As a new week begins as global leaders head to the Middle East to help push a ceasefire between Israel and Palestine, market focus will be on meetings in Doha and Egypt as UN head Ban arrives along with Secretary of State Kerry. U.N. chief Ban Ki-moon has called Israel’s latest incursion “atrocious,” and said it must do far more to protect civilians. The draft resolution called for the protection of civilians, the lifting of the “Israeli restrictions imposed on the movement of persons and goods into and out of the Gaza Strip” and immediate humanitarian assistance to civilians in Gaza.

This morning as a special session of the United Nations in New York has begun, the death toll on both sides continues to climb. Market attention will also focus on the Malaysian airliner tragedy in Ukraine as news that the rocket launcher was supplied to pro-Russian separatists by Russia. Risk Aversion remains the dominating mode of investors. Asian markets are trading on a positive note today and recovered after sharp fall in last two trading sessions which was due to downing of passenger jet in Ukraine leading to rise in global geopolitical tensions. Asian stocks rose today, joining a global rebound after the downing of a passenger jet in Ukraine and Israel’s invasion of Gaza affected investor sentiment adversely in the recent past. Key benchmark indices in Indonesia, Hong Kong, Taiwan, Singapore, and South Korea rose by 0.02% to 0.58%. China’s Shanghai Composite fell 0.31%.

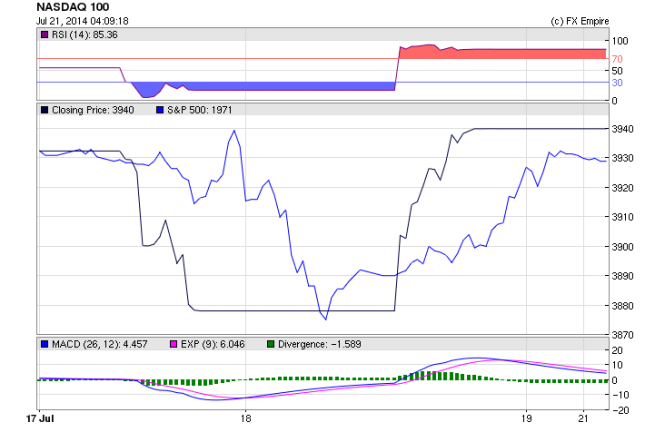

Wall Street ended on a positive territory on back of bargain hunting as traders seemed to shrug off the geopolitical concerns that contributed to the weakness seen in the previous session. European stocks clawed back from early losses due to situation in Ukraine and Russia tensions flare.

Currency traders detected a softening in Bank of Japan Governor Haruhiko Kuroda’s stance toward the stronger yen. While the currency has risen 3.9 percent this year to 101.36 per dollar, the central-bank chief signaled this week he’s satisfied with the exchange rate. The yen rose to trade at 101.26 against the greenback and at 137.04 as safe haven trading kept the yen strong. Bank of Japan policymakers have raised concerns about the nation’s slowing exports, with some citing “structural factors” that might not be addressed in the near term, according to the minutes of their meeting released Friday.

The New Zealand dollar tumbled last week along with most commodity currencies after the US dollar gained. The kiwi tumbled to trade below the 87 price level but traders recovered this morning adding 19 points to rise to 0.8706 while the Aussie dollar is trading at 0.9388 on comments from the RBA.

The euro fell below $1.35 for the first time since February, crossing what’s seen by some dealers as the dividing line between success and failure for the European Central Bank’s attempts to boost growth. The euro recovered to trade at 1.3533 but is expected to continue to decline after the IMF expressed worries over the low inflation rate in the zone. IMF chief Christine Lagarde has warned that low inflation could damage growth in Europe and urged the European Central Bank to maintain a flexible policy. Last month, the European Central Bank cut its key interest rates, including taking one into negative territory for the first time, in a bid to help the region’s stalling economy emerge from the eurozone debt crisis

The US Dollar rallied the most in eight weeks as the Federal Reserve acknowledged surprise in the improvement in the U.S. labor market and amid heightened geopolitical turmoil. The dollar gained to trade over the 80.60 price but gave back gains on geopolitical stress to trade at 80.55 this morning.

The Looney is trading at 1.0737 after a turnaround in the CAD dollar which advanced to the strongest level in a week after an inflation gauge rose in June for a second month past the central bank’s 2 percent target.