Global economic growth is sputtering, and it isn't the weather.

The economic expectations bar is low thanks to repeated downgrades, but the surprise index is falling even faster as noted by the Financial Times.

“Last year it became apparent that global growth was accelerating, but there are now reasons to believe that the acceleration phase is over,” said Larry Hatheway, chief economist at Gam, an asset manager. “It might not be decelerating yet, but markets trade on inflection points.”

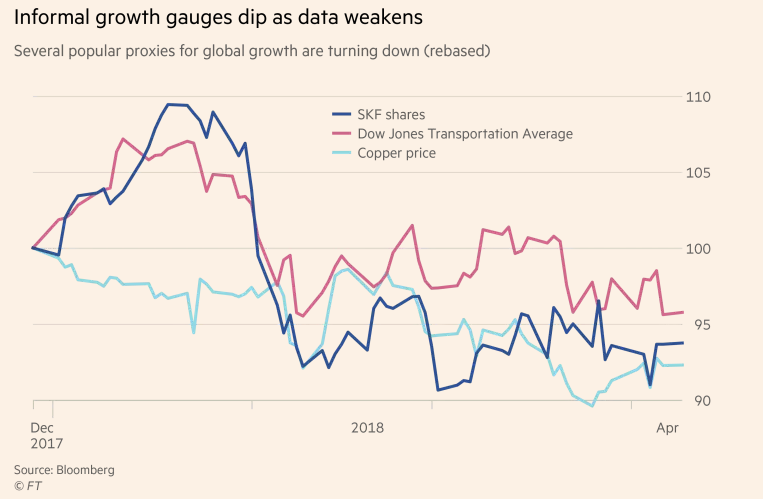

Growth Gages Dip

It's a bit peculiar to put SKF, a Swedish maker of ball-bearings on a chart with copper and the Dow Jones transportation index, but "Dr. Copper" and the Dow have a different message.

Then again, MarketWatch reports Dow Transports Bounces Back Out of Dow Theory 'Sell' Territory, Again.

But how much faith does one want to put on an indicator that has gone into and out of sell territory three times in seven sessions?

I suggest, one of these times the signal is going to break, and break for good. Meanwhile, I question whether a signal based on 20 stocks is all that relevant anymore.

Regardless, here we are.

Complacency Abounds

-

“It’s on my list of things to worry about, but it’s a long list,” Mr Hatheway at Gam said. “It’s hard to get overly worried about global growth right now.”

- Robert Buckland, chief global equity strategist at Citi, argues that investors should still “buy the dips”, even if those dips will get bigger as the global economic cycle enters its final stage.

Buy the dip? No thanks. Of course, I have said that for years.

So go ahead, buy the dip, the water's fine.

Bears are taunted at every peak, then all the way down before the final panic.