The iM-Best(N:SPY-IEF) MarketTimer incorporates three market timing models which provide signals which indicate the percentage of funds to allocate to stock market investment in 25% increments, from 0% to 100%, also referred to as signal strength.

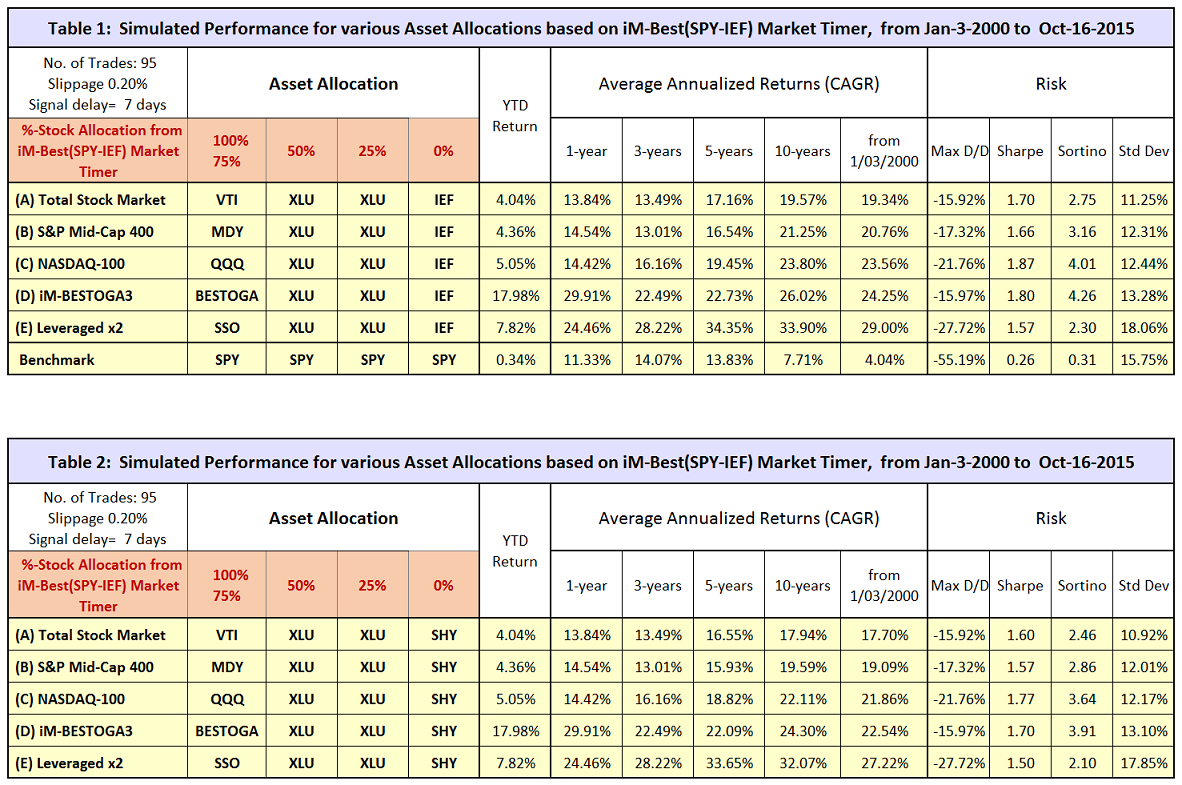

Alternatively, instead of allocating a percentage of funds to stocks and bonds, one can be fully invested in stocks or bond funds according to the signal strength, as shown in the tables below.

Performance is shown for the following asset allocations:

- When the Timer signal strength is 100% or 75%, the model invest 100% of funds in a stock ETF such as N:VTI, N:MDY, or O:QQQ. (A stock trading model such as BESTOGA3, or the 2x leveraged SSO, can be used as well.)

- When the Timer signal strength is 50% or 25% the model invest 100% of funds in the Utilities Select Sector SPDR® Fund (N:XLU)

- When the Timer signal strength is 0% the model invests 100% of funds in a bond ETF such as N:IEF, or N:SHY.

The above performance figures assume closing prices adjusted for dividends and incorporate transaction cost of 0.2% for each switch trade to allow for brokerage fees and slippage. Also trade execution was delayed by 7 days after a signal to ensure that time between trades was longer than 7 days. This resulted in 95 completed trades over the backtest period.

For all asset allocations performance and risk measurements are superior to those of the benchmark SPY, the ETF tracking the S&P 500.

Disclaimer

One should be aware that most of the results shown are from a simulation and not from actual trading. Out-of-sample performance of the Timer’s three component models is relatively short, about 2 years. This timing model is presented for informational and educational purposes only and shall not be construed as advice to invest in any assets. Out-of-sample performance may be much different. Backtesting results should be interpreted in light of differences between simulated performance and actual trading, and an understanding that past performance is no guarantee of future results. All investors should make investment choices based upon their own analysis of the asset, its expected returns and risks, or consult a financial adviser.