Gilead Sciences (NASDAQ:GILD) just released its fourth quarter fiscal 2017 financial results, posting earnings of $1.78 per share and revenues of $5.95 billion. Shares are down 2.4% to $78.50 in trading shortly after as a result.

Currently, GILD is a #4 (Sell) on the Zacks Rank, and earnings estimate revision activity is trending downwards for the foreseeable future, as earnings growth also looks to be on the decline.

Gilead:

Beat earnings estimates. The biopharmaceutical giant reported non-GAAP earnings of $1.78 per share, coming in above the Zacks Consensus Estimate of $1.70 per share. Net income was $2.34 billion for the quarter.

Beat revenue estimates. The company saw revenue figures of $5.95 billion, beating our consensus estimate of $5.78 billion.

Total product sales for the fourth quarter came to $5.8 billion, a much lower figure compared to the $7.2 billion in the same period in 2016. Breaking it down by region, product sales were $4.1 billion in the U.S., $1.1 billion in Europe, and $553 million in other locations.

Antiviral product sales, which include the sales of Gilead’s HIV, chronic hepatitis B (HBV), and chronic hepatitis C (HCV) products, were $5.2 billion in Q4 compared to $6.6 billion in the same period last year.

Looking at the full year 2018, Gilead expects net products sales in the range of $20 billion to $21 billion, and non-GAAP product gross margin in the range of 85% to 87%.

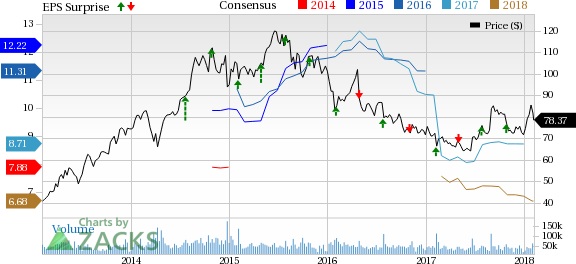

Here’s a graph that looks at Gilead’s price, consensus, and EPS surprise:

Gilead Sciences is an independent biopharmaceutical company that seeks to provide accelerated solutions for patients and the people who care for them. They have a broad-based focus on developing and marketing drugs to treat patients with infectious diseases, including viral infections, fungal infections and bacterial infections, and a specialized focus on cancer. They have expertise in liposomal drug delivery technology, a technology that the company uses to develop drugs that are safer, easier for patients to tolerate and more effective.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Original post

Zacks Investment Research