WEEKLY REVIEW

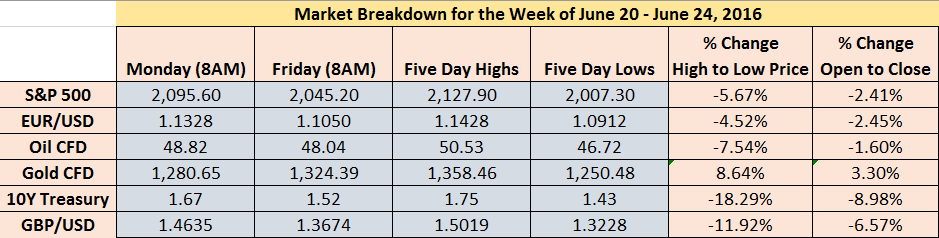

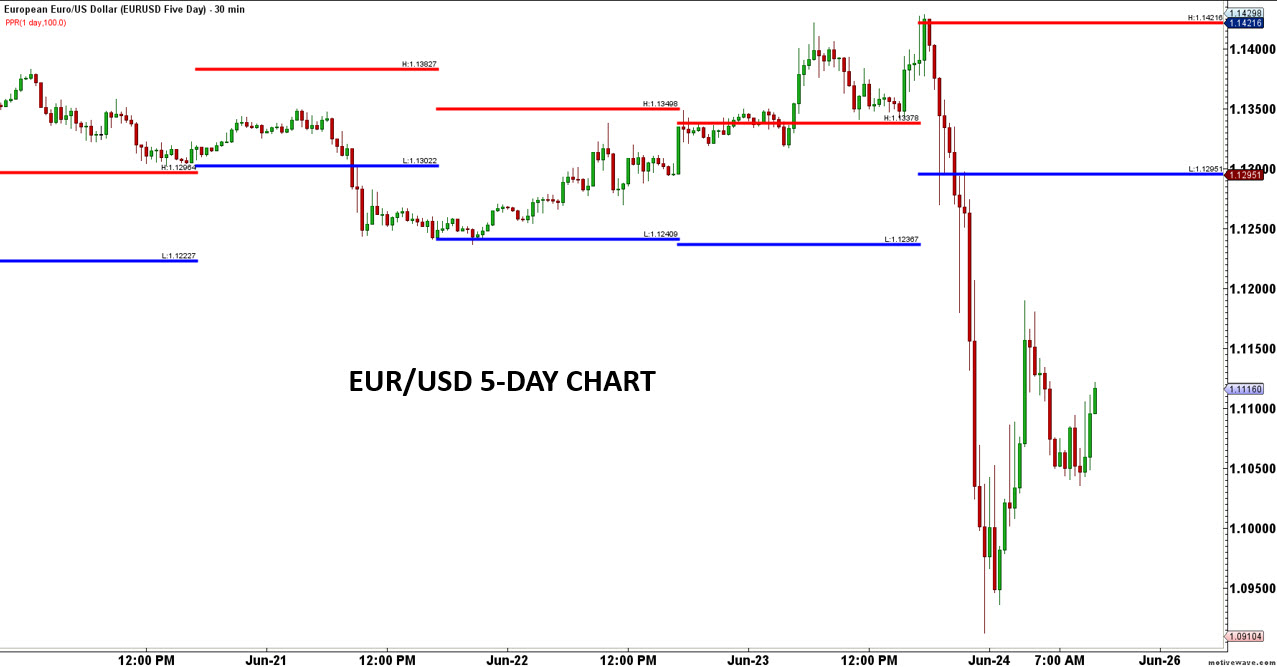

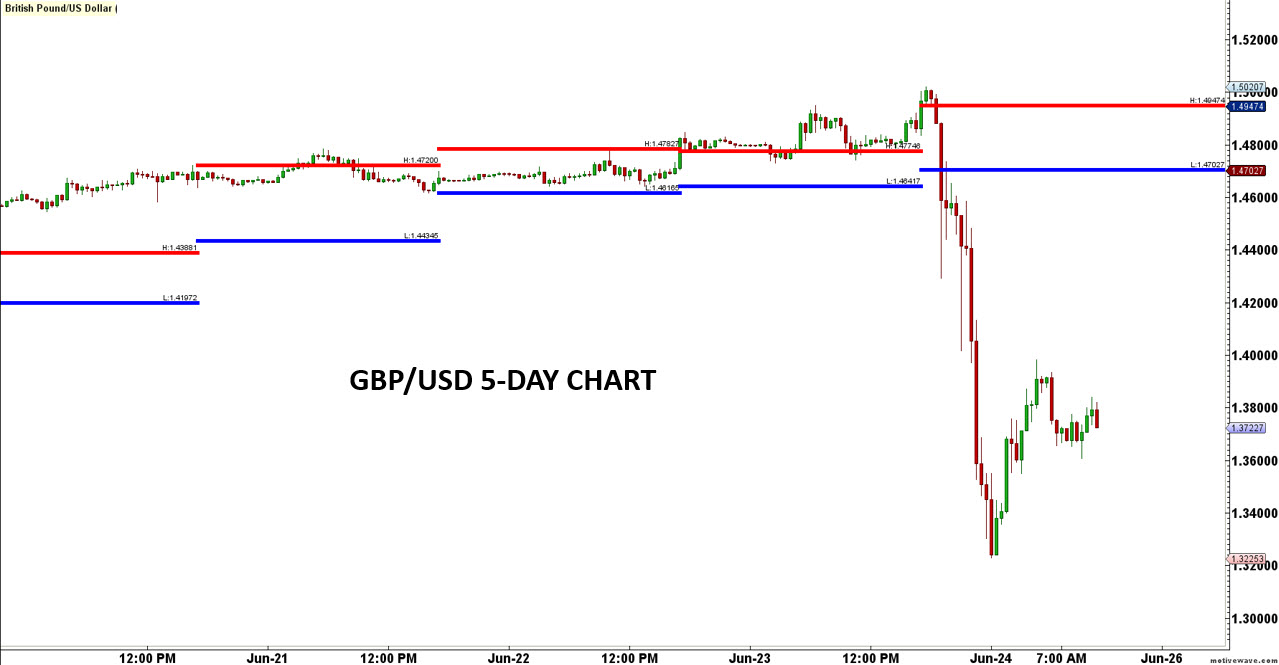

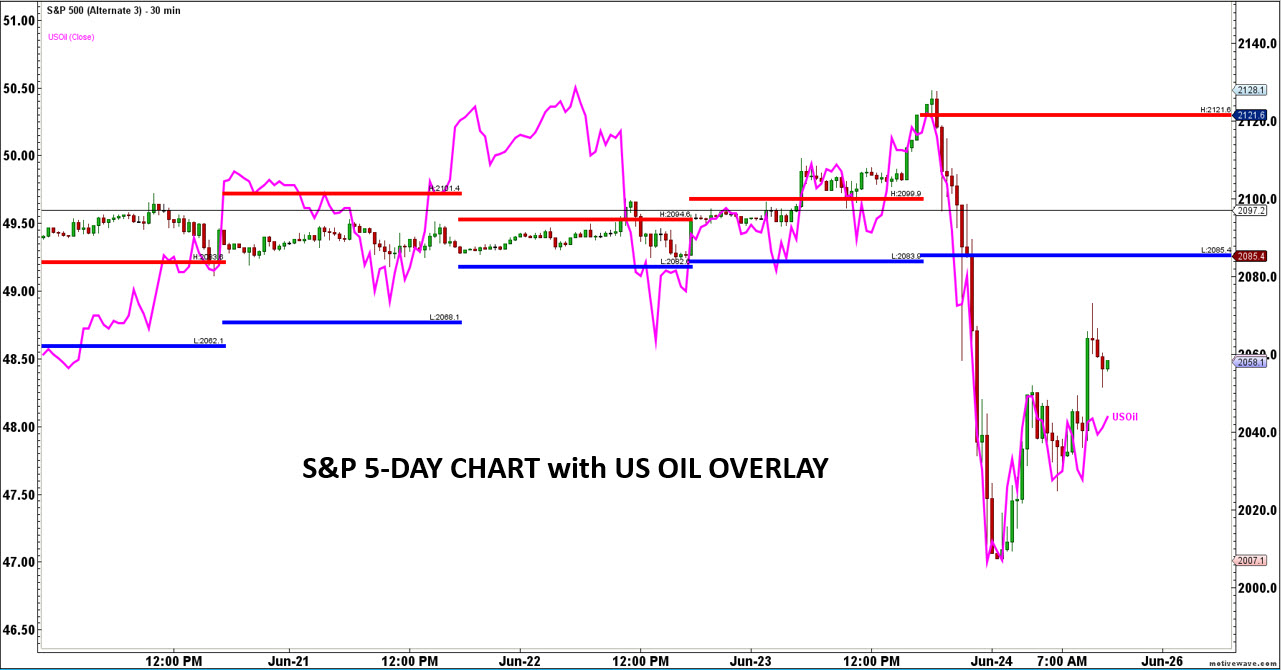

It was a historic week to say the least, as the financial markets embraced a shocking victory from citizens of the UK for a Brexit. Investors were prepared for a “risk-on” environment early on as the S&P 500 traded 32 points higher for the week into UK’s referendum before dropping 121 points from the voting results, and cutting those losses to close the week down 50 points. Similarly, oil had traded higher into the referendum results as well, but dropped sharply following the announcement to close the week down 78 cents. The British Pound on the other hand saw a disastrous drop from its weekly high of 1.5019 to close the week at 1.3674 after reaching a low of 1.3228. Meanwhile, safe haven assets finished in the green with gold closing the week up $44, the US dollar strengthening with EUR/USD dropping 2.45% for the week, and 10-Year Treasury yields sliding 15 basis points to 1.52%.

The last time the GBP/USD had moves of this magnitude was Black Wednesday, September 16, 1992, when the Bank of England was forced to withdraw the GBP/USD from the European Exchange Rate Mechanism (ERM) because the GBP/USD was under too much pressure for the Bank of England to support it any longer. I remember that day well as I was working for a bank at the time, so this is déjà vu indeed. I am quite certain that this historic week will be compared to that event in the days and weeks to come.

US ECONOMY

Janet Yellen started off the week by testifying on Capitol Hill, and mostly reiterated what was stated during June’s FOMC meeting. Once again, the chair mentioned that the economic outlook continues to be unclear, and the possibility of a volatile environment if Brexit were to come to fruition. Despite positive long-term projections on the US economy, Yellen noted that the Fed would still look to maintain rates at current levels. This is mainly due to sluggish growth prospects, recent weakness in the labour market, and a slow pace of inflation. More importantly, Yellen cautioned that productivity growth has been disappointing largely from a lack of business investment.

Pre-Brexit, Fed funds futures were pricing in a 49% odds of a rate hike this year – down 27% from the start of June. Post-Brexit, not surprisingly, Fed funds futures are pricing in a 21% chance of a rate hike this year.

EUROPE

The biggest market moving event took place on Thursday as more than 30 million Britons went to the voting polls to determine their future with the European Union.The markets ended up being largely shocked with a majority of 51.9% of the votes favoring a leave. The surprise comes after last week’s surveys had shown the vote to be roughly in balance, and difficult to predict the outcome. The primary reasons that lead citizens to vote for a Brexit included controlling immigration, creating their own laws, and saving the capital it funds to the EU budget. On the other hand, the IMF, the Federal Reserve, and the UK Treasury have all stated that a Brexit would negatively affect financial markets, the domestic labour market, impact international trade, and cause a hefty slide in the British Pound. Leading up to the day, the markets certainly believed that the final vote would result in the UK staying in the EU as evidenced by the GBP bouncing from a low of $1.4011 last Thursday to a six-month high of $1.5019 on the day of the referendum. The vote caused a 12% collapse from the high to the low of 1.3228, to close the week down 6.57%.

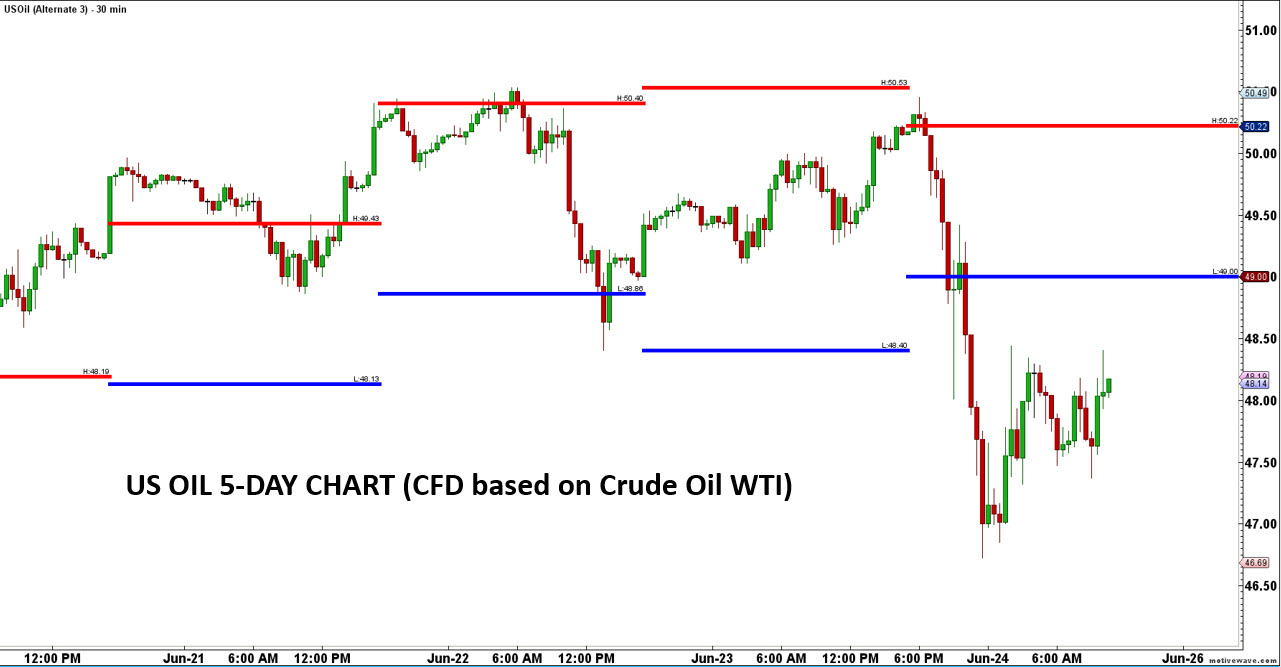

Oil prices once again traded in a choppy range for the majority of the week failing to hold above the key $50 level. Crude had also initially traded higher to start the week as reports indicated that a Brexit was becoming less likely. Prices peaked at $50.53 on Wednesday before the EIA reported that oil inventory declined by 917,000 barrels the prior week, which came in below expectations for a 1.7-million-barrel drop.Despite being the fifth straight weekly drop in stockpiles, prices sold off before bouncing off $48.40 and trading almost $2/barrel higher. This comeback fell short with the Brexit vote, causing crude to drop almost $4/barrel to $46.72, and ultimately ending the week at $48.04.

S&P 500

After surging higher to start the week, the S&P 500 saw a massive selloff due to the results from the UK referendum. Equity markets initially gapped higher on Monday after positive news out of Britain showed that majority of the voters were likely to favor staying in the EU as opposed to leaving. On top of that, investors had remained neutral after Yellen’s remarks on Capitol Hill, but took into consideration the Fed’s cautious views on high equity valuations.

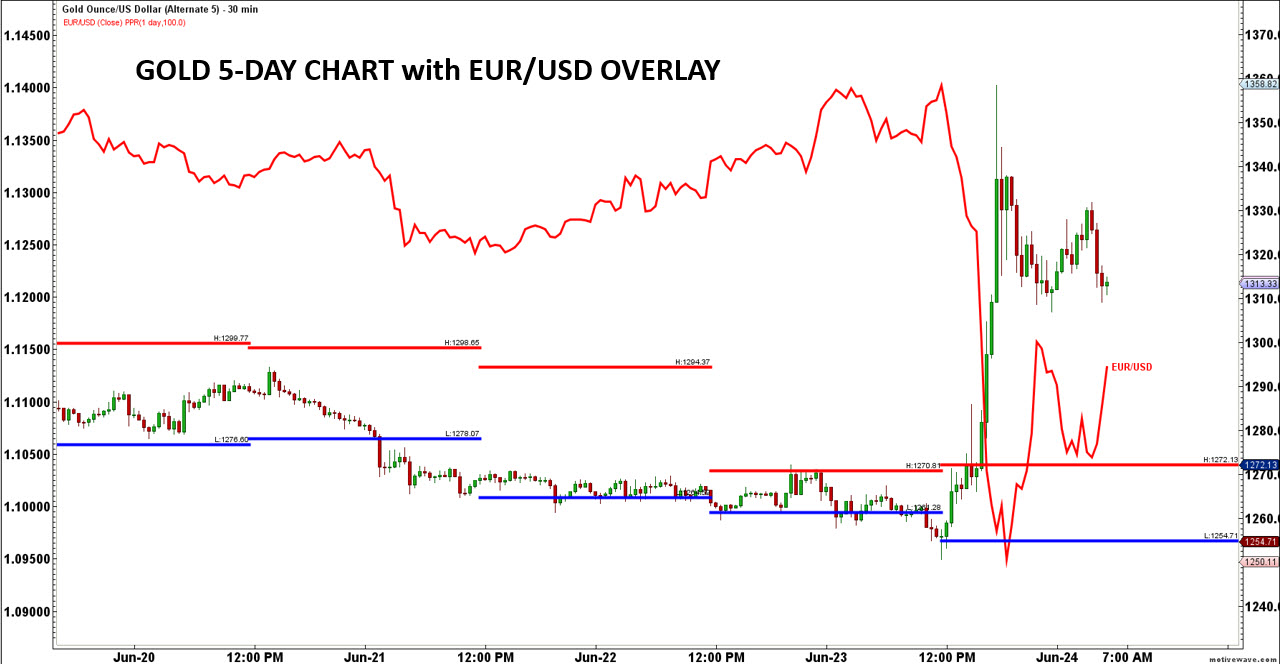

As crude oil and equities rallied to start the week, investors steered away from gold due to lower worries of a potential Brexit. However, after the UK referendum results were released, gold roseabruptly by $108/ounce off its weekly lows at $1,250 to $1,358, a gain of 8.64% at the extreme. In fact, the normal inverse relationship between gold and the dollar (Gold up/ Dollar down) diverged, as the market bought both gold and the dollar.

In fact, all of the moves subsequent to Brexit were a flight to safety, including a move into gold and the dollar and out of risky assets. The “risk-off” environment will likely persist as the market digests the implications of Brexit moving forward.