European market opening calls:

Euro Stoxx 50 2883 +18

FTSE 100 +26

DAX 9729 +49

CAC 4263 +26

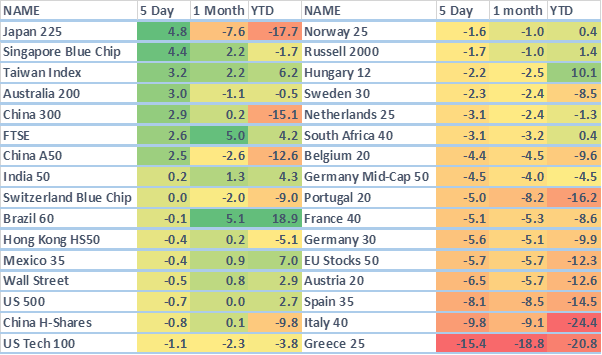

Global winners and losers from Brexit

It has been an incredibly volatile week in global markets in the wake of the UK’s decisions to leave the EU, and while some equity markets have surfed the waves of volatility and come out relatively unscathed, others got caught up in the backwash.

Asia-Pacific regions and non-European emerging markets have definitely come out the best after the selloff. The rally in the Singaporean SGX is particularly interesting given that some of its gains may partly be driven by speculation that financial services firms may look to relocate some of their London positions to other cities. Brazil was also impressively unfazed by the Brexit selloff and seems solidly driven by its domestic issues. Taiwan also rebounded to within touching distance of its 2016 highs.

On the other hand, Greece, Italy and Spain have struggled to recover much of their post-Brexit selloff. Brexit has really cast doubt over whether the EU and the Eurozone will ultimately be able to survive in the long term. The key losers in an EU break up scenario would be the PIGS (Portugal, Italy, Greece, Spain) countries, and it’s not surprising that in the wake of Brexit their equity markets have seen the least love in the rebound rally.

In an attempt to shore up some of these concerns, Italy was granted permission by the European Commission on Sunday to provide 150 billion euros of liquidity support to its banks until the end of the year. But the Italian government is also keen to directly inject 40 billion euros into its banks, given that almost 18% of their loan book is non-performing.

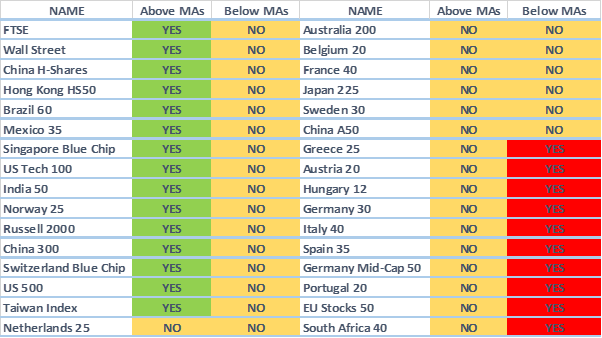

The markets’ perception of the impact of Brexit becomes clearer by looking at which indices are above their 10-day, 20-day and 50-day moving averages. There are only three European markets trading above their moving averages – UK’s FTSE, Switzerland’s SMI, and Norway’s OBX – none of whom are part of the Eurozone. This, I think, adds to the argument that Brexit raises greater concerns about the viability of the European Union going forward.

The equity indices with the clearest momentum in the post-Brexit landscape look to be Taiwan and the FTSE (in local currency terms at least). Taiwan’s Taiex has totally recovered its post-Brexit selloff and looks set to retest its November highs.

While the FTSE 100 companies continue to benefit from the expectations of BOE stimulus and potentially further falls in the pound, the picture is, of course, less rosy in non-pound denominations. But in index terms, the FTSE 100 has a good shot at recovering 6590-6600 in the near-term.