This article was originally published at TopDown Charts

Executive Summary

-

Global-ex US stocks have significantly declined vs USA equities since early June as growth (tech) came back in favor

-

The medium-term/strategic outlook for ex-US equities becomes more compelling, but technicals must be monitored and respected

-

Sector, style, and currency movements are important factors when analyzing country stock market moves; the US dollar has rallied near-term and continues to hold support

Global Equities Summer Swoon

Mega cap US growth has left everything else in the dust since early June. It feels like old times again. The FANGMAN stocks (or whichever the latest acronym is!!) have soared to all-time highs. Facebook (NASDAQ:FB) recently briefly climbed above $1 trillion in market cap while Microsoft (NASDAQ:MSFT) is above $2 trillion.

Last week we asked, “Is Everything Expensive?”—of course, we don’t think so (there are pockets of value and relative-value opportunities), and we posit that ex-US stocks offer an even more compelling strategic case right now.

Many Stocks Correcting

Everything else—the US extended market, value stocks, and ex-USA equities—is generally just meandering if not correcting. You can’t go a few minutes reading through financial market narratives without poor market breadth being discussed. Indeed you need only look at our latest weekly S&P500 ChartStorm.

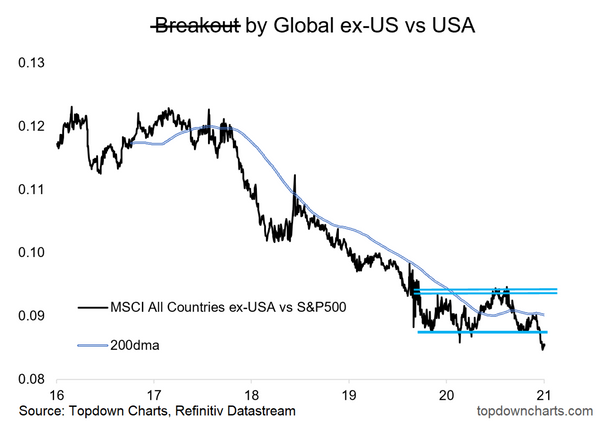

Breakout

Recent price action in global stocks is partly to blame for the lack of upside participation. The Chart of the Week shows the nixed breakout of Global ex-US vs. USA stocks. Foreign equities were strong at times coming out of the COVID crash, but it was nothing spectacular. It was somewhat surprising to see how close the US market tracked with the ACWI ex-US index considering how much the two can diverge when looking through history...

Chart of the Week: Global Equities vs S&P500 relative performance

Is the Thesis Alive?

In our Weekly Macro Themes report, we analyzed the factors helping to drive global equities down on a relative basis. The US dollar is always a culprit, but so too are the mechanics of defensive sectors and old cyclical sectors versus the information technology sector: sectors matter! Indeed, even part of the bull case for global stocks is the outperformance of such areas versus Tech—but there are now questions on that thesis despite defensive sectors holding up well last week.

Longer-term, we still look for old cyclicals (financial, energy, industrials, materials) to rebound which would aid the performance of global ex-US vs. USA equities. It’s something to keep watching through the second half.

US Dollar’s Near-Term Rally

Back to the US dollar. The USD has been remarkably quiet so far this month despite the divergence between US and ex-US markets. The greenback remains in a short-term trading range while technicals swing into overbought territory.

Part of our currency analysis includes how investor positioning and sentiment look on the charts. We see USD positioning now net-long while sentiment is close to neutral. We keep watching support near 89 on the USD index, but especially resistance - which the index is contending with right now. With some near-term upside risks, our medium-term bearish case remains intact for now.

Value Succumbs to Growth Once More

Finally, the Value vs. Growth theme is under pressure. Value investors had their time in the sun from November through April. But was that 6-month window all the beaten-down style could muster?

We don’t think so.

The relative valuation case is increasingly attractive. In particular, the valuation gap between the cheapest vs the most expensive parts of the market has widened further. We’ve written on this topic before, and it suggests a medium-term opportunity for value stocks (and many of the things to say about value vs growth can also be said about global ex-US vs US equities).

Conclusion

Among our 10 Charts to Watch in 2021 is how the USA vs RoW equity story unfolds. US stocks made an initial breakout as the technology sector surged since holding support in mid-May. It seems like moons ago, but those growth stocks that are now household names were out of favor among investors in early Q2.

We will monitor the technical levels and factors driving global returns, but the strategic case for being overweight ex-US equities has become more compelling.