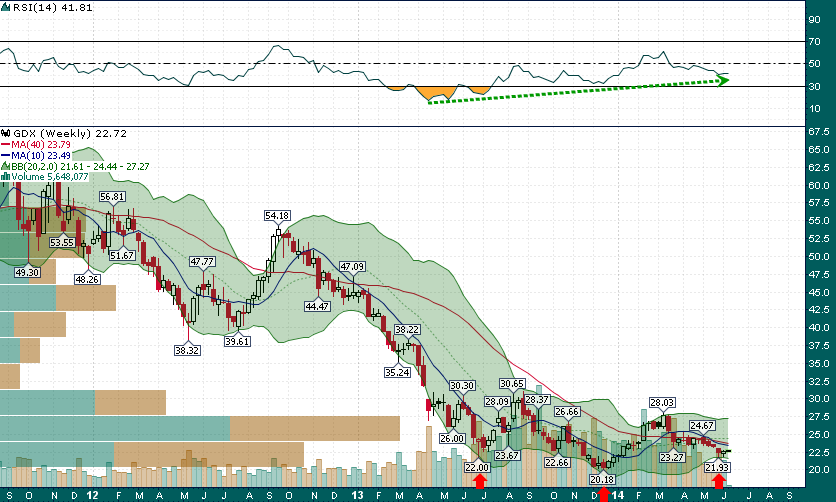

As the gold mining sector enters its worst time of the year historically (June and July) there is some reason for hope. The weekly chart of Market Vectors Gold Miners (ARCA:GDX) (the gold miners ETF) shows a potential head and shoulders bottom that is nearly symmetrical:

The head and shoulders bottom is virtually symmetrical with the left shoulder forming last June, the head forming at the December low, and the low of a couple of weeks ago potentially putting in place the right shoulder – a rally back above the $24 level would go a long way toward confirming that a long term bottom has been put in place for the senior gold producers.

The outperformance of GDX relative to gold since the May 29th low also offers some reason for optimism that perhaps the miners have simply become too cheap. Moreover, with roughly 10% of downside and easily 30-40% of near term upside the risk/reward proposition of adding some GDX to one's portfolio is simply too attractive to pass up.