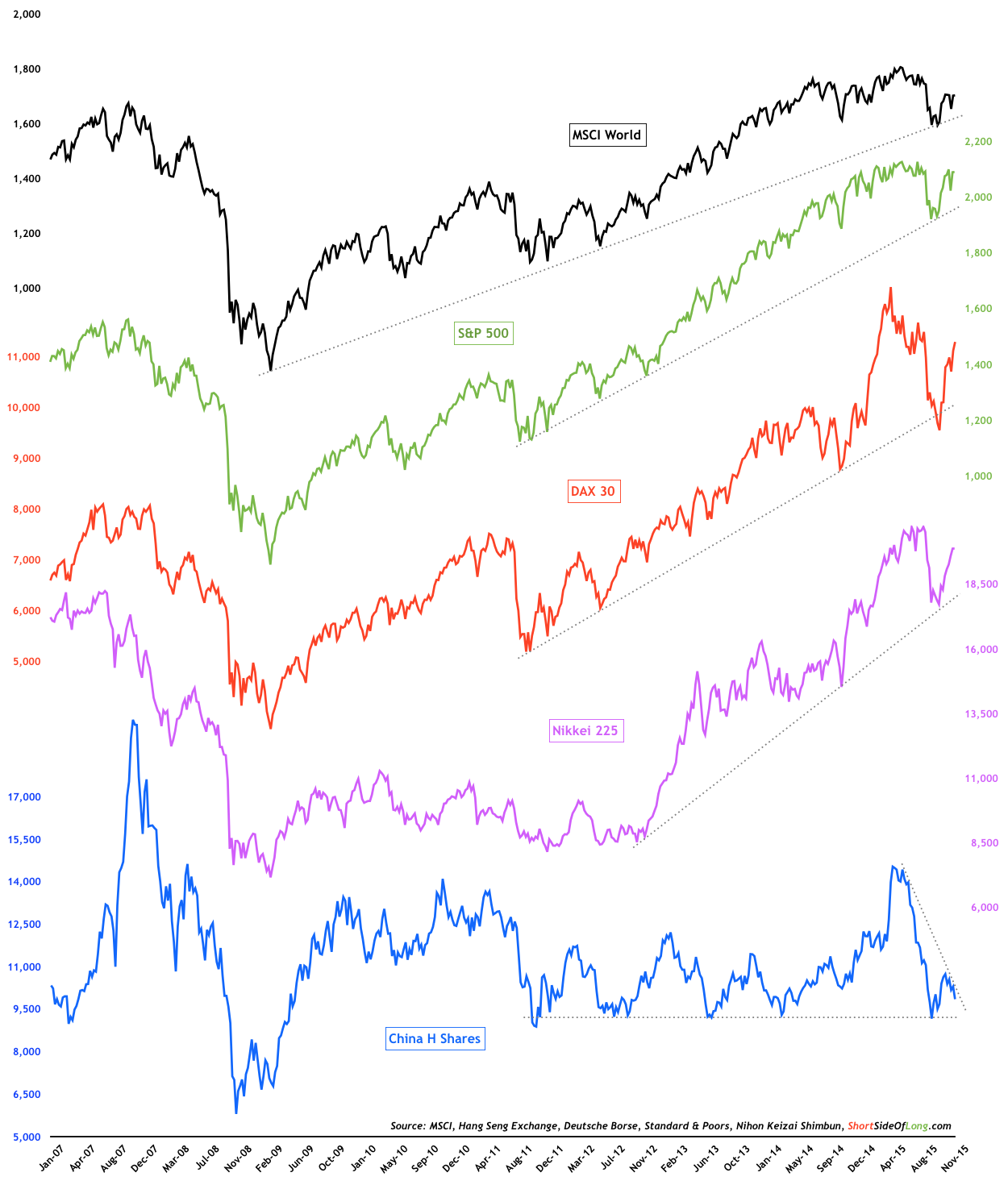

Global stock indices, apart from China, remain in a primary uptrend

Source: Short Side of Long

The Federal Reserve is pretty much ready to pull the trigger on the first interest rate hike since 2006.

So how are global stocks performing, heading into December?

October was a very strong month in all global stock markets, while November was a more mixed picture.

United States equities (N:SPY) initially corrected rather sharply, but afterwards managed to crawl back close to those record highs from earlier in May. While the losses were more dramatic in foreign markets, recovery rallies have been just as powerful.

Both German (N:EWG) and Japan (N:EWJ) are well on their way, as Developed Markets (N:EFA) remain in a primary uptrend. On the other hand, China (N:FXI) together with the rest of the Emerging Markets (N:EEM), continue to struggle.

Chinese H Shares broke down on Friday, below the physiological 10,000 point level, while the Shanghai Composite (N:ASHR) fell by more then 5%. However, it needs to be stated once more, that most Emerging Markets indices represent extremely cheap valuation propositions, both nominally and relatively.