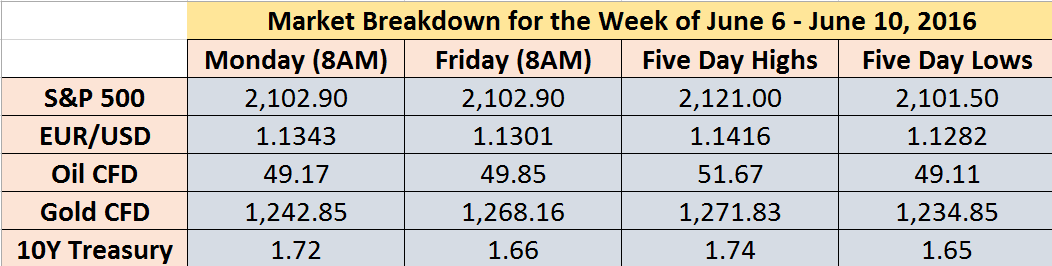

Weekly Review

It was a quiet week in the financial markets, as investors are sitting tight waiting for the next FOMC meeting held later this month. After a strong rally to start the week, the S&P 500 gave back all its gains to settle the week flat and closing near the critical $2,100 level. Similarly, crude oil prices also managed to trade almost $2 higher from the open on Monday, but also reversed from its weekly high of $51.67 to all the way back below $50. The US dollar on the other hand made a strong late inning comeback, with gold surging almost $28/ounce for the week, and 10-year Treasury yields finishing the week down 6bp to 1.66%.

US Economy

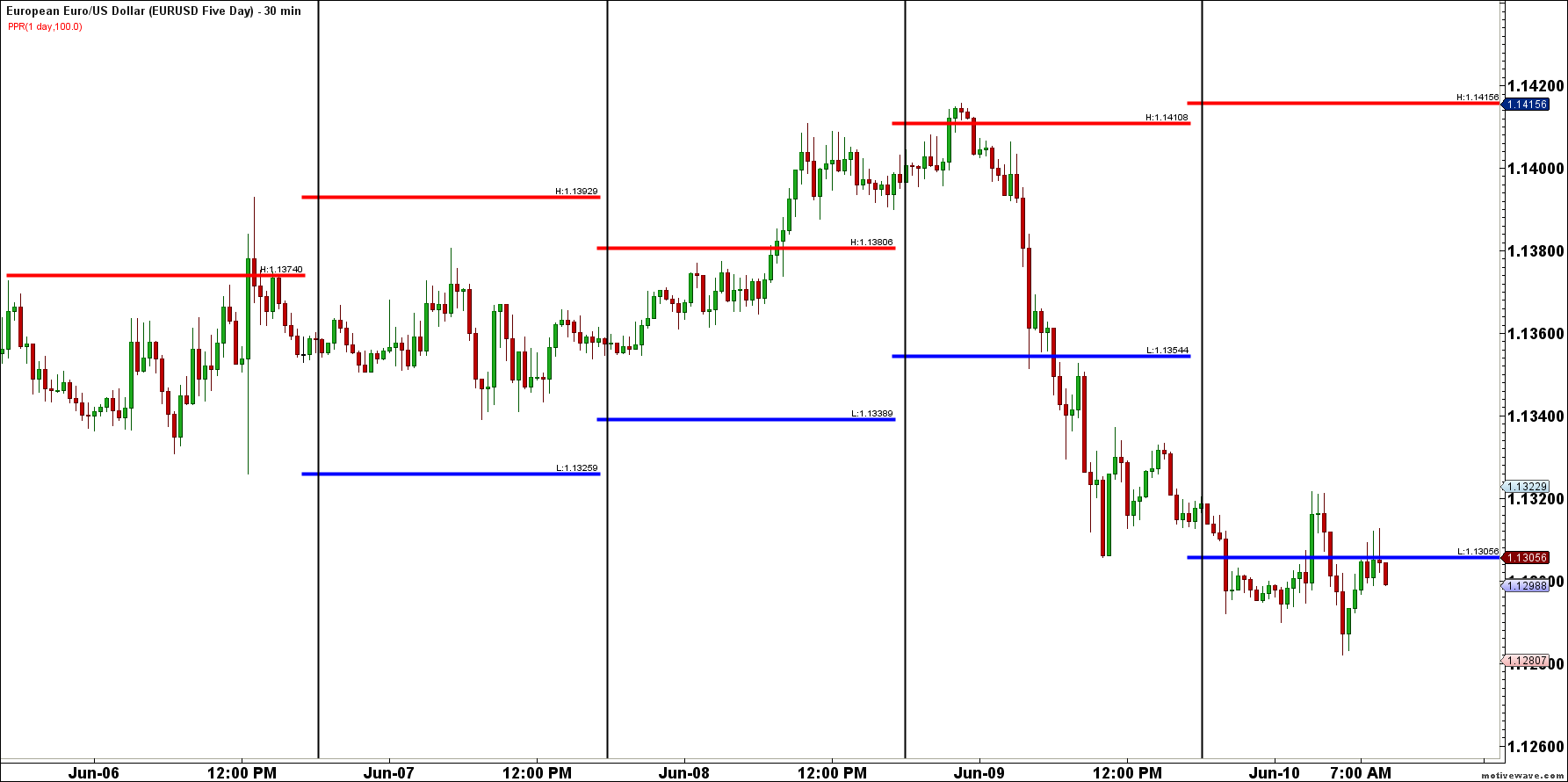

All eyes were once again set on Janet Yellen who publicly spoke for the final time before the much anticipated June FOMC meeting. Remarks made by Yellen on Monday were unsurprisingly dovish as the Fed assured their patience to hike rates. As a result, the US dollar weakened for most of the week with EUR/USD reaching a three-week high of 1.1415 before trading lower. The markets are now pricing in a 0% chance of the Fed increasing rates at the June 15 meeting, while the odds of a December year-end hike has been trimmed 15% from last week to 59%. Yellen stated that last week’s horrendous jobs report was in fact concerning, and will continue to watch the labour market closely to gauge the overall health of the economy.

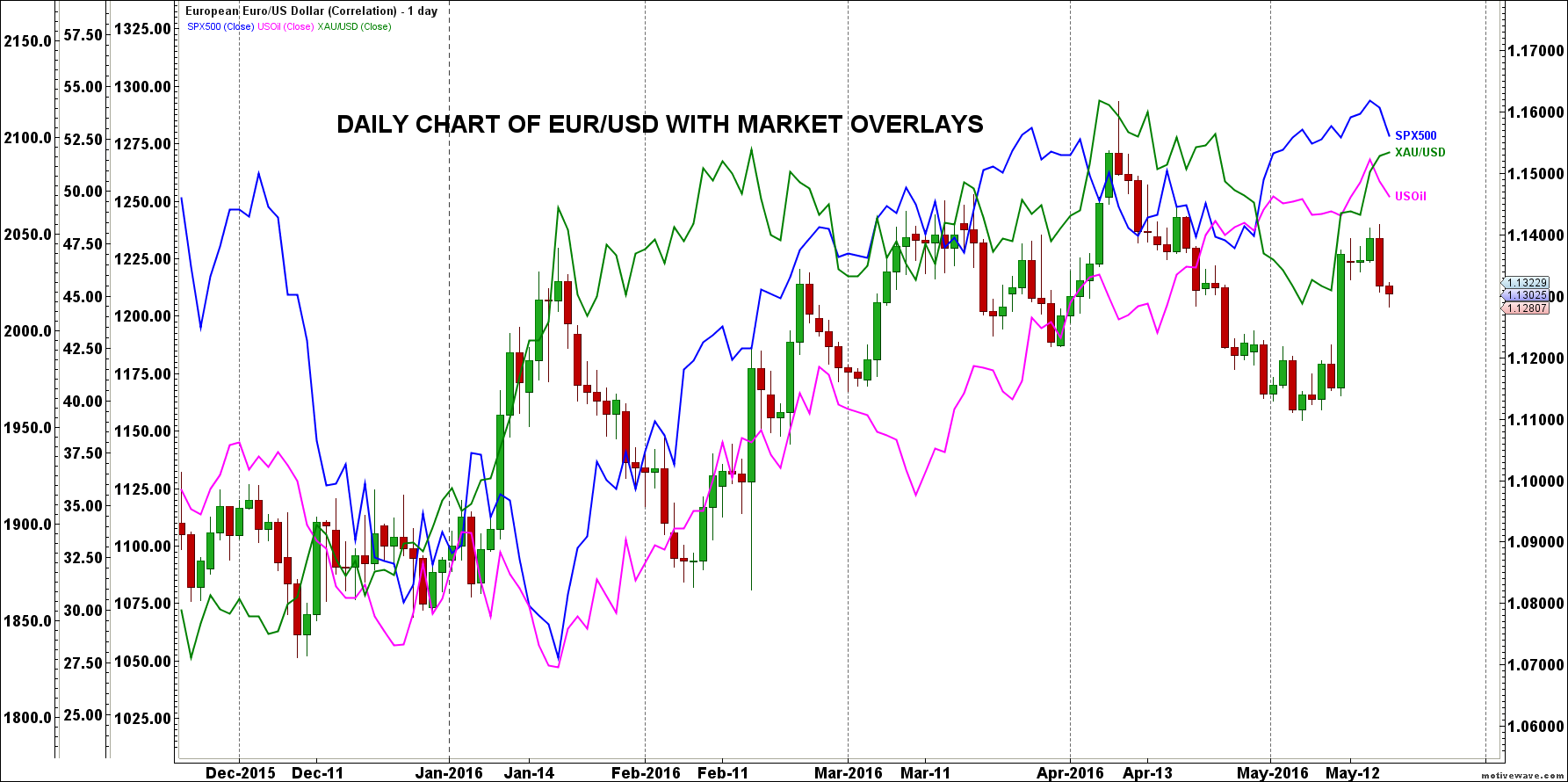

Market Correlations

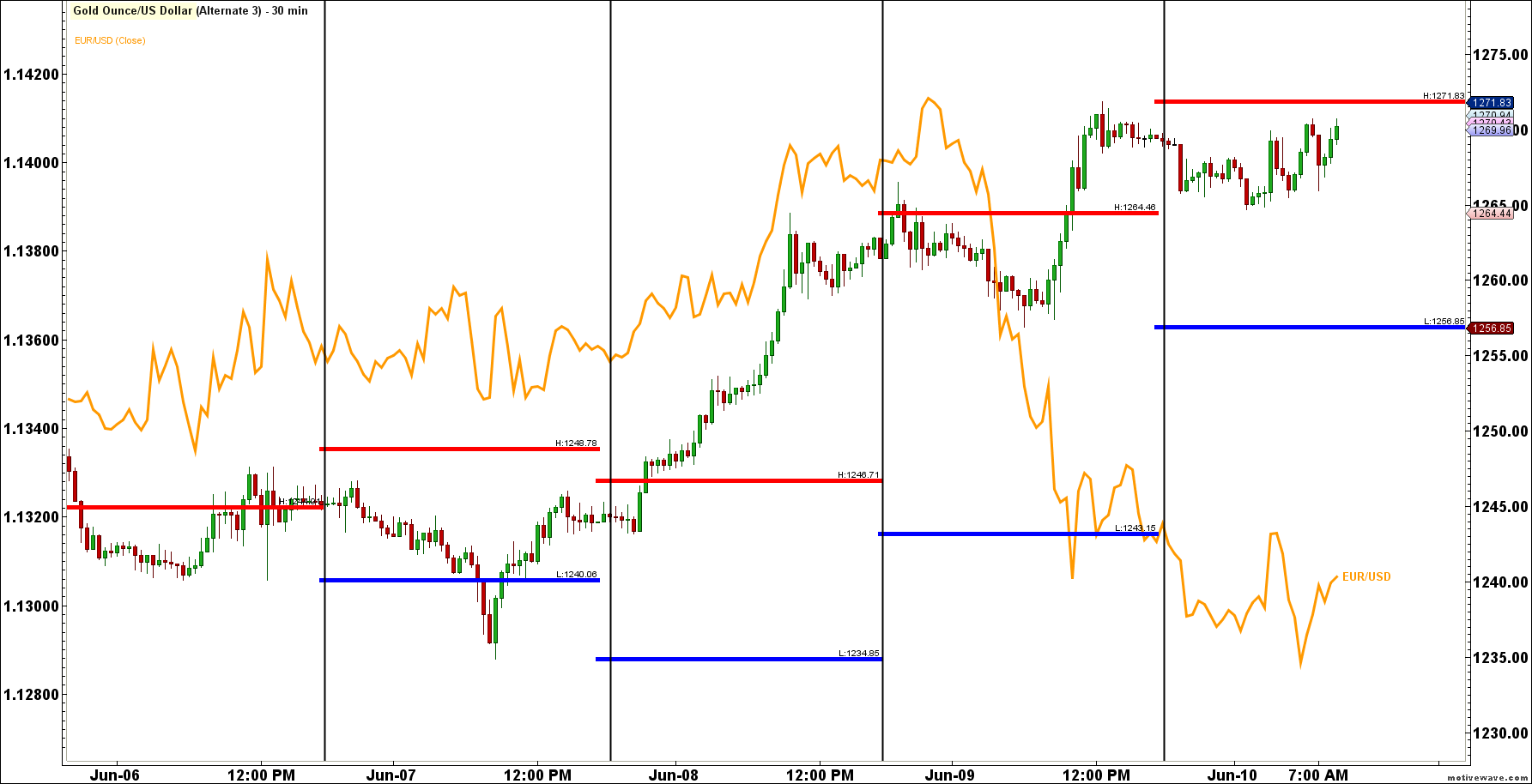

The chart below shows how well the EUR/USD, oil, S&P and GOLD have continued to correlate since January 2016. Intermarket analysis is key to understanding what is driving markets and at any point in time, there are different drivers. Currently, the key drivers are US economic activity and when the Fed will raise rates. GOLD and the Dollar followed their inverse relationship for the most part, as the Dollar soldoff to start the week, and GOLD rallied. They diverged on Thursday and Friday. Also, the S&P 500 price action followed the movement of OIL this entire week.

European Economy

Over to Europe, a potential Brexit continues to put investors on cautious mode as polls throughout the week showed more citizens were in favor of leaving the EU. The low volatile environment is signaling that investors are sitting on the sidelines waiting for the June 23rdreferendum to give a clear mandate on global risk. However, Draghi noted that more stimulus would be required if a financial shock from Brexit were to take place, causing the Euro to selloff Thursday morning.

On the other hand, the European Central Bank commenced its corporate bond-buying program on Wednesday to bring inflation and growth back in the Euro area. Aside from that that, economic data out of Germany showed some positive news out of Europe as industrial production increased 0.8% in April m-o-m after declining by 1.1% during the prior month. In addition, annual GDP growth out of Europe was left unchanged at 1.7% due to stronger consumer spending and business investment.

The EUR/USD has already corrected the last swing move higher by 50% so expect a test of at least 61.8% at 1.1243, not to exceed 1.1140. A breakdown of 1.1140 will imply lower levels.

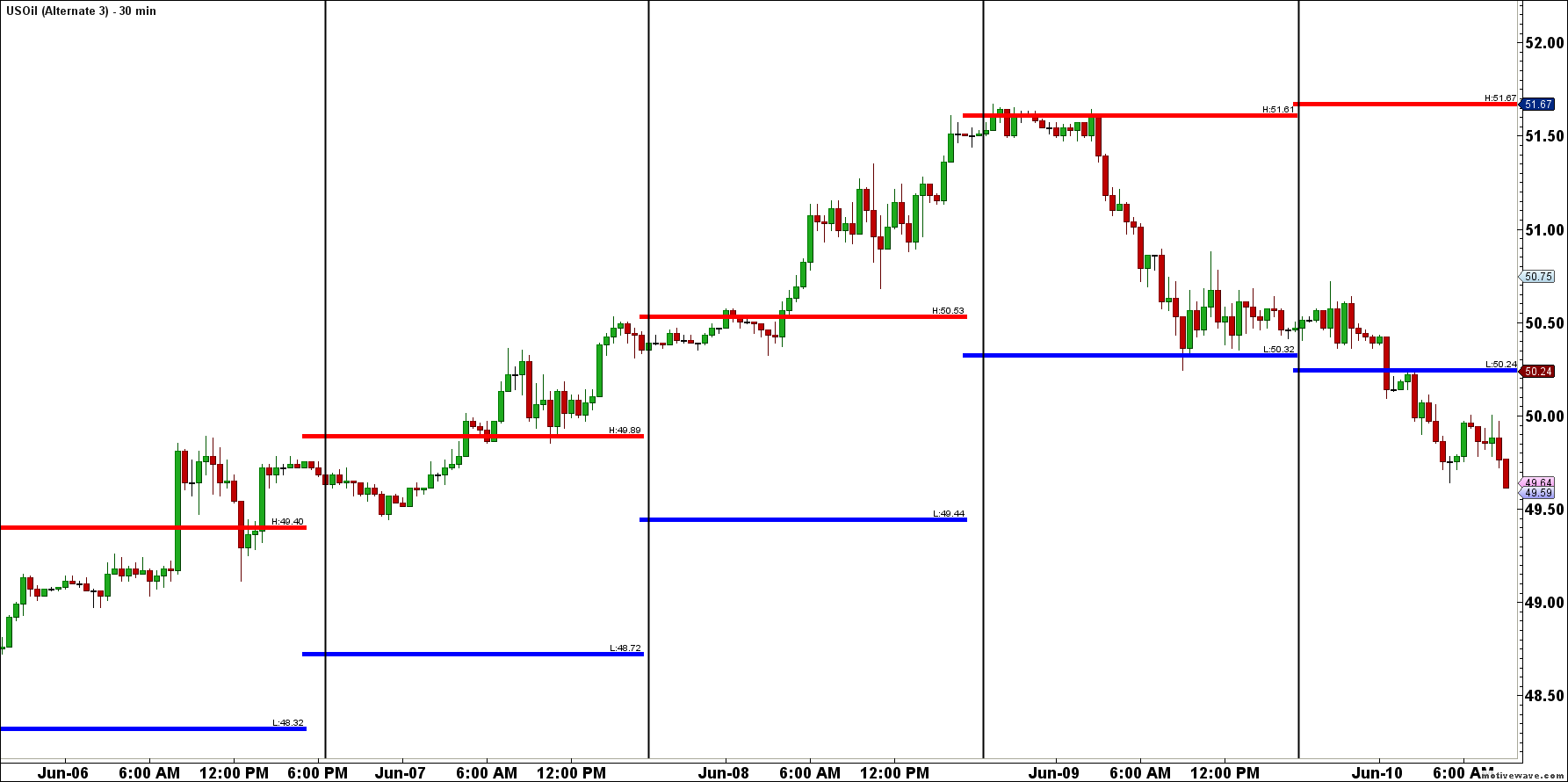

Crude Oil

Crude Oil finally pushed well ahead of the highly watched $50 level, as it rallied to a nine-month high of $51.67, but gave back all the gains to trade at $49.85 heading into Friday. Initially, continuing worries of a supply shortage out of Africa’s largest producer in Nigeria, aided prices higher. Thereafter, oil soared higher after Wednesday’s EIA report showed crude inventory declined by 3.23 million barrels last week – meeting analysts’ expectations. Moreover, the EIA forecasts that crude production out of US will continue to drop in 2016 and 2017, as well as an uptick in demand for oil this year. Hence the positive sentiment within the energy markets, combined with a weaker US dollar from expectations of a postponed rate hike has given an extra boost for oil prices lately.

In terms of next week’s price action, expect oil to consolidate its gains, on the topside watching 51.67 and on the downside, last week’s low at 47.75.

Gold

Gold prices sustained its rally after last Friday’s disastrous NFP report by soaring $35 to close the week at a three-week high. As you can see, the usual correlation weakened slightly on Thursday which saw the US dollar strengthen with gold prices. From an Elliott Wave perspective, we completed 5 waves up on Gold this week so expect a retracement of the move into this week. If price continues above the highs of 1278 a potential extended trend move will take place.

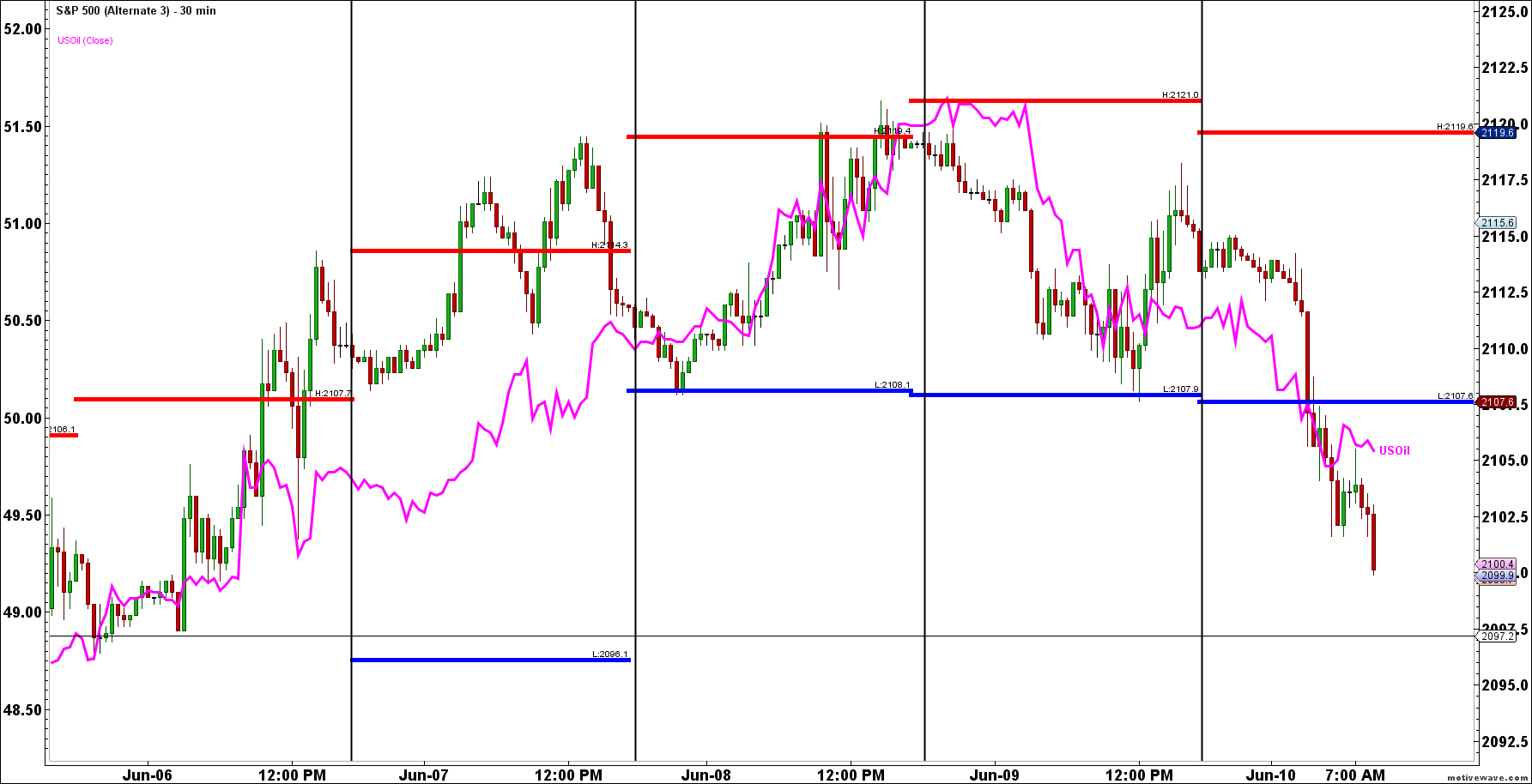

S&P 500

The S&P 500 was on its way to testing the all-time highs before coming back all the way down to test the significant $2,100 level. The markets reacted positively following comments from Janet Yellen, and continued to trade alongside the direction of crude oil as prices reached an eleven-month high of $2,120.55. Investors appeared to have brushed off last week’s horrible job numbers given the dovish tone of the Fed. For this week’s price action, expect the S&P 500 to potentially retrace the last swing move up from 2,025 to a high of 2,121 by at least 38.2% at 2,084.