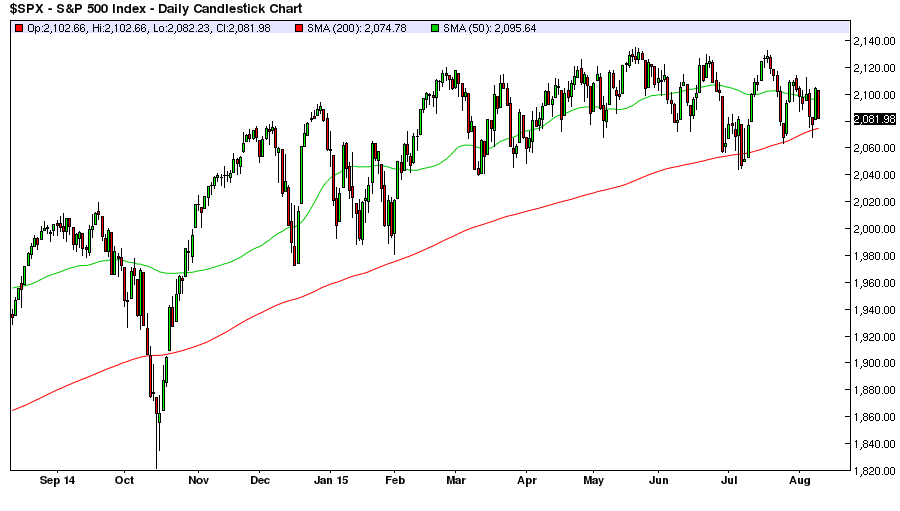

S&P 500 is now on the verge of breaking its tight range and trading below the 200-day MA

Will It Or Won’t It?

We have been discussing S&P 500 over the last few months, focusing on whether the US large cap index will finally drop below its 200-day moving-average support. The index of 500 components has outperformed the rest of the global stock markets for awhile, now, remaining the only game in town. But how long can this outperformance last, while rest of the global assets keep dropping with deflationary pressure?

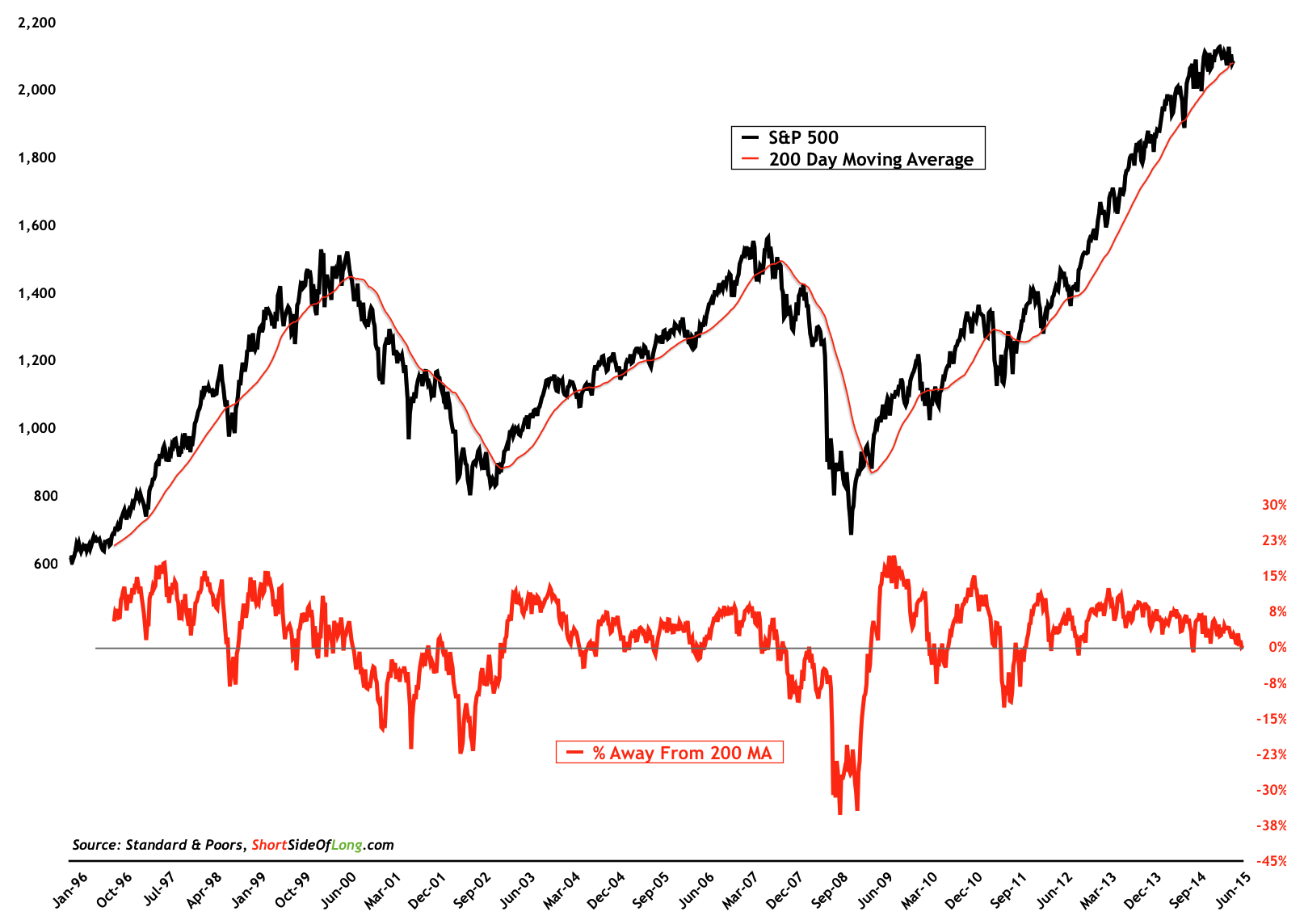

Possibility of a 10% correction is high, with last one occurring almost 4 years ago

Source: Short Side Of Long

Readers should remember that the index has not suffered a 10% correction (on a closing basis) since October 2011, almost 4 years ago. This is now one of the longest historical stretches without a meaningful correction. Obviously, VIX is behaving due to artificial conditions, where major central banks remain engaged in QE.

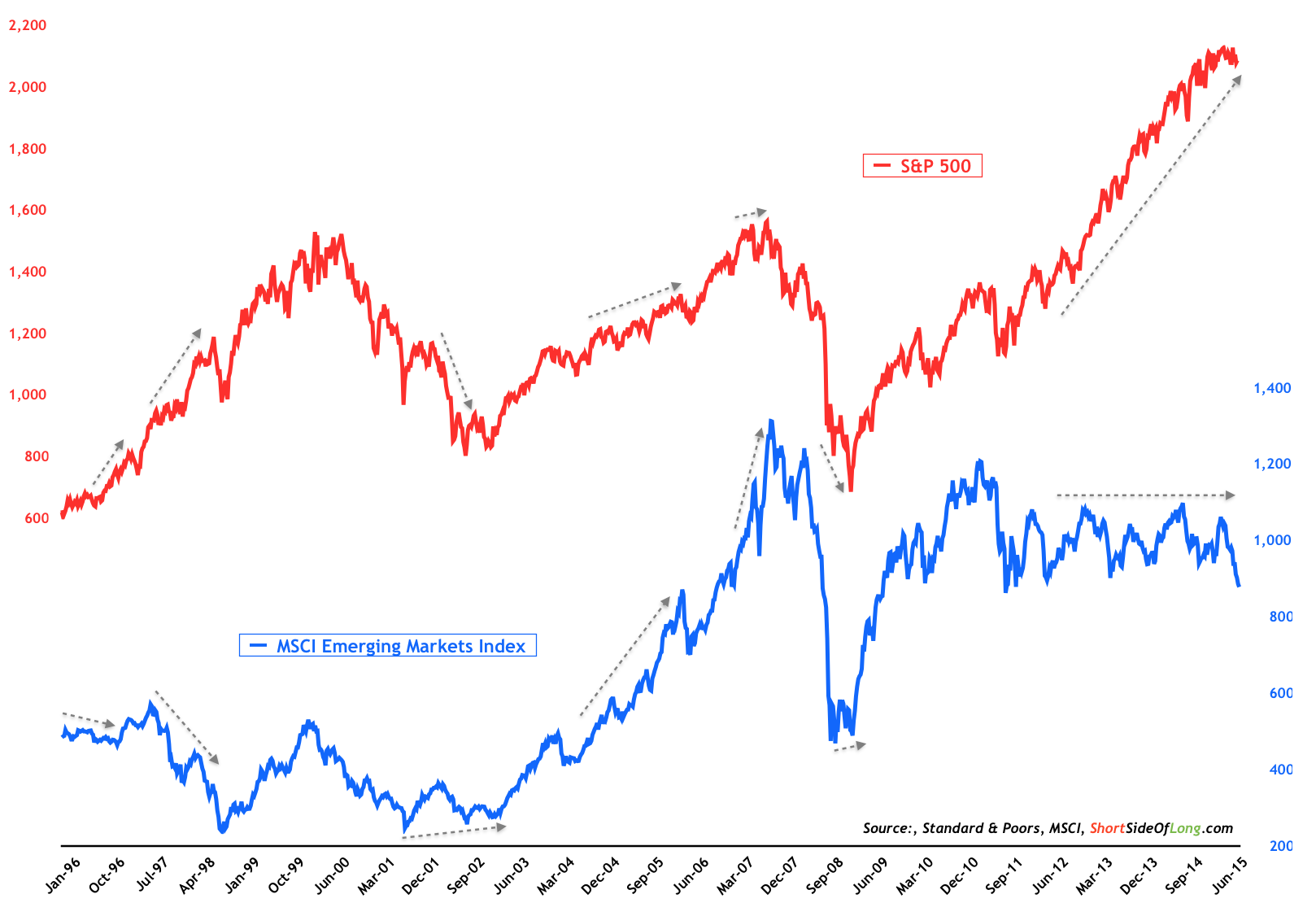

Furthermore, as I mentioned in previous posts, S&P 500 has traded above its 200-day moving average for 183 out of the last 187 weeks, so it is definitely overdue for a drop and a mean reversion. Today’s price reversal looks likely to signal that bears could finally take control (for awhile). If S&P breaks lower, one can expect other global markets, such as MSCI Emerging Markets Index (ARCA:EEM), to feel even more pressure going forward.

If the global stock market correction continues, Emerging Markets will feel more pain

Source: Short Side Of Long