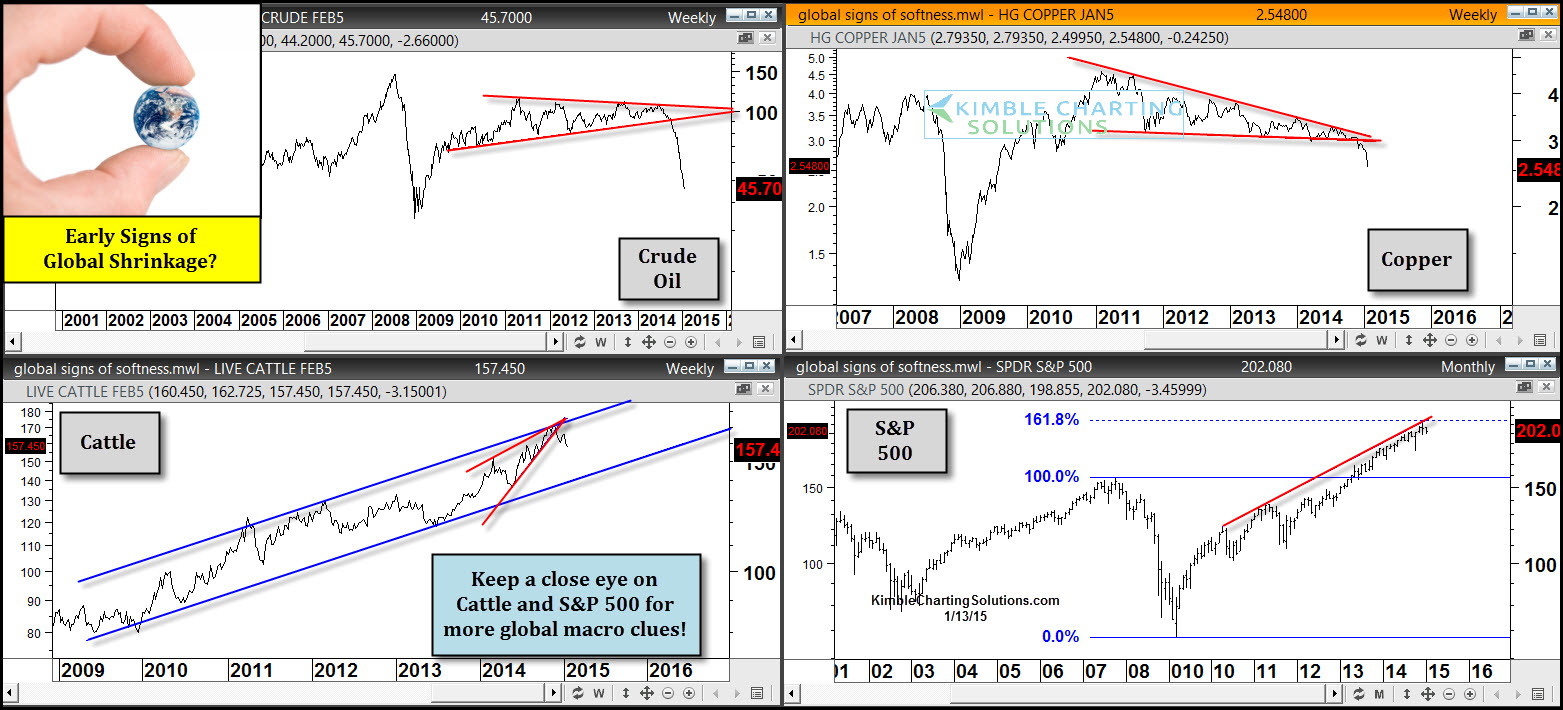

- Are rapidly falling crude oil prices a sign that the world is shrinking from an economic point of view? Some say, 'too soon to tell'.

- Are rapidly falling copper prices a sign the world is shrinking from an economic point of view? Others say, 'too soon to tell'.

Cattle and the S&P 500 are often considered decent barometers of global confidence -- or a lack thereof. At this point, these two are NOT following in the footsteps of the crude-copper trade.

Billions of free-thinking people have created patterns in cattle and SPY that should be respected as potential resistance. On Tuesday, cattle was down big -- I'm talking lock-limit down. One day does NOT make a trend for sure. Investors might want to see if this continues in cattle as a bearish rising wedge took place at the top of a rising channel.

Tuesday's S&P 500 was a big reversal day for the first time since 2011.

If cattle and SPY follow in the foot steps of crude and copper, the odds that we've got a least a small case of global shrinkage on our hands increase.