Since the last article was written, more selling has occurred in global stocks. This is especially true when all majors are priced in US dollars, as global currencies remain quite weak. The MSCI World Index peaked in June of this year and continues to consolidate. Bears argue that we are witnessing a topping pattern, while bulls argue this is a pause before further upside. The truth is, both bulls and bears are correct. It is just a matter of speaking in the right context.

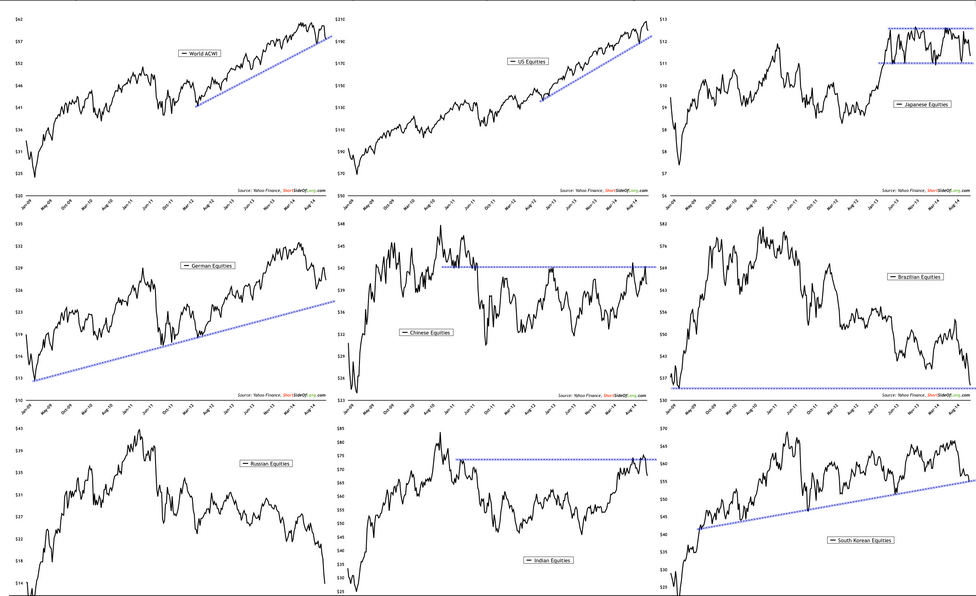

For example, let us refer to Chart 1. Notice that US equities continue to outperform and have barley fallen since peaking in recent days. On the other hand, European and Japanese stocks (priced in USD) have been struggling for a while. Japanese stocks have done well, but the currency has been awful. Here, it is probably important to buy stocks with a currency hedge.

Chart 1: Global equities are consolidating with GEMs under pressure!

In the emerging markets sector, there is just as much variance between the good, the bad and the ugly. India has done very well until recently, while China has outperformed during the recent correction. On the other hand, Brazil and Russia are about to test their March 2009 lows. Due to the currency weakness, Russian stocks are in full blown capitulation. Yesterdays volume spike on the Russian Stocks, MarketVectors TR Russia ETF (NYSE:RSX) was insane. Obviously, these countries are suffering from commodity fall out. Imagine if the economy and currency suffered as much in the US. and the S&P traded at 666, where it was almost 6 years ago…

Finally, I have noticed that the VIX is getting quite high now, as we approach close to 25. Also bonds are outperforming stocks by quite a few standard deviations. Keep an eye on these indicators, because a mean reversion is coming soon.