Gold Today –New York closed Friday at $1,264.40. London opened at $1,258.40today.

Overall the dollar was stronger against global currencies, early today. Before London’s opening:

The USD/EUR was stronger at $1.1802 after the Friday’s$1.1881: €1.

The Dollar Index was stronger at 93.38 after Friday’s 92.74.

The yen was weaker at 110.81 after Friday’s 110.026:$1.

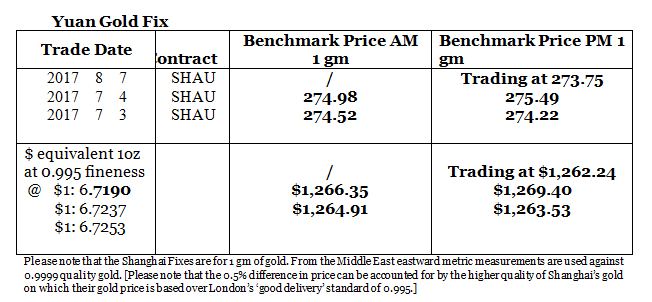

The yuan was stronger at 6.7190 after Friday’s 6.7200: $1.

The Pound Sterling was weaker at $1.3050 after Friday’s $1.3149: £1

New York closed $2 lower than Shanghai’s close Friday. But today, we are seeing a stronger dollar, and a lower dollar gold price in London. The jobs report was met with enthusiasm that turned the dollar higher for now. Even with a stronger dollar we are seeing a stronger Yuan. London opened $385 lower than Shanghai but Shanghai was trading at only $2 lower than New York’s Friday close.

Silver Today –Silver closed at $16.25 Friday after $16.63 at New York’s close Thursday.

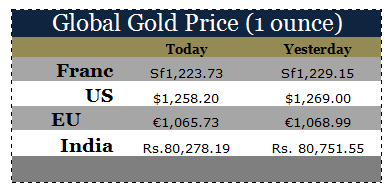

LBMA price setting: The LBMA gold price was set today at $1,257.55 from Friday’s $1,269.30. The gold price in the euro was set at €1,065.90 after Friday’s €1,068.34.

Just before the opening of New York the gold price was trading at $1,258.20 and in the euro at €1,065.73. At the same time, the silver price was trading at $16.21.

Gold (very short-term) The gold price should consolidate, in New York today.

Silver (very short-term) The silver price should consolidate, in New York today.

Price Drivers

The jobs report was read by the market in a positive light. It turned the dollar stronger against all currencies and pulled the gold price down in dollar terms. We expected a rise in the gold price because we expected higher employment and felt the market would only react to wage inflation, which, in line with our views, was barely noticeable. But the market looked only at the jobs numbers.

In the euro there was only a small drop in the gold price. So where is the dollar going from now on? We don’t see the gold price falling in other currencies and indeed we are not convinced by the jobs report spurring wage inflation soon. The jobs being created are easily low, but on top of that the impact of technology on quality jobs is heavy. The failure of full employment to spur wages is a structural change that will not reverse.

In the Gold Forecaster we have outlined that in the developed world up to 50% of all jobs will be permanently lost to A.I. and machines. This fact has not been accepted in general, by economists. Until, not just the problem but new-industry, job creation is put into effect it is unlikely that wage inflation will take off. In turn, that slows the recovery and makes it vulnerable. Likewise, for fixed interest markets! The current equity, fixed interest rate levels are becoming more vulnerable by the day.

So we don’t move away from a weak dollar. We see the current rise as being short lived before the dollar resumes its fall. This translates into gold holding current levels in currencies other than the dollar, then rising in the dollar once more. It will see a good boost in the Autumn when the gold ‘season’ kicks off.

Gold ETFs – There were sales from the SPDR Gold (NYSE:GLD) ETF of 4.731 tonnes but no change in the Gold Trust holdings on Friday. The SPDR gold ETF and Gold Trust holdings are at 787.144 tonnes and at 211.43 tonnes respectively

Since January 4th 2016, 1658.608 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust.

Since January 6th 2017, 0.283 of a tonne of gold has been added to the SPDR gold ETF and the Gold Trust. The gold acquisitions by these two funds in 2017 have returned to the negative and now stand at -3.867 of a tonne in 2017.