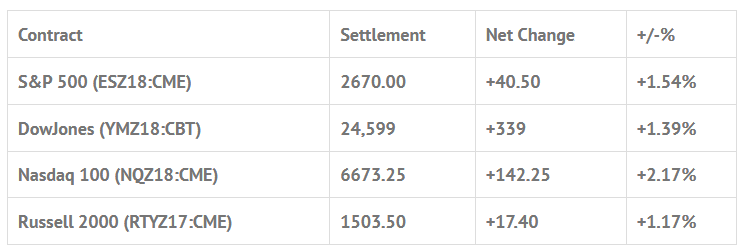

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 5 out of 11 markets closed lower: Shanghai Comp -0.04%, Hang Seng -0.17%, Nikkei +0.64%

- In Europe 12 out of 13 markets are trading lower: CAC -0.36%, DAX -0.35%, FTSE -0.22%

- Fair Value: S&P +0.16, NASDAQ +5.56, Dow -8.50

- Total Volume: 1.36k ESZ & 283 SPZ traded in the pit

As of 8:00 AM EST

Today’s Economic Calendar:

Today’s economic calendar includes Richard Clarida Speaks 7:45 AM ET, Redbook 8:55 AM ET, S&P Corelogic Case-Shiller HPI 9:00 AM ET, FHFA House Price Index 9:00 AM ET, Consumer Confidence 10:00 AM ET, Raphael Bostic Speaks 2:30 PM ET, Esther George Speaks 2:30 PM ET, and Charles Evans Speaks 2:30 PM ET.

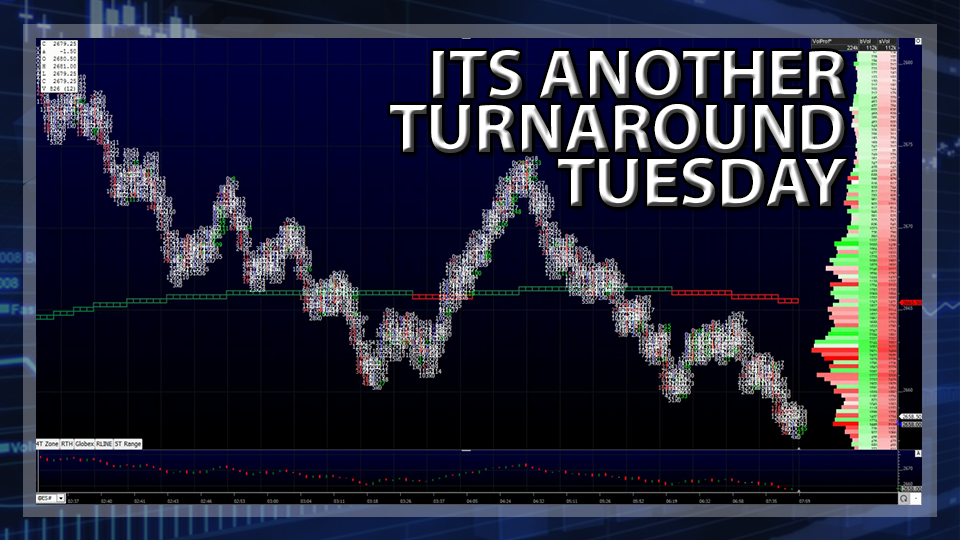

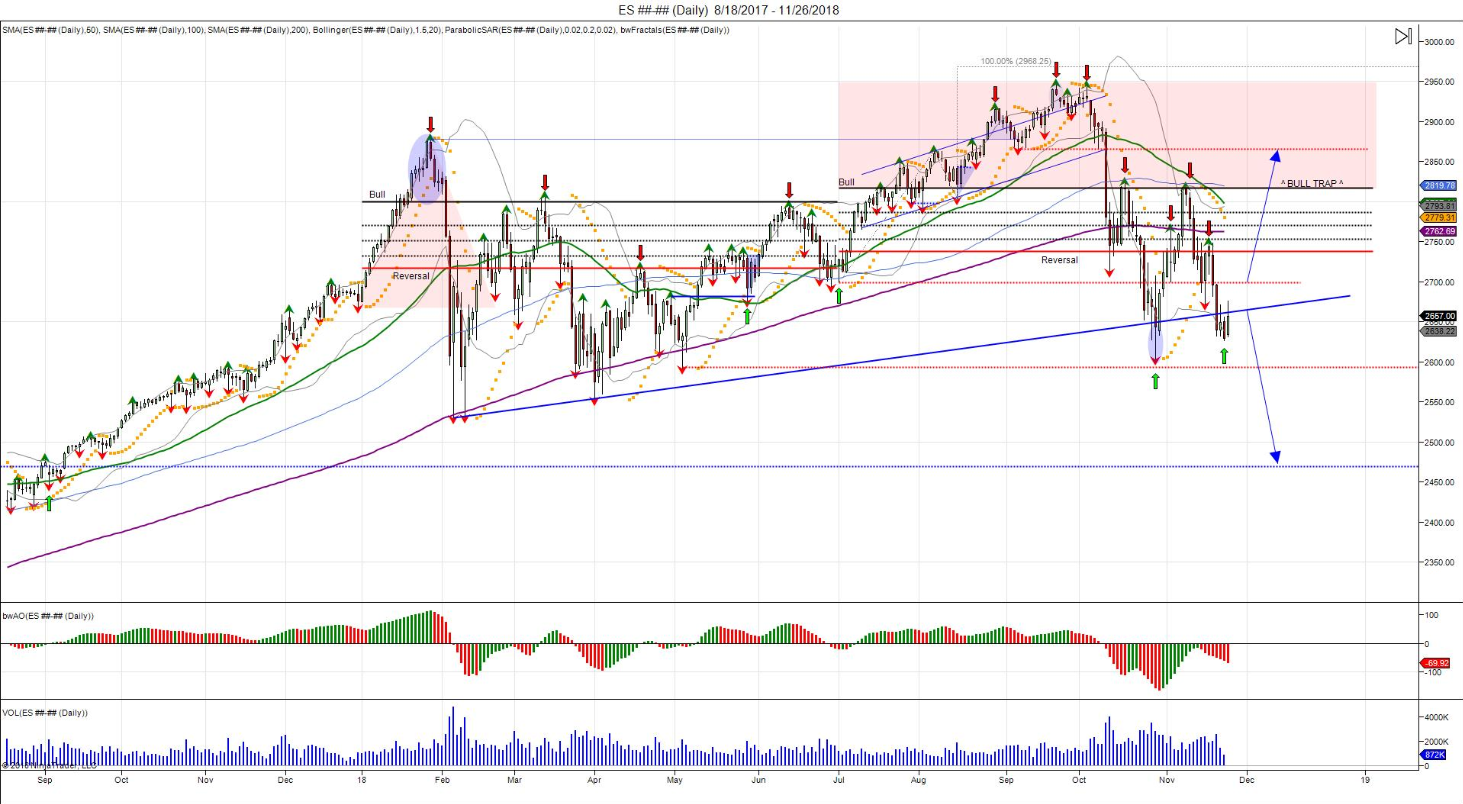

S&P 500 Futures: Mutual Fund Monday And A Big Fat ‘Short Squeeze’

After pushing higher for much of the overnight session, and then retracing some into the open, the S&P 500 futures printed 2657.25 on Monday’s 8:30 AM CT bell. From there, the futures made an early morning low at 2655.75 before strong early buy programs helped push the ES to the morning high of 2671.75 just after 9:00. After that, the ES traded down to 2662.25, then back up to a retest high of 2670.75, before dropping down to the mid morning low of 2658.25 just after 9:30. There was a late morning bounce up to a lower high at 2667.25 before trailing lower through the remainder of the morning to 2652.25.

The afternoon saw the equity futures get a lift, as the ES traveled up to 2674.00 in the 1:30 to 2:30 hour, testing and retesting that level, then making a high of day at 2676.25 late in the session. The ES went on to print 2673.75 on the 3:00 cash close, and then settled the day at 2669.00, up +39.50 handles, or +1.50%.

In the end, when you hear stats like ‘S&P Has Worst Thanksgiving Week since 1939’, you know something is going to happen. What happened was the ES rallied 46.25 handles in one day. That’s how this works now, big drops and big pops. In terms of the days overall tone, it was firm, and every little pullback was bought, until late in the day when the Trump / China tariff threat headlines hit the tape. In terms of the days overall trade, and despite the big move up, total volume was low, only 1.36 million ES futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.