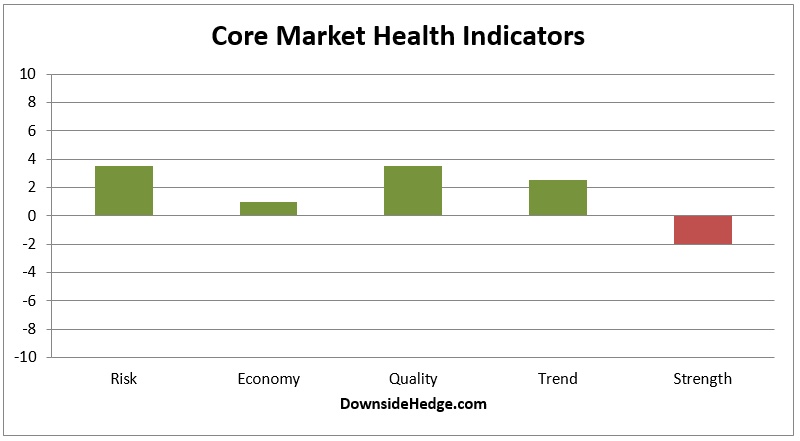

Last week, I said you should get ready for a rally. This week my core market health indicators are telling us to get ready for a breakout above 2500 on the S&P 500 Index. Most of them improved and various measures of breath also improved.

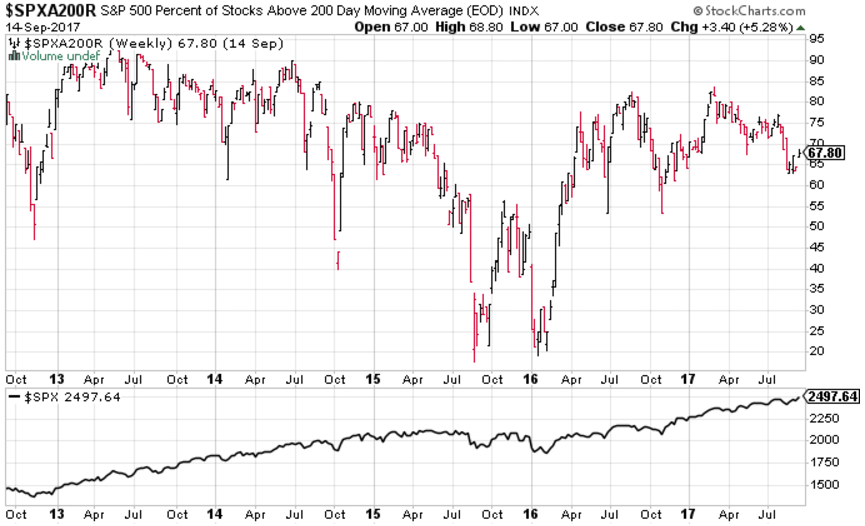

One breadth indicator that I’m watching closely is the percent of SPX stocks that are above their 200 day moving average. There are still about 32% of these stocks below their 200 dma. If SPX breaks above 2500 I expect this measure to rise quickly as money managers look for value as the market rallies.