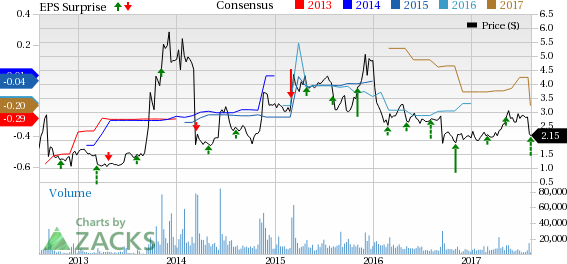

Geron Corporation (NASDAQ:GERN) reported a loss of 4 cents per share in the second quarter of 2017, which was narrower than the Zacks Consensus Estimate of a loss of 5 cents. In the year-ago quarter too, the company had recorded a loss of 5 cents.

Shares rose 4.7% in after-hours trading on Wednesday. However, so far this year, Geron’s shares have underperformed the industry. Shares of Geron rose 3.9% during the period, while the industry witnessed a gain of 8.8%.

Quarterly revenues came in at $0.17 million compared with $0.21 million in the year-ago quarter. Revenues missed the Zacks Consensus Estimate of $0.56 million. Revenues comprised royalty and license fee revenues received under various non-imetelstat license agreements.

Research and development (R&D) expenses declined 45.6% to $2.5 million due to lower costs for the proportionate share of clinical development costs for imetelstat. General and administrative expenses declined 2.2% to $4.4 million due to reduced consulting costs.

The company ended the quarter with $117.2 million in cash and investments compared with $121.7 million at the end of the first quarter.

Pipeline Update

Geron is developing anti-cancer therapies based on telomerase inhibitors. The company currently has one candidate in its pipeline, imetelstat. It is being developed for the treatment of hematologic myeloid malignancies like myelofibrosis (MF) and myelodysplastic syndromes (MDS). Geron has a collaboration with Johnson & Johnson’s (NYSE:JNJ) subsidiary Janssen for imetelstat.

In Sep 2016, Janssen announced unfavorable findings from the planned internal reviews of initial data from the two studies of imetelstat, IMbark (phase II) for the treatment of MF and IMerge (phase II/III) for the treatment of MDS.

However, in Apr 2017, Geron informed that Janssen has completed the second internal data review of the two studies and as a result of the review, both trials are continuing unmodified

For IMerge, Janssen said that the benefit/risk profile of imetelstat in the treated patients supports continued development in lower risk MDS indication. Geron mentioned that if Janssen decides to proceed to Part 2 of IMerge (a larger, 170 patient, phase III study), patient enrollment will begin in the fourth quarter of this year. Last month, Geron announced that Part 1 of IMerge will be expanded to enroll additional patients in a refined MDS population to confirm the clinical benefit and safety observed from the current result.

For IMbark, the results suggested that the clinical benefit and a potential overall survival benefit observed supports continuation of the trial without modifications. Janssen is expected to evaluate maturing data from the IMbark study during next year, including an assessment of overall survival.

Last month, Geron said it expects Janssen, upon examining overall survival, to make a continuation decision in the third quarter of 2018.

Stocks to Consider

Geron currently carries a Zacks Rank #3 (Hold). Some better-ranked stocksin the pharmaceutical sector are Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) , both with a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Regeneron have increased 29.1% this year so far while earnings estimates for 2017 have increased 31.3% in the past seven days.

Shares of Alexion have risen 11.9% this year so far while earnings estimates for 2017 have increased 4.8% in the past 30 days.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Johnson & Johnson (JNJ): Free Stock Analysis Report

Geron Corporation (GERN): Free Stock Analysis Report

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Original post

Zacks Investment Research