The Tuesday session has a couple of announcements worth paying attention to, with the CPI numbers coming out of the United Kingdom first. The year-over-year October numbers are anticipated to be 1.2%, and as a result we could see a bit of volatility in both the GBP/USD pair, and the FTSE. After that, we have the German ZEW Economic Sentiment numbers for November, anticipated to come out at 0.9 for the month. This number tends to move the DAX and the EUR/USD, so pay attention to volatility in those markets.

After that, the Americans release their PPI numbers, which can have an effect on the S&P 500 and other US indices. Obviously, the better the number, the better the reaction we will see in the US stock markets.

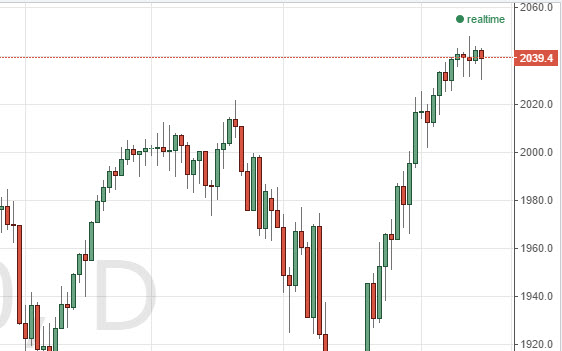

Looking at the S&P 500, you can see that we pulled back during the session on Monday, but found plenty of support below in order to show a hammer for the day yet again. This tells us that the market is going to continue to grind sideways here, but most certainly has a bullish bias to it as the parabolic move is not being retraced. With that, we are buyers of calls on short-term dips as we believe the S&P 500 will continue to show real strength.

Looking at the EUR/USD pair, you can see that we tried to rally during the session on Monday, but as we had warned on Friday – there was serious trouble at the 1.26 level. The market turned back around and offered plenty of put buying opportunities. We believe that will continue to be the case, as is market will fall every time it tries to rally. We are buyers of puts on short-term rallies.

The DAX looks rather healthy, as we rallied after a significant fall. It appears that the €9200 level is going to be supportive, and then ultimately the market should head to the €9500 level. With that being the case, and the fact that the German ZEW numbers come out today, we believe that any pullback offering a bit of volatility should be a call buying opportunity.