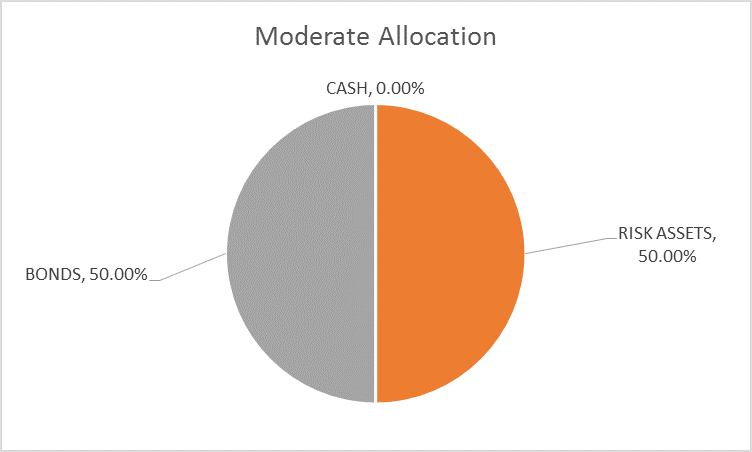

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50.

The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle. Post meeting, a lot of the rise came out of the market. Nominal and real 10 year Treasury rates dropped by an identical 11 basis points on the day. Rates fell at the short end too as the yield curve shifted lower but didn’t flatten significantly. The market was looking for a big change in the Fed’s growth and inflation expectations and the dots basically didn’t move. Long term growth expectations are still 1.8-2.0% and inflation expectations were unchanged at 2.0% on the PCE deflator.

Just as or maybe more important was the emphasis in the statement on its “symmetric” inflation target. Rather than say, as they did in the last statement, that inflation was expected to “rise to 2% over the medium term”, the Fed now says “inflation will stabilize around 2%”. I know it seems like a minor change but what it means is that the Fed isn’t going to get too excited if the inflation rate goes above 2% for a period of time. They further emphasized the point by saying:

The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

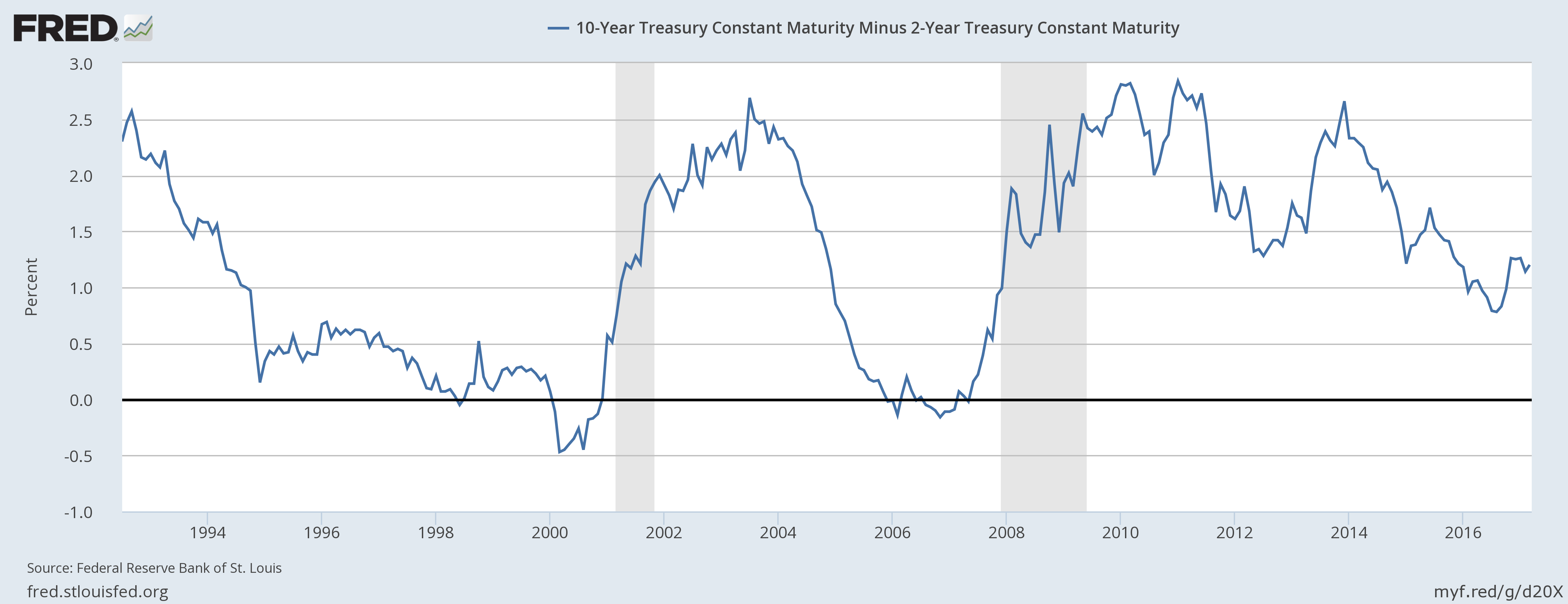

What all the language changes mean is the Fed isn’t really shifting to a more hawkish stance and that rate hikes will not be coming fast and furious this year. The dot plot indicates the Fed still expects two more hikes this year. The market was starting to price in four (today’s plus two more) and that had to come out of the market after the meeting. This was the most dovish rate hike in the history of rate hikes. Greenspan’s old conundrum was that long term rates weren’t rising as the Fed hiked. The conundrum today is that even short term rates aren’t rising as the Fed hikes. Two year note yields are right back to where they were after the December rate hike.

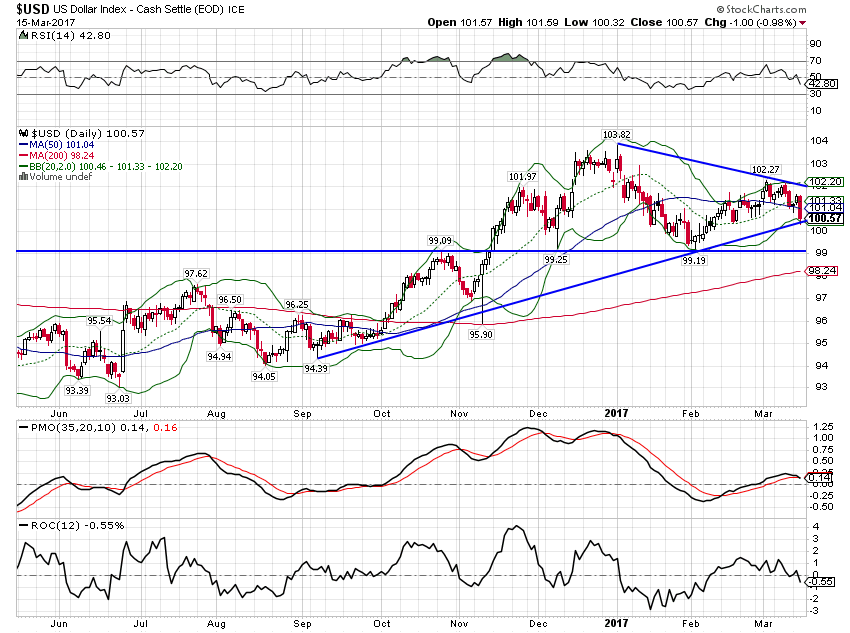

The post-FOMC moves today were very beneficial for our allocation. Obviously, the move in bonds was beneficial as we are overweight bonds in our moderate risk portfolio. We also have more duration in our bond allocation than most firms; we are much more wary of credit risk than duration risk. The indirect consequence of today’s meeting was felt in currency and commodity markets which was also beneficial. The dollar index fell hard after the announcement as the difference in growth expectations between the U.S. and Europe continue to narrow. That pushed gold and other commodities higher along with commodity sector stocks, all of which are represented in our portfolio.

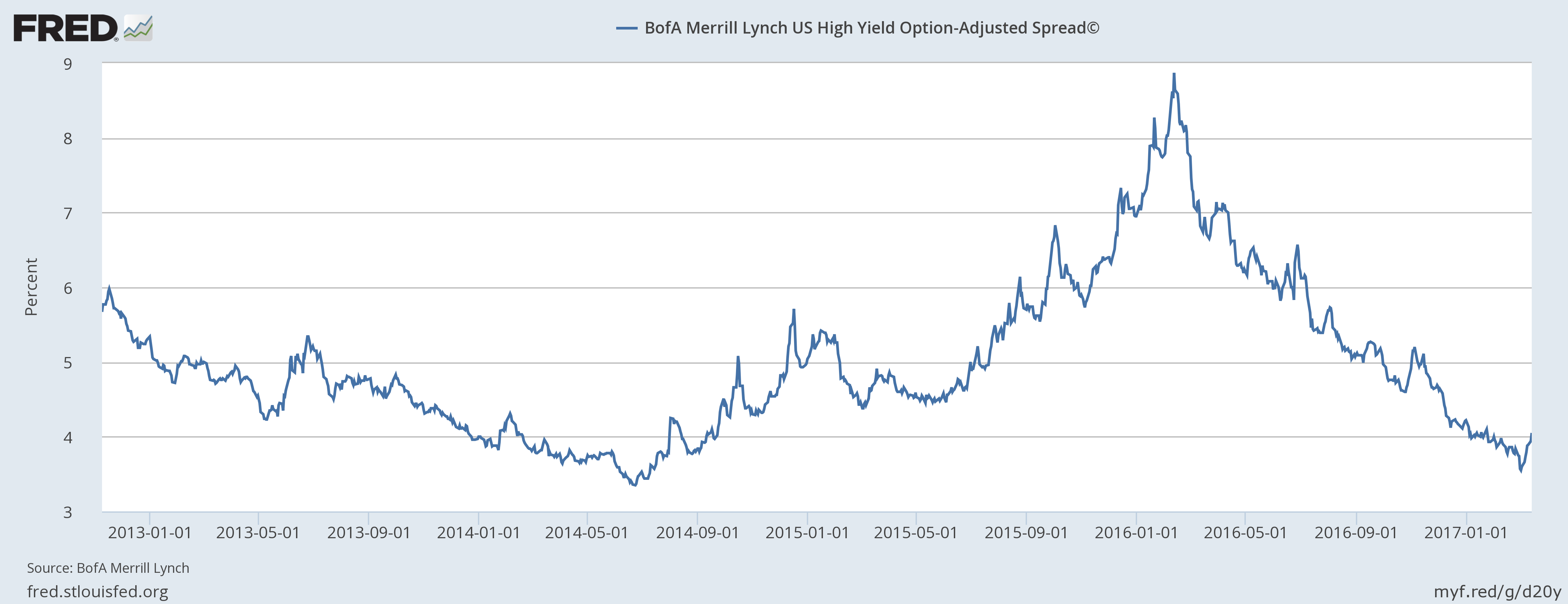

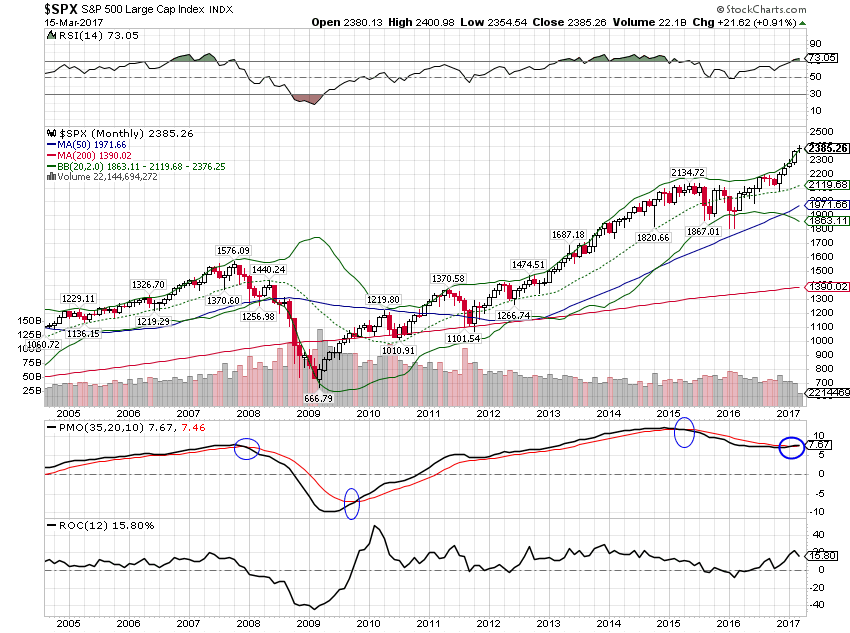

Overall, our indicators haven’t changed enough to warrant any changes to the allocation. The yield curve sits in the middle of its historic range, providing us with little guidance. Credit spreads narrowed, then started widening again and finished up a bit wider than the last update. But it wasn’t enough to trigger any action. Earnings were up in Q4 and may even be able to get a third consecutive quarter of improvement in Q1 but stock prices have once again outpaced actual earnings growth. In other words, valuations in the U.S. are still sky high. As I’ve stated many times over the last couple of years, ex-U.S. stocks are much cheaper and that is still true. Momentum isn’t telling us a lot either, certainly nothing that warrants a change in allocation.

Credit Spreads – At the time of my last GAA post, HY spreads were 3.90%. They subsequently fell all the way to 3.55% but over the last two weeks have moved up nearly 50 basis points to 4.05% (this does not include any post FOMC move; data wasn’t available yet but it looks like spreads tightened just 2 or 3 basis points on the day). This widening, if it continues, could be a cause for concern. The widening is a result, primarily, of falling oil prices. I’m not sure what to make of oil prices at this point. The technicals seem to point to lower prices as do the supply/demand fundamentals, but a weaker dollar might mitigate the damage. Whatever happens, we are now on alert regarding spreads.

Yield Curve – The yield curve changed by just 1 basis point over the last month. There just isn’t much information to be gleaned from the yield curve. I expect it to resume flattening but that might not be the case until later in the year when – if? – the Fed hikes again.

Valuations – Valuations continue to favor international markets over the U.S. Q1 earnings estimates for the S&P 500 are still falling, down to 9% now versus expectations for 11% a month ago. I see no reason for that trend to change. Energy earnings will be the driver based on higher prices and more hedging but the rest of the market is probably more geared to Q1 GDP growth which is not looking terribly robust. The Atlanta Fed’s GDPNow real time forecast is down to just 0.9%. Personally, I don’t see much change in the recent trend of around 2% but it could be slightly higher or lower in any given quarter.

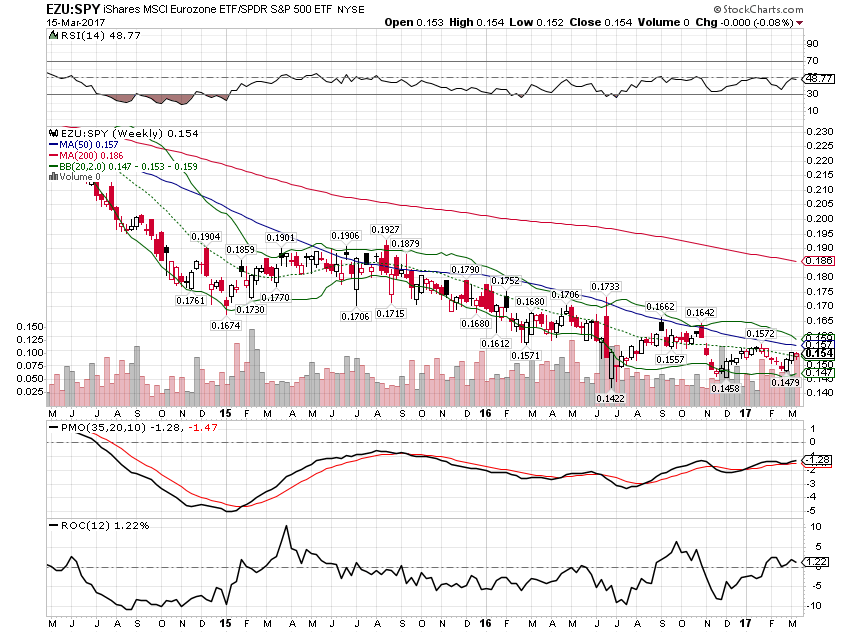

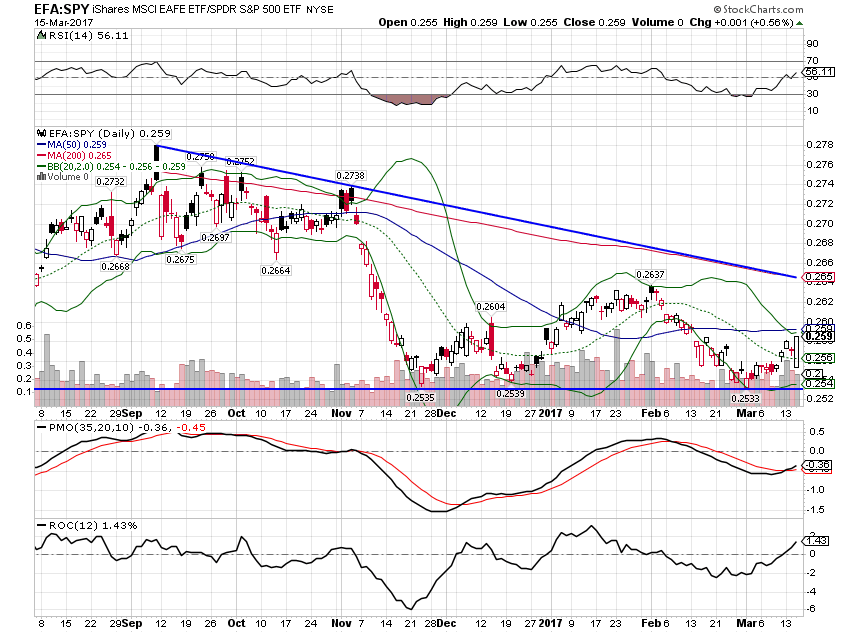

Of course, we’ve favored international markets over the US on a valuation basis for a couple of years now so this isn’t exactly news. I’ve also said consistently that you won’t see international markets outperform consistently until the dollar gets into a downtrend. That may be the missing piece for international stocks that is about to fall into place. The dollar index fell over 1% after the FOMC announcement and the euro broke above 1.07. Growth expectations between the U.S. and Europe are converging. I considered adding a specific exposure to Eurozone stocks this month but there just isn’t enough momentum versus the S&P 500 yet. If the dollar index keeps falling – the technical level I’m watching is 99 – Europe may be worth adding.

Momentum – The long term momentum indicator we use flipped to buy at the beginning of March for the S&P 500. With the market as overbought as it is on a short/intermediate term basis, I am not adding any more S&P exposure based on this signal. I am skeptical to say the least. The index is so far above its long term moving average that it is either a bubble or an indication that the long term rate of economic growth has shifted up. Dramatically. Permanently.

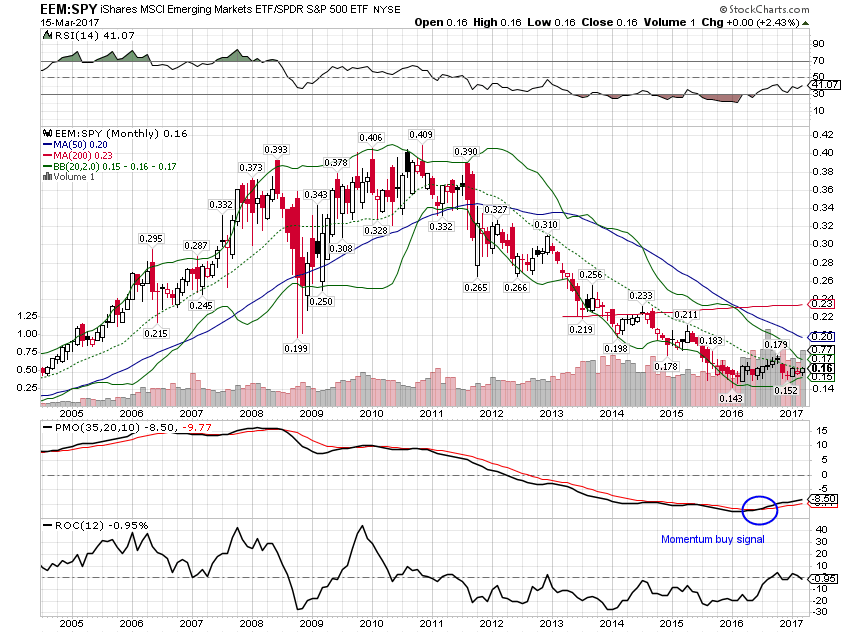

Emerging markets were the big equity movers in the wake of the Fed’s decision. Not surprising considering the drop in the dollar. Momentum favors EEM over SPY:

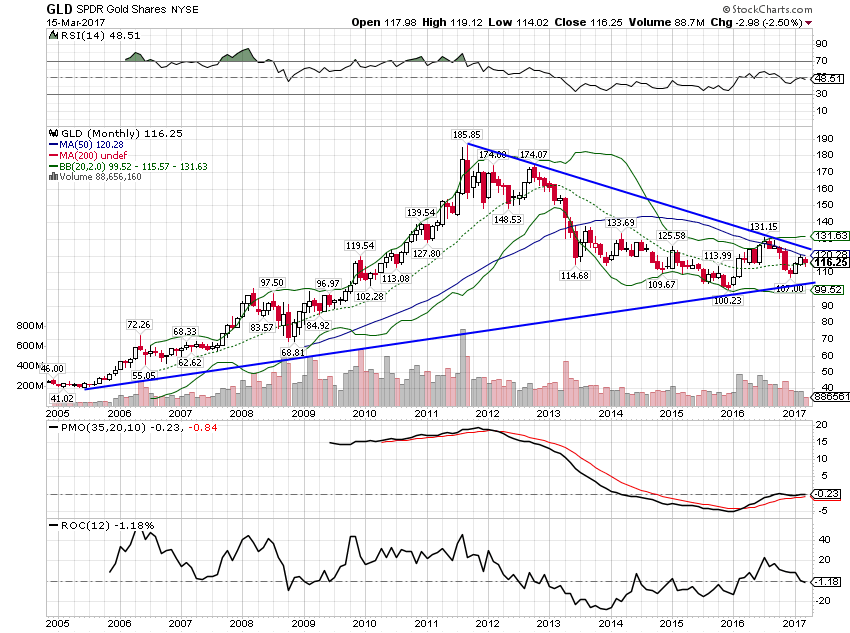

Gold remains in an uptrend. Momentum is still positive after the recent correction.

Long term momentum has not shifted yet to international markets. EFA vs SPY (NYSE:SPY) is trying to make a bottom on a shorter term basis though. Again, the dollar is important here and probably needs to keep falling for EFA to outperform SPY. This is a trend – SPY outperforming EFA – that has been in place for years (since 2008) so human nature dictates that it is hard to break. But when it does it probably won’t be a short term event. Currency trends are very persistent and so therefore are relationships influenced by them.

Market expectations for U.S. economic growth fell after the FOMC meeting. Stocks didn’t seem to notice or care but bonds and the dollar certainly did. It might be nothing more than a blip and the incoming economic data may push growth expectations right back up. Sentiment certainly points in that direction but not much else. It appears that might have to suffice for a while as the Trump administration agenda isn’t exactly in overdrive right now.

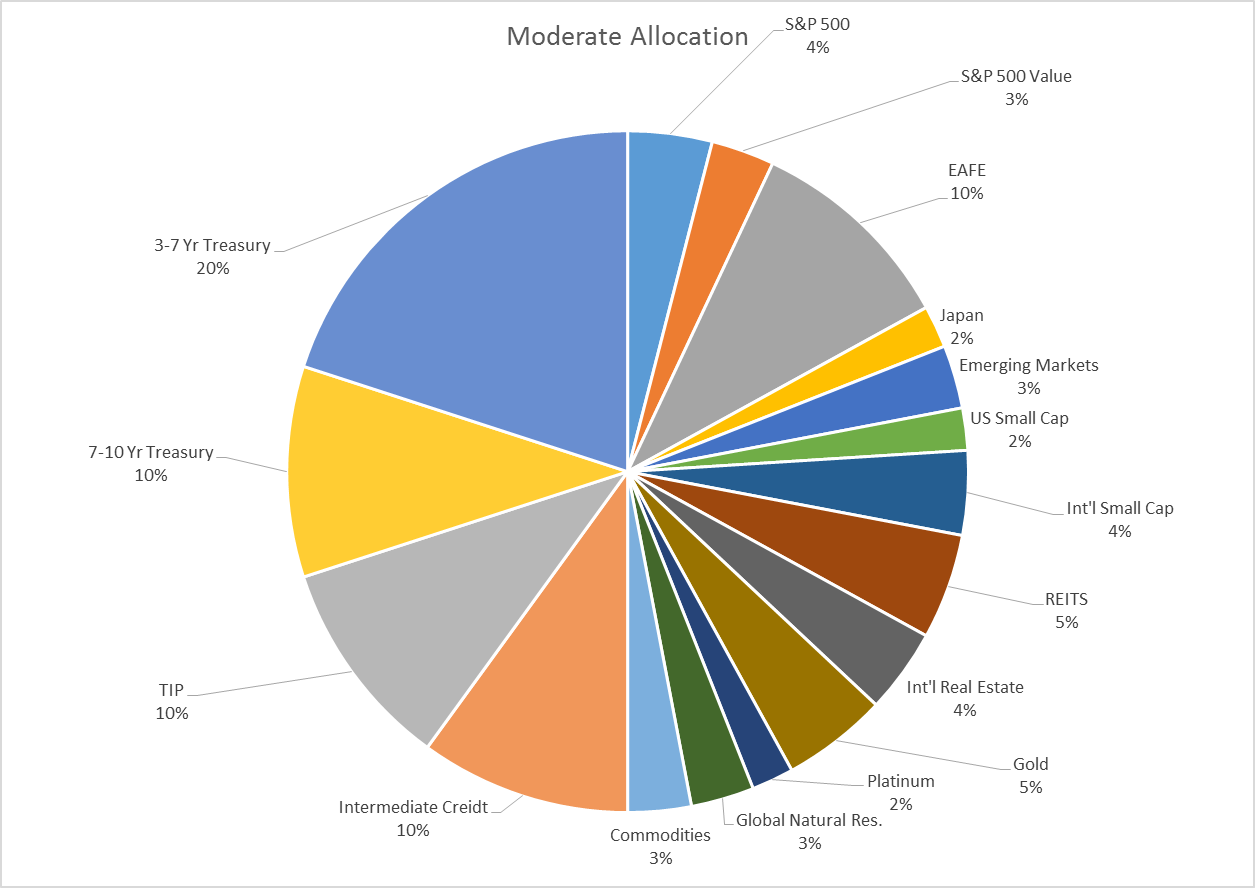

Here’s the Moderate Allocation unchanged again: