Here’s What Happened

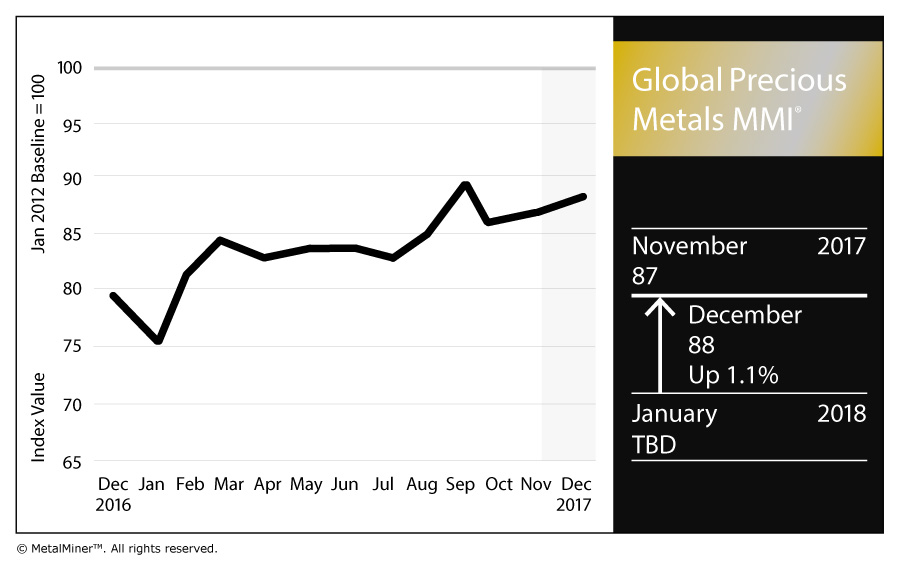

- MetalMiner’s Global Precious MMI, tracking a basket of precious metals from across the globe, ticked up another point to 88 for the December reading, a 1.1% increase.

- Palladium flexed its muscles, officially busting through the $1,000 per ounce ceiling. The platinum-group metal’s (PGM) U.S. bar price has jumped nearly a whopping 50% since the beginning of the year.

- Platinum crept closer to palladium’s level over the last month, ending up in the mid-$900s per ounce level. It has receded from its most recent high of March 2017, when it landed above $1,000 per ounce.

- “We’ve got a trend, folks!” — this is the third straight month in which palladium is priced at a premium to platinum, which has not been the historical norm.

- After breaking and holding above the $1,300 per ounce threshold at the beginning of September for the first time since October 2016, the U.S. gold price has been dropping for a couple months before leveling out for Dec. 1. Gold bullion is just about $4 per ounce higher than it was at the start of November.

What’s Going On in the Background?

- Why has palladium been trading at a premium to platinum? A reminder: “Palladium has traded at a discount to platinum because of platinum’s greater cost of extraction and its wider scope of applications,” according to Stuart Burns, MetalMiner’s editor at large. But the fall of diesel (compared to gas) engines has bumped up palladium demand — which, coupled with anticipation of both palladium and platinum production falling, according to analysts from UBS and SP Angel, paints a picture of potentially sustained higher prices. For now, heading into the winter holidays, the current trend is making palladium investors feel pretty good.

- Gold in the spotlight. Let’s pivot to gold a bit this month. A gold mine in Ireland is causing some controversy amidst the background of Brexit, with greater numbers of potential jobs and environmental impact all hanging in the balance.

What Metal Buyers Should Look Out For

- Meanwhile, our own Irene Martinez Canorea recently drilled down into the gold markets herself, albeit from an analytical perspective. She took a close look at the gold price vs. the U.S. dollar, the S&P 500 and the Chinese stock market — but ultimately unlocks the reason why industrial metal buyers (especially those buying copper) should pay attention to gold. Check out the article for full details.

- Back to PGMs. ETF Securities, an investment and intelligence firm, which we used to cover quite regularly, expects precious metals (including PGMs) to remain pretty stable for the course of 2018, according to EFT’s Outlook 2018 report. (That might be pretty telling in itself, if only because the firm would likely stand to gain from “talking up” future precious metal price increases, hoping that would make the markets move that way, rather than remaining flat.)

by Fouad Egbaria