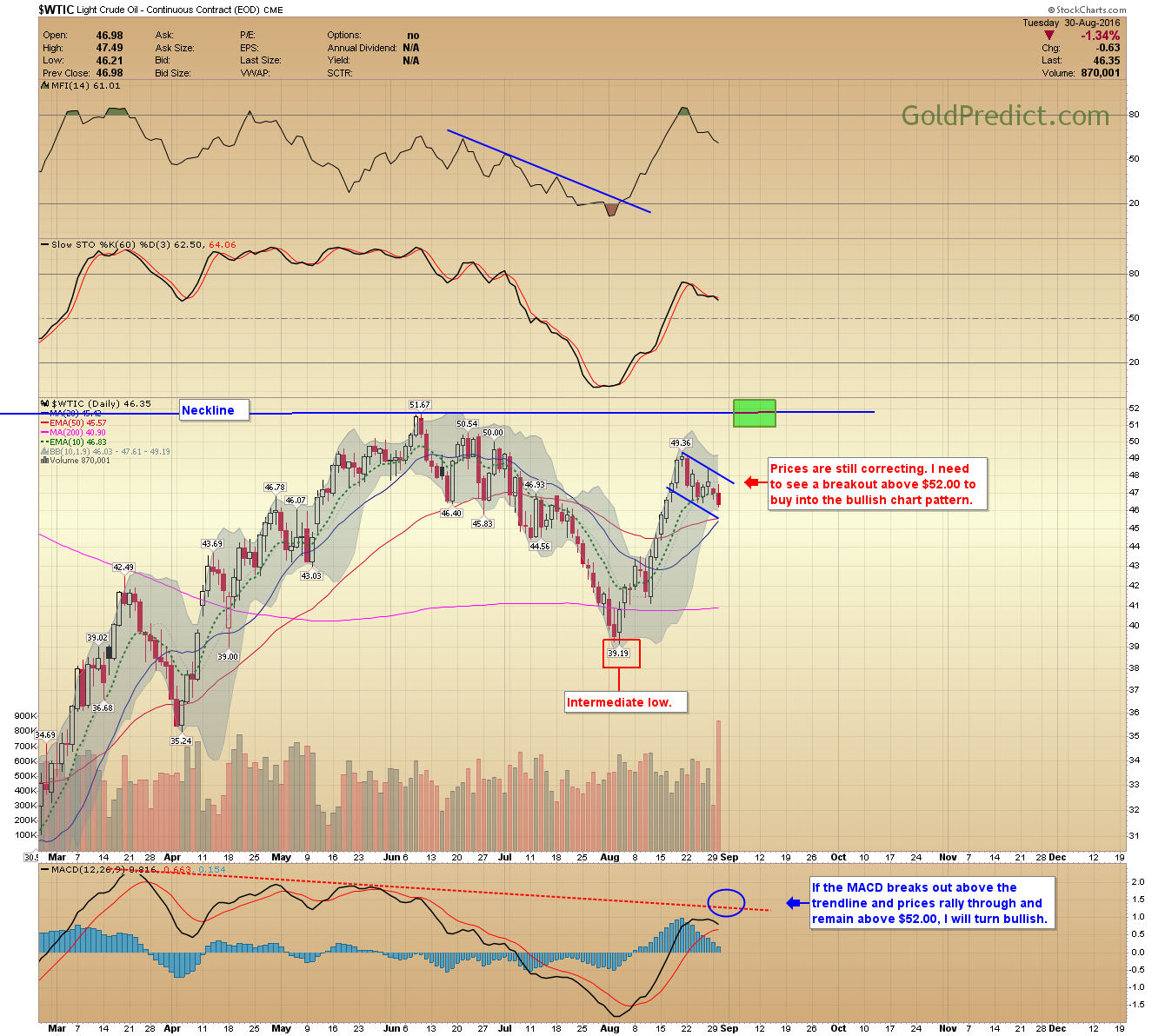

-WTIC- Prices are still correcting. I need to see a breakout above $52.00 to buy into the bullish chart pattern.

I will update if necessary; I'd like to see Gold solidly close below $1,310 and $1,300 this week.