As the bull market pushes past its seventh year and stock-market averages triple in value off their great-recession lows, it can become increasingly difficult to find good companies trading at reasonable values. As Buffett famously said, “You can buy a good company, but at a bad price it can still turn into a bad investment”. The S&P 500 currently trades at 17x forward earnings and 19x TTM earnings. While this isn’t bubble territory when factoring in generational lows in the risk-free rates, it’s far from cheap.

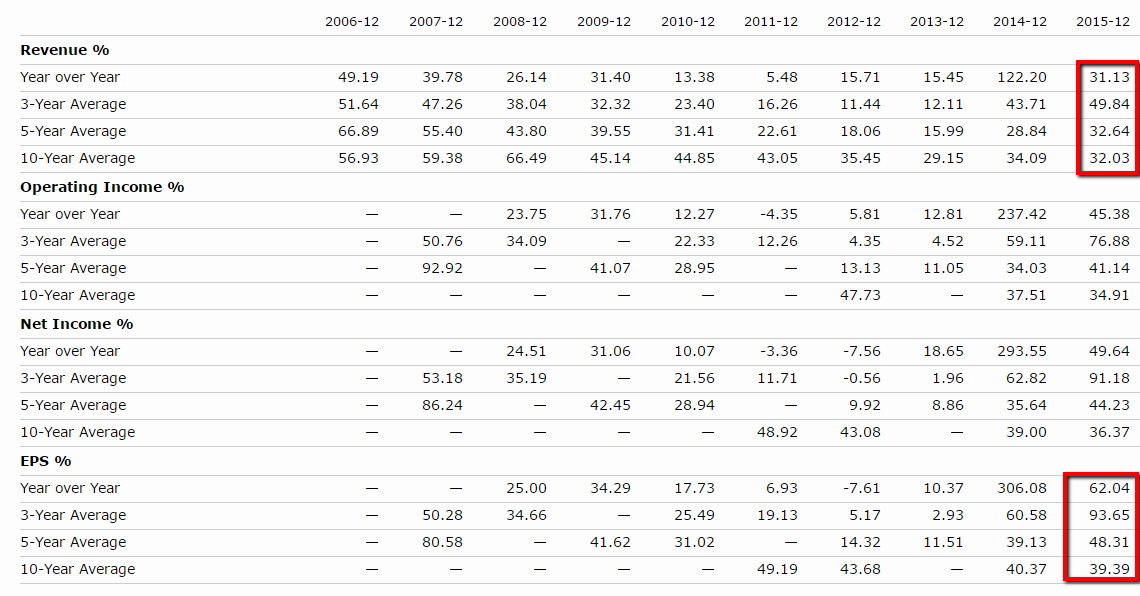

Which brings me to Gilead Sciences (NASDAQ:GILD), which is trading at 7x forward and TTM earnings (5-year average is 21x) and 3.9x sales (5-year average is 7x) for a company that has grown revenue at an average annual pace of 32% for the last 5- and 10-year period and earnings at a pace of 40%-50% annually for the same period (chart above). The company also displays operating and gross margins well above the industry average.

Now there are always two sides to every trade and the bears are looking at the overhead potential of drug pricing reform and more specifically at what other generic drugs may cut into Gilead’s future revenue and earnings growth potential. While nothing is certain, it’s usually a good idea to buy good companies with a margin of safety. In this case we have a solid company with good competitive advantages, exemplary management and revenue growth that exceeds even Amazon’s (NASDAQ:AMZN), trading at a fraction of its historical average.

Taking a look at the weekly chart, GILD looks to have a confluence of support between the $82.50-$84 range with the 200-week MA just below.

Next, take a look at the entire biotech sector chart. Here we see that the whole sector has been under pressure since the 2015 highs, down 40%. The sector appears to be stabilizing and a break above $289 would bode well for all those beaten-down biotech names like Gilead, Regeneron (NASDAQ:REGN) and Allergan (NYSE:AGN).

Gilead Sciences reports earnings after the market closes on Monday. The street is looking for earnings of $3.10/share on $7.95 billion in revenue. The bar appears to have been set quite low for the quarter, and, for that matter, the future as well.