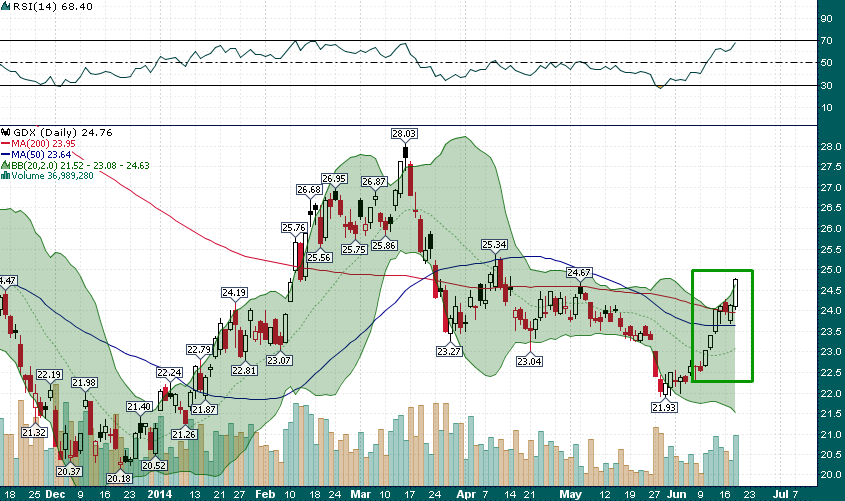

Since our “Some Reason for Optimism in the Gold Miners” post from two weeks ago, the senior gold miners (ARCA:GDX) have posted nothing short of a 10% rally:

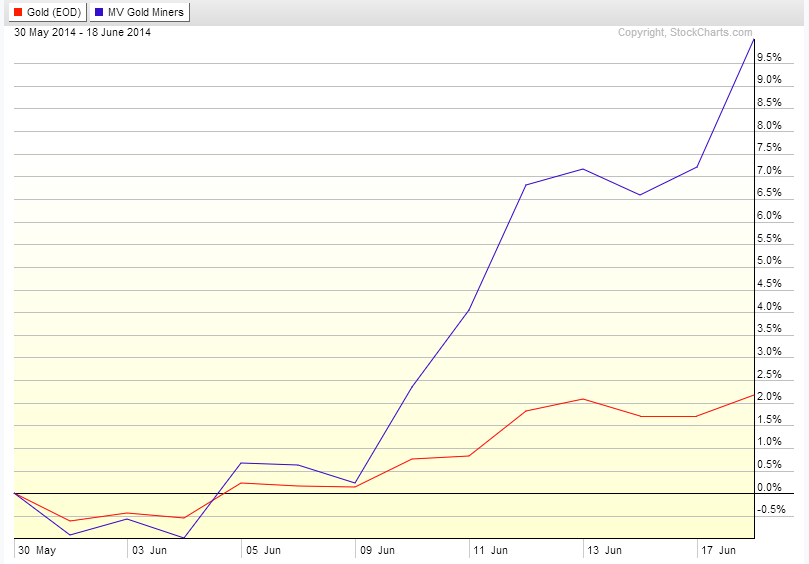

The most interesting aspect of the recent rally in gold stocks is the fact that the metal itself has lagged considerably behind:

A Bullish Sign

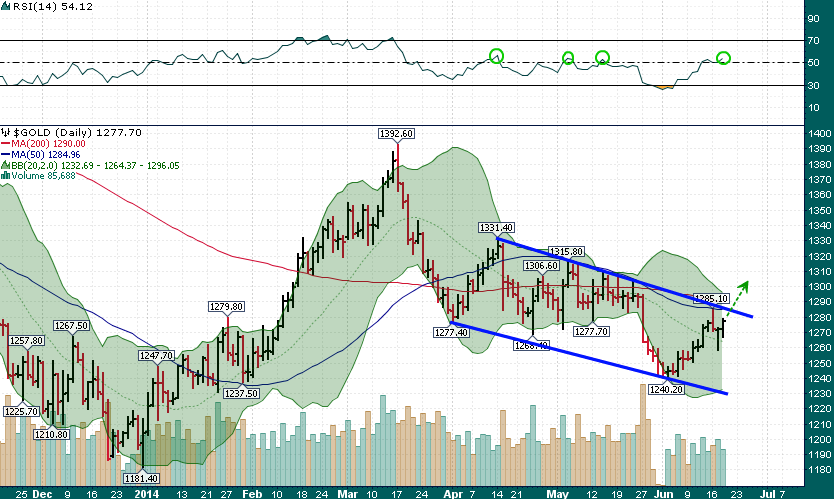

Given that we are currently right in the heart of the ‘summer doldrums’ (the weakest period of the year for the precious metals space historically) this can only be construed as a bullish sign. As of Thursday morning, gold was breaking out of the downtrending channel, which began in April:

Indeed, Thursday's spike above the channel indicates that the downtrend has ended and a new uptrend may have begun 3 weeks ago – the $1300 price is likely to continue to serve as resistance until proven otherwise, with $1275 becoming support once again.

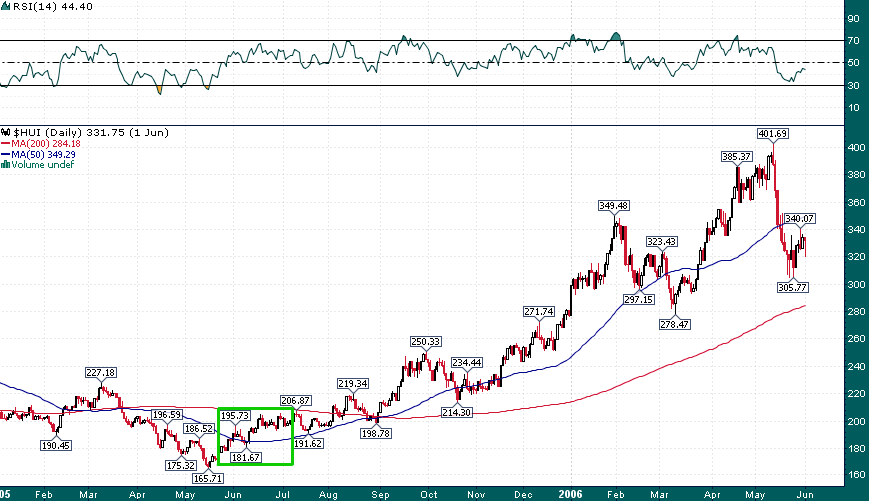

No Joke, It's A Rally

The significance of this June rally cannot be overstated – thus far, it is the strongest June for the gold miners since at least 2005 (the HUI and TSX-Venture would proceed to more than double between June 2005 and May 2006):

If history is any indication investors should pay close attention to the growing number of bullish signs in the precious metals mining sector.

Summer 2014 could jkust be a summer to remember.